This article is a summarized version of the “SaaS Annual Report 2021″ published by UB Ventures, which provides an overview of SaaS trends in Japan and Asia in 2021.

Editor’s Note

Osamu Iwasawa, CEO and Managing Partner of UB Ventures

SaaS business is in a period of transition.

There are several companies with ARR (annual subscription sales) exceeding JPY 10bn, being invested in or acquired by listed SaaS companies. The amount of funds raised by unlisted SaaS companies has also reached a record high of JPY 146.5bn.

2021 will be remembered as a year where the trend fully manifested itself across markets.

Meanwhile, in public markets, it appears that excessive valuations are coming to an end, and we are entering a phase in which the true strength of each company’s business is being tested, and competition between SaaS companies is intensifying.

As new trends such as Vertical SaaS and Product-Led Growth begin to emerge in the market, how will SaaS evolve next? Will this just be a transient trend or will it have an indelible, permanent impact on industries in Japan?

We believe that the turning point of SaaS is happening right now.

This report is comprised of 4 segments: ‘Overview’, which summarizes the latest data on the SaaS market; ‘Playbook’, which describes the key points in SaaS so far; ‘Trends’, which looks ahead to what is in store for SaaS in 2022; and ‘China SaaS’, which analyzes the SaaS market of China, where SaaS adoption is greatly accelerating.

By identifying the key trends and deriving our hypothesis from the market data available, we seek to propose a vision of the future we hope to build – this is our identity and our vision at UB Ventures.

We thank our team who have worked tirelessly to bring this report together, and we hope that this will contribute in any and every manner to the overall industrialization of SaaS in Japan.

This page provides a summary version of the Annual Report. Please feel free to download the full report below.

Full deck

– Overview –

SaaS has seen many rapid developments in 2021.

In order for us to have a clear look at this ever-changing industry in Japan, we have compiled data to provide a brief overview of the ecosystem, covering various aspects of SaaS, such as ARR, growth rates, valuation multiples, IPOs, private fundraising, and M&A transactions.

This summary will briefly touch on key aspects of the report for your reference.

1. ARR:Growth of Japan SaaS as Players Scale Rapidly

Since Money Forward’s listing in 2016, we have observed an influx of diverse SaaS companies being listed each year. The JPY 10bn ARR – a generally-accepted benchmark for a successful SaaS company – has been achieved by many since. Now, with Sansan inching towards JPY 20bn ARR in 2022, we can expect to witness the next stage of growth for SaaS.

Following the growth of horizontal SaaS companies, we have also seen a rise of IPOs of vertical SaaS companies in 2021, as well as SaaS companies providing sophisticated solutions with AI and hardware components. This expansion of SaaS across various industries and technological fields is expected in the near future.

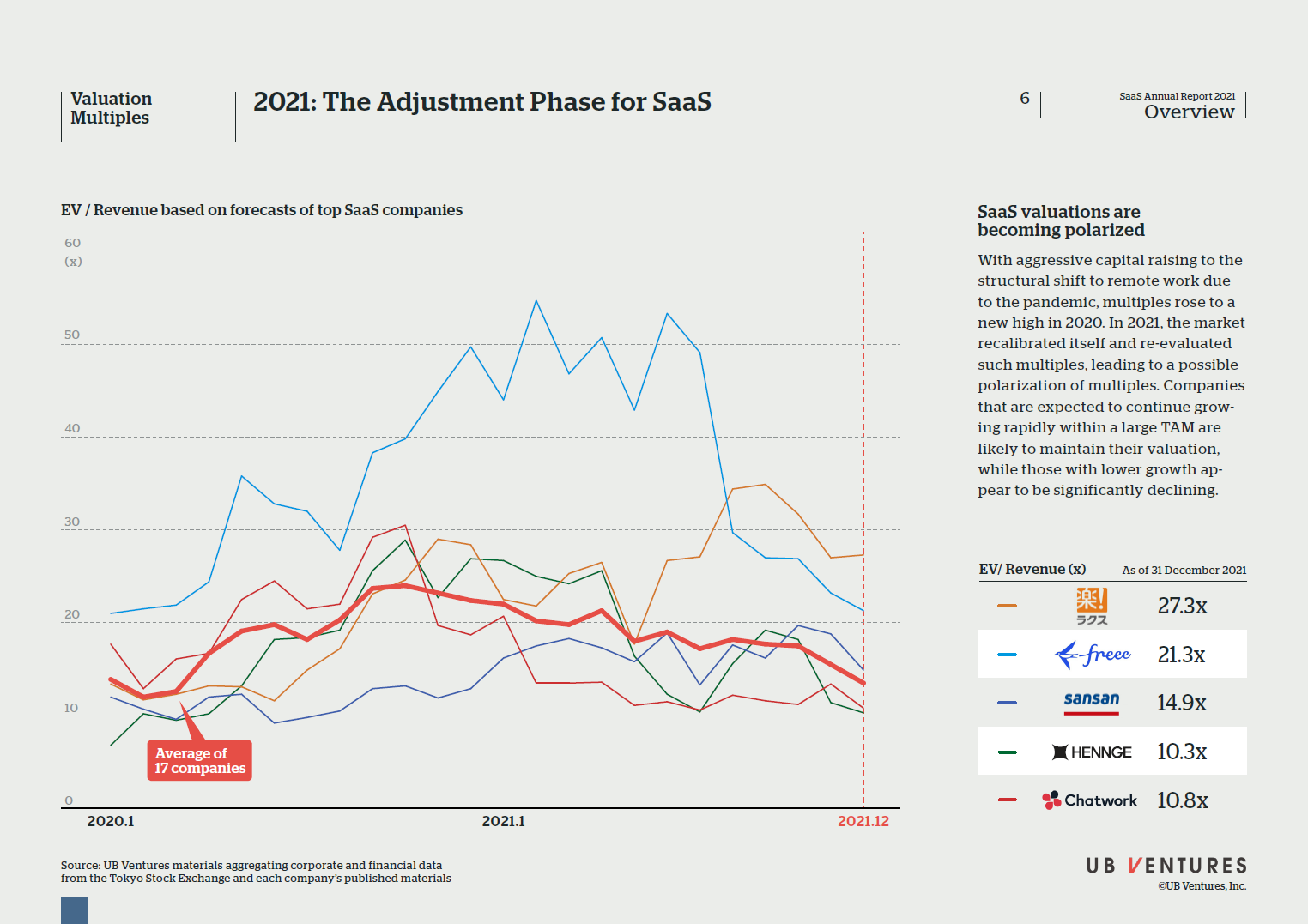

2. Multiples:SaaS Valuations are in the Adjustment Phase

With rising capital market supply amongst VCs, shift to remote work due to covid-19, and structural needs arising from the push for digitalization, high multiples arose for SaaS from 2020 to 2021, with EV / Revenue averaging 20x.

The SaaS market entered an adjustment phase in 2021, with valuations becoming increasingly polarized. While the relatively higher valuations may persist for companies with higher expected growth rates and large TAM, lower valuations are becoming more apparent for those with lower growth rates.

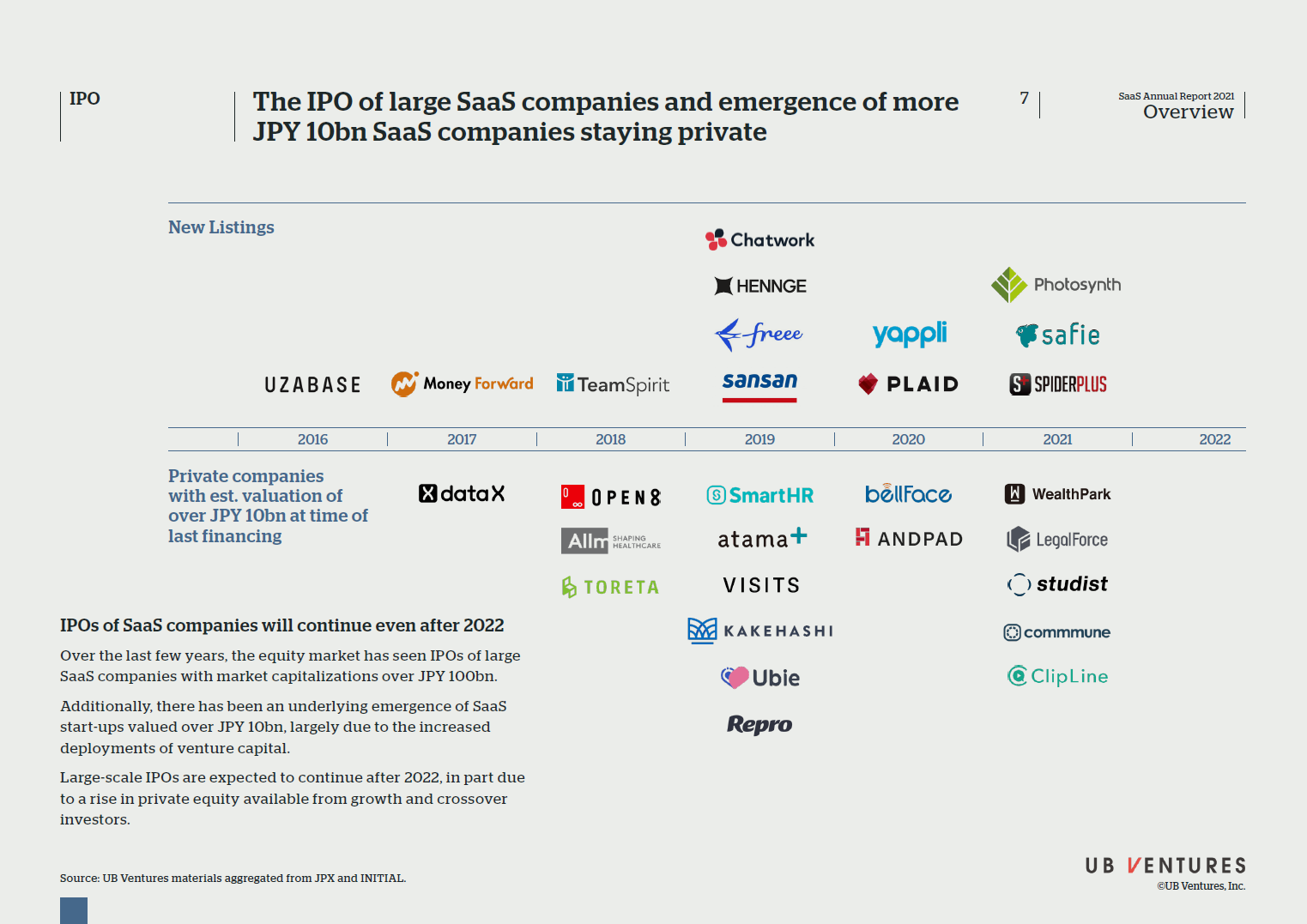

3. IPO:IPO of large SaaS companies and emergence of more JPY 10bn SaaS companies staying private

Over the last few years, the equity market has seen IPOs of large SaaS companies with market capitalizations over JPY 100bn. Additionally, with an underlying emergence of SaaS start-ups valued over JPY 10bn, this has led to increased deployments of venture capital. Large-scale IPOs are expected to continue after 2022, in part due to the rise in private equity available from growth and crossover investors.

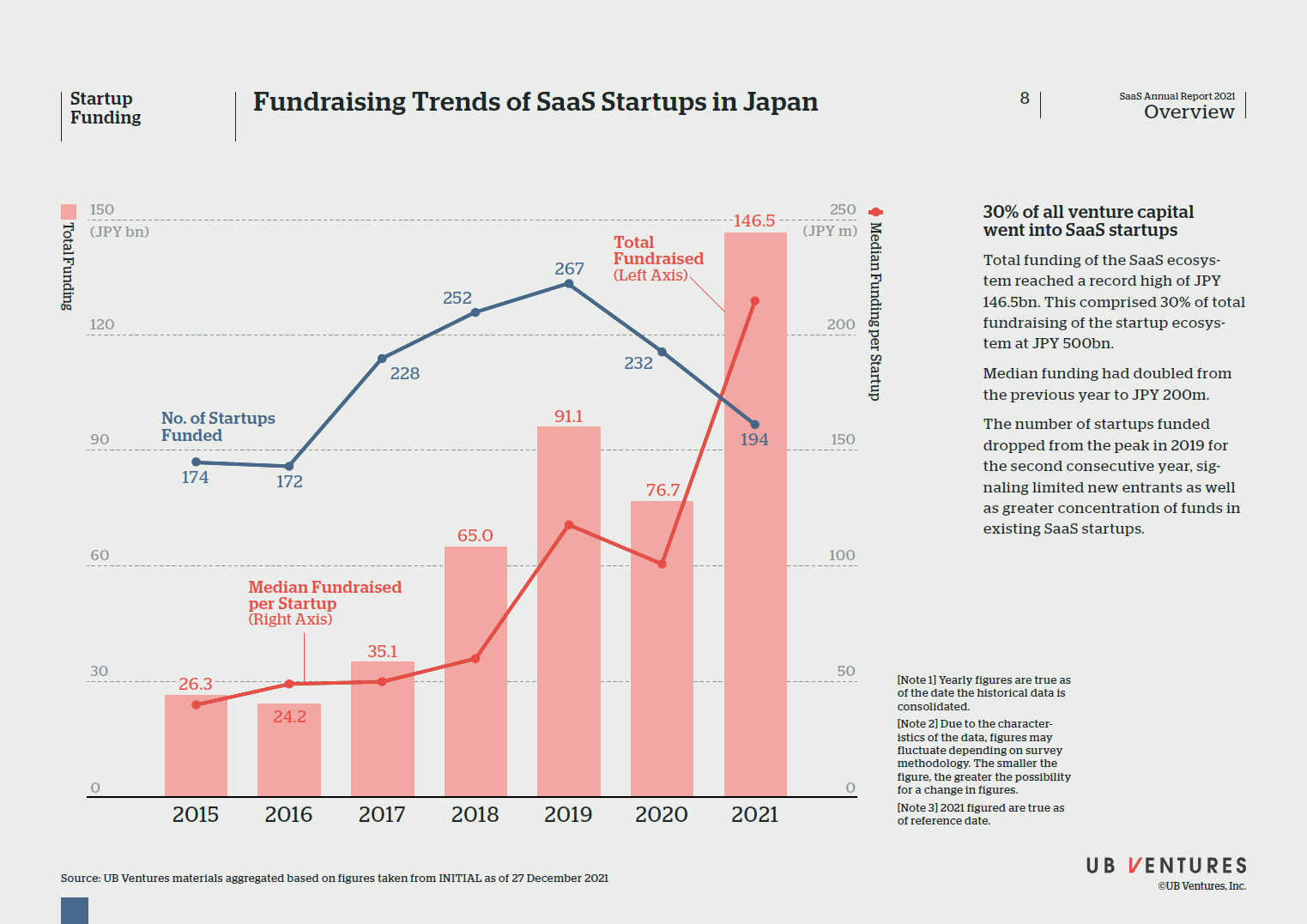

4. Startup Funding:Total funding has reached JPY 146.5bn, with the median amount fundraised increasing significantly.

The total amount of funding raised by SaaS startups has reached a record high of JPY 146.5bn in 2021.

This comprised 30% of total funding of the startup ecosystem, which has reached JPY 500bn.

Median amount fundraised by a startup has doubled from the previous year to JPY 200m. The number of startup fundraising dropped from the peak in 2019 for the second consecutive year, signaling limited new entrants as well as greater concentration of funds in existing SaaS startups.

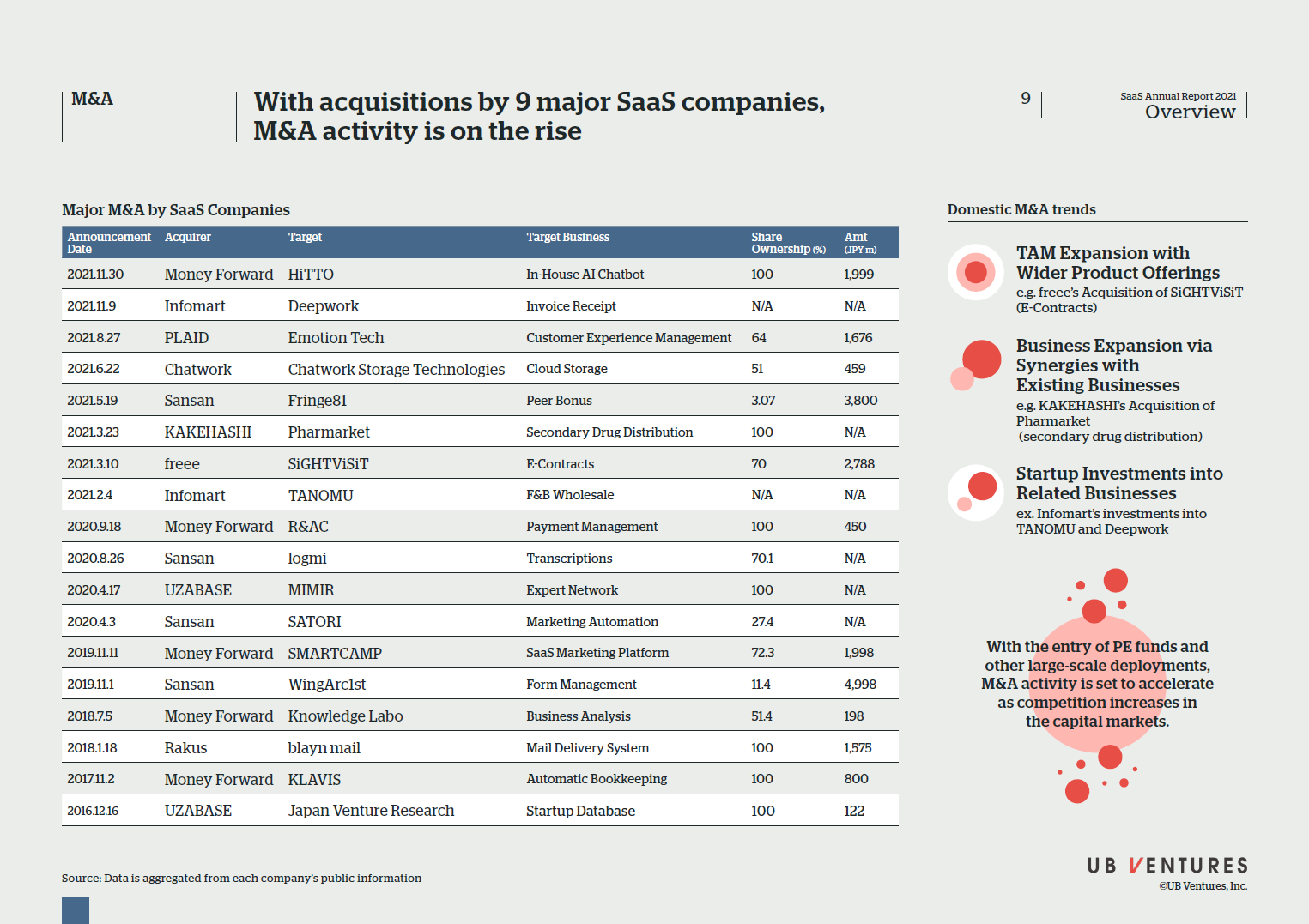

5. M&A:Full-scale investment / acquisition movement due to expansion of business format

M&A activity amongst Japanese SaaS companies is on the rise.

Leading SaaS companies like Money Forward and freee have set aside large amounts of funds for M&A allocations, as they seek to acquire more companies that could possibly complement their existing products and generate business synergies. By looking at past recent transactions, M&A activity can be categorized into the following patterns:

1) TAM Expansion with Wider Product Offerings

ex. freee’s acquisition of SiGHTViSiT (e-contracts)

2) Business Expansion via Synergies with Existing Businesses

ex. KAKEHASHI’s acquisition of Pharmarket (secondary drug distribution)

3) Startup Investments into Related Businesses

ex. Infomart’s investments into TANOMU and Deepwork

With the entry of PE funds and other large-scale deployments, overall growth is set to accelerate as competition increases in the capital markets. From the startup’s perspective, it would be prudent to closely monitor how M&A could develop in the near future as a potential exit opportunity as well, in parallel with IPO exit trends.

– UB Ventures SaaS Playbook –

In the segment entitled ‘SaaS Playbook’, we explore key metrics such as “MRR Velocity”, “Net Revenue Retention”, and “Growth Persistence” – indicators that UB Ventures look at in post-PMF SaaS startups.

We have reorganized the various costs involved in SaaS businesses under this section for ‘costs to be included in COGS for SaaS’, which forms the premise for the SaaS playbook.

6. Gross Margin:SaaS requirement to exceed gross profit margin of 70%

UB Ventures believes that a gross profit margin of at least 70% is a prerequisite for SaaS.

In the disclosures of financial results for listed SaaS in Japan, expenses such as customer support, customer success, engineer costs etc. are generally not separated from general and administrative expenses, which makes it challenging at times to make a uniform comparison across the board for SaaS companies. Here we classify these costs into 6 different categories for clarity.

Looking forward from 2022 onwards, it is possible that the market will pay more attention to not only high growth rates but also high gross profit margins as well, especially for companies who continue to record net loss while growing.

UB Ventures seeks to continue sharing knowledge in this domain, in the effort to push for a standardization of cost benchmarks that would help to foster deeper and more constructive dialogue in this regard.

– SaaS Trend 2022 –

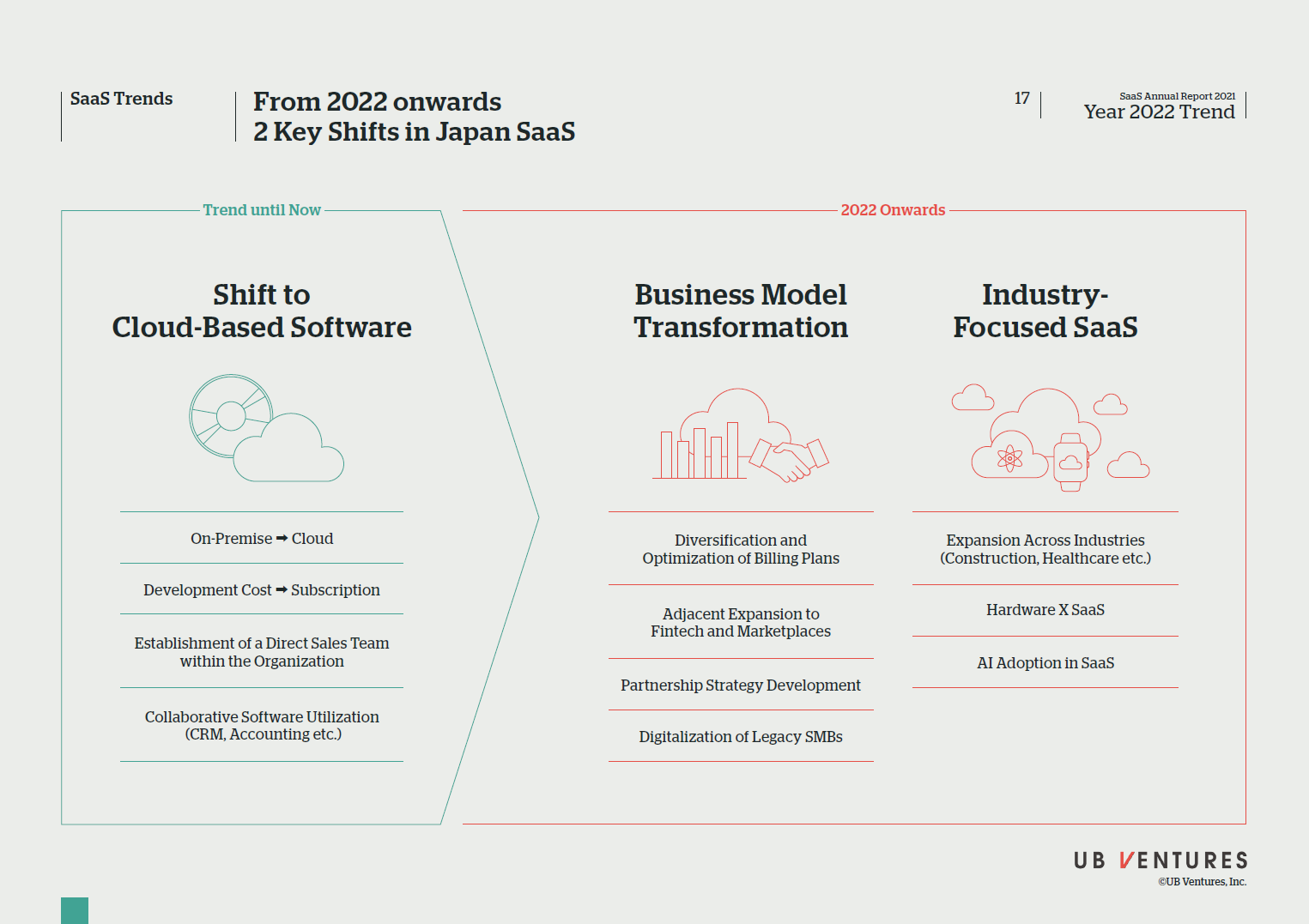

Two trends that we are observing at UB Ventures – Business Model Transformation and Industry-focused SaaS.

Specifically within these two themes, the report will be covering Product Led Growth (PLG) and Vertical SaaS respectively.

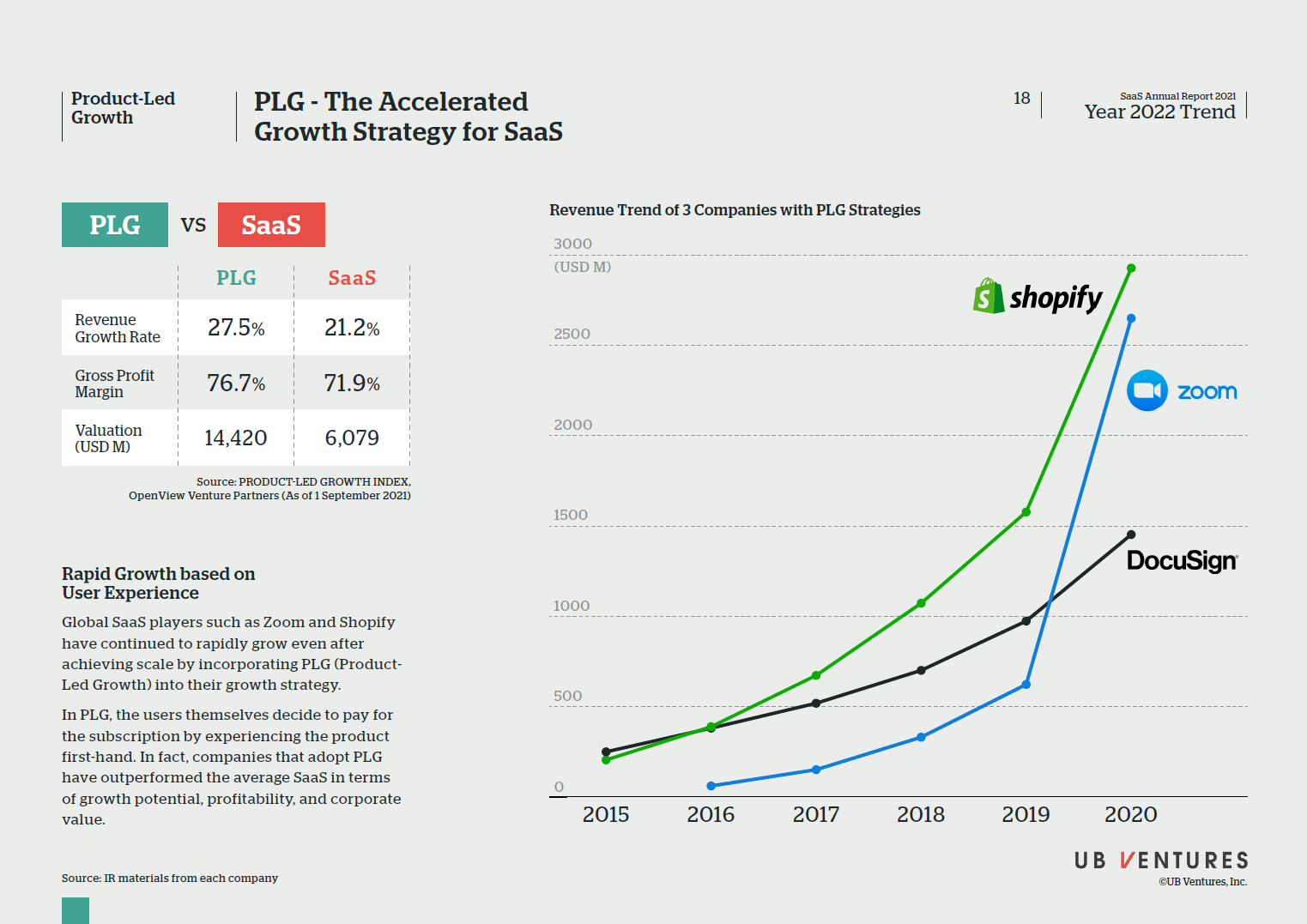

7. PLG: Rapid Growth based on User Experience

Global SaaS players such as Zoom and Shopify have continued to rapidly grow even after achieving scale by incorporating PLG into their growth strategy.

In PLG, the users themselves decide to pay for the subscription by experiencing the product first-hand. In fact, companies that adopt PLG have outperformed the average SaaS in terms of growth potential, profitability, and corporate value.

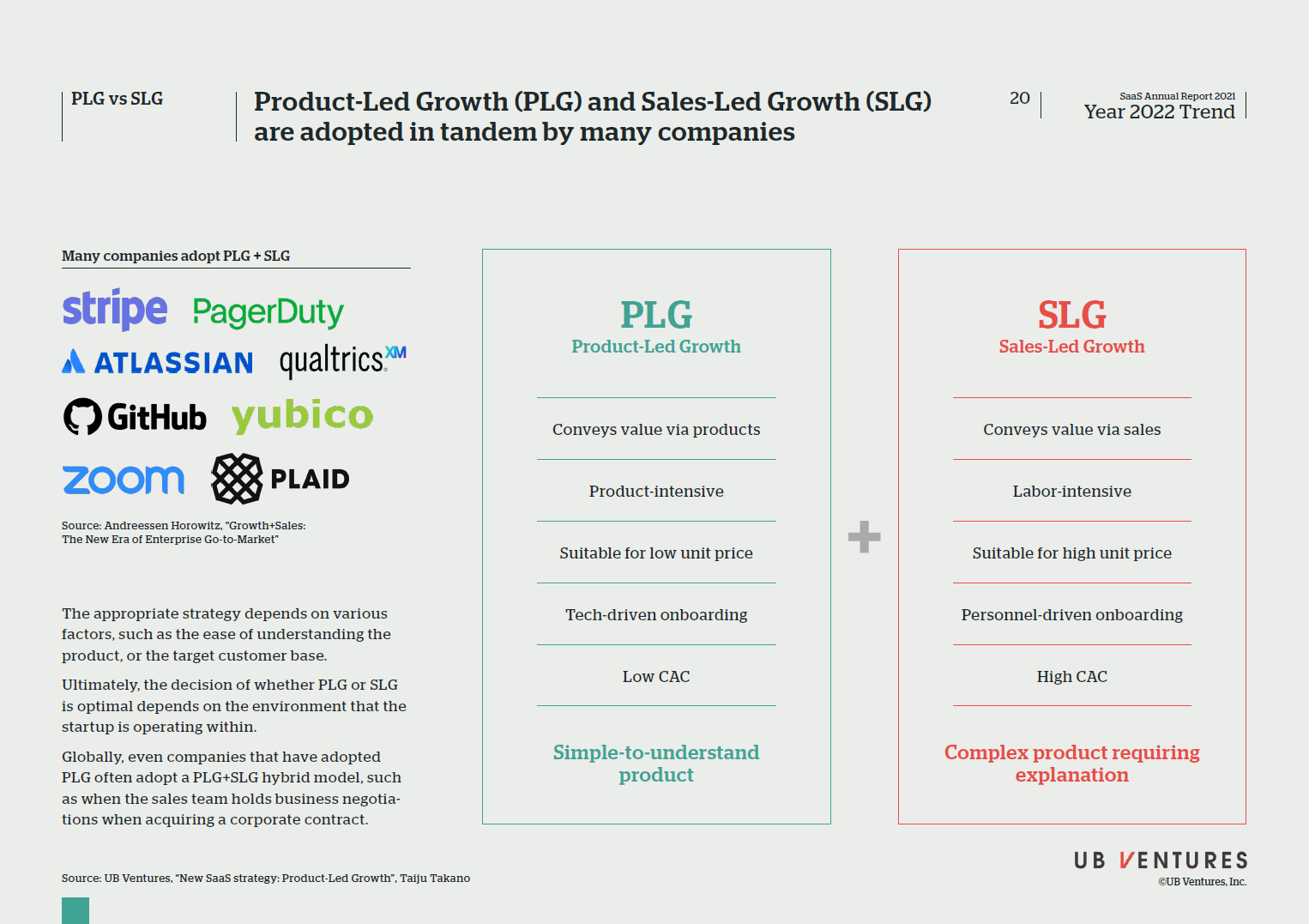

8. PLG&SLG:Many companies adopt both in tandem, rather than choosing only one

When considering the appropriate SaaS growth strategy, it is necessary to consider the ease of understanding of the product, the size of the customer base, and the phase of the product. The decision of whether SLG or PLG is most optimal depends on the environment that the startup is operating within. Globally, even companies that have adopted PLG often adopt a PLG+SLG hybrid model as well, such as when the sales team holds business negotiations when acquiring a corporate contract.

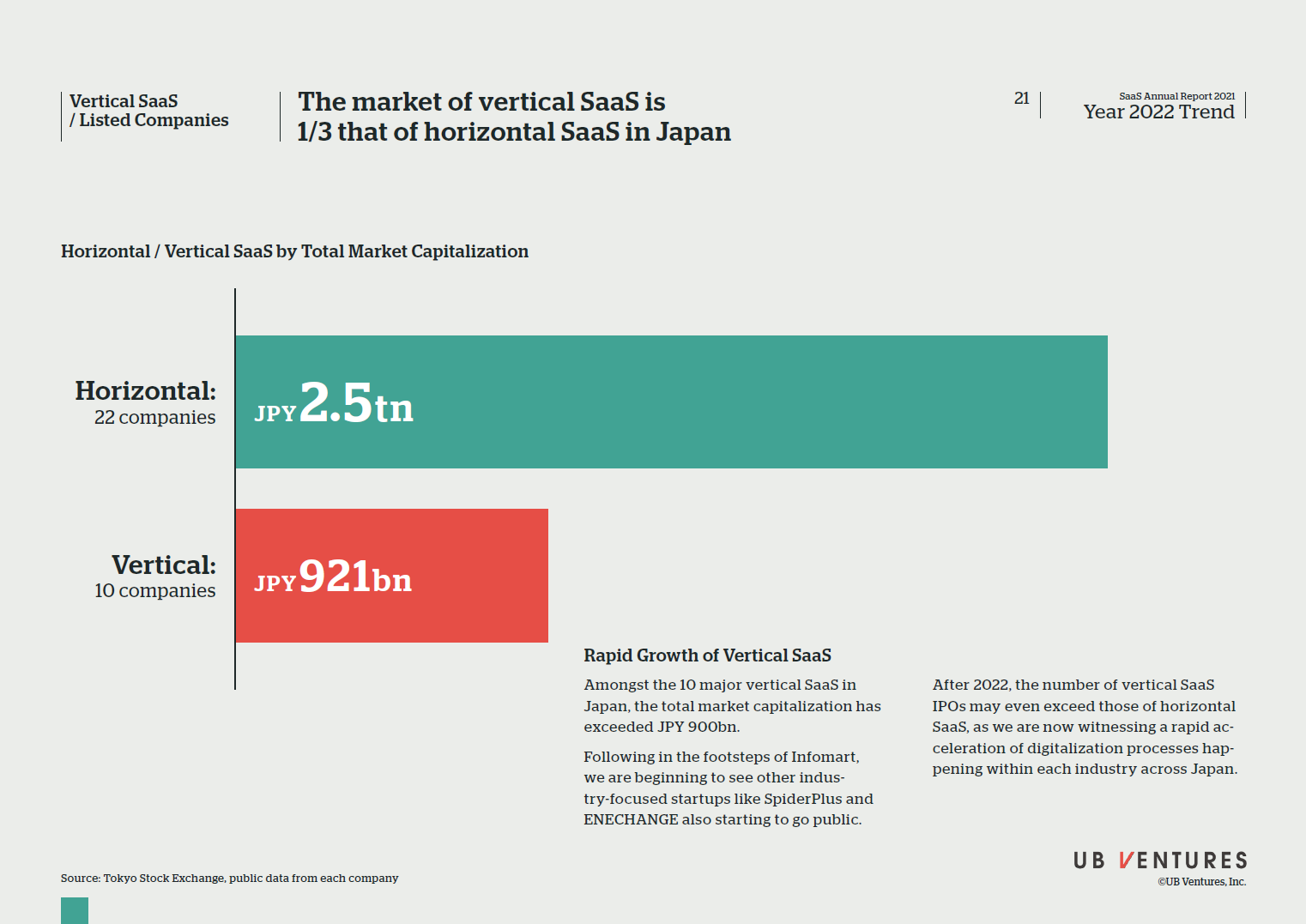

9. Comparison by Market Capitalization:Japan’s Vertical SaaS is about one-third that of horizontal SaaS

There are currently 10 major public vertical SaaS companies in Japan with a total market capitalization of JPY 900bn.

Following in the footsteps of Infomart, we are beginning to see other industry-focused startups like SpiderPlus and ENECHANGE also starting to go public.

After 2022, the number of vertical SaaS IPOs may even exceed those of horizontal SaaS, as we are now witnessing a rapid acceleration of digitalization processes happening within each industry across Japan.

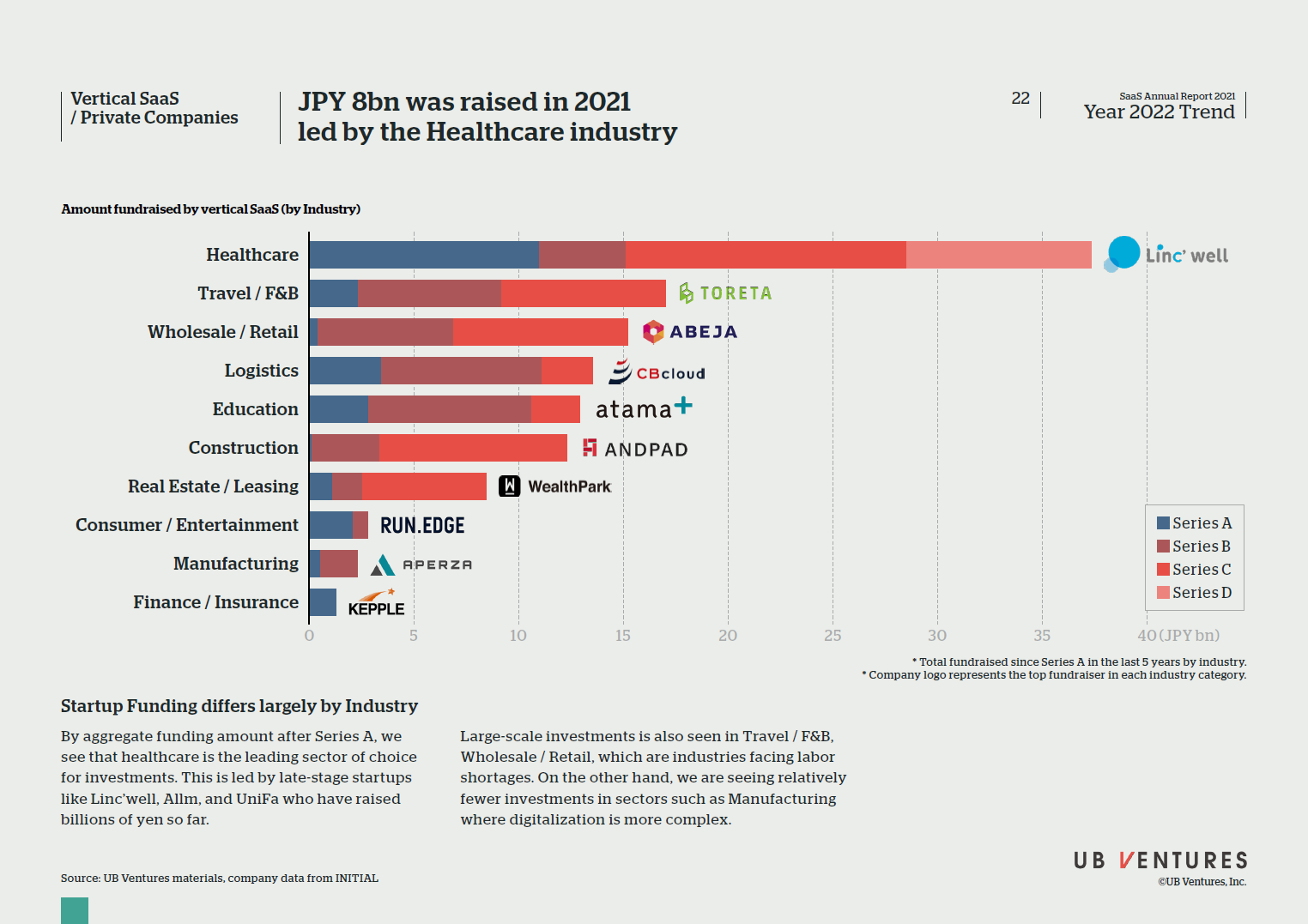

10. Private Vertical SaaS:Healthcare is the leading industry for vertical SaaS investments

By aggregate funding amount after Series A, we see that health is the leading sector of choice for investments. This is led by late-stage startups like Linc’well, Allm and UniFa who have raised billions of yen so far.

Large-scale investments are also seen in Travel / F&B, Wholesale / Retail, which are industries facing labor shortages.

On the other hand, we are seeing relatively fewer investments in sectors such as Manufacturing, where digitalization is more complex.

– China SaaS –

In November 2021, UB Ventures welcomed Chiamin Lai as a new Managing Partner – who brings a wealth of experience in business across Japan and China, alongside her professional experience in venture capital – as we continue to provide insights not only in the Japan ecosystem, but in China and across Asia.

In this segment, we seek to provide a brief look at the macro trends and developments in the China SaaS market today.

China SaaS:The Golden Age of the Chinese SaaS is only beginning

Overall Direction

Osamu Iwasawa (Representative Director, Managing Partner)

Akio Hayafune (Chief Analyst)

Content Direction

Osamu Iwasawa (Representative Director, Managing Partner)

Chiamin Lai (Managing Partner)

Takuya Oshika (Principal)

Akio Hayafune (Chief Analyst)

Editor

Takaki Nishitani (Researcher)

Design

Hajime Aomatsu (sukku)

Production / Translation

Jorel Chan

Shinya Iwashita

Data references

INITIAL:https://initial.inc/

Aggregate Corporate Data:https://note.com/_funeo

Here at UB Ventures, we regularly deliver useful content on both Japanese and global startup trends, as well as hands-on experience from our very own venture capitalists and specialists. Please feel free to contact us via the CONTACT page if you would like to be in touch. Click here to follow UB Venture’s SNS account!

-

SCALING

METRICS

TRENDS

SaaS Annual Report 2023-2024

-

SCALING

METRICS

TRENDS

SaaS Annual Report 2022 – The Key to Industry Transformation –

-

TRENDS

Will the next Unicorn Emerge from the Industrial IoT market in Japan?

-

TRENDS

Will hanko seals ever disappear from Japan?

-

TRENDS

System Integrators – the Key to Success for SaaS in Japan

-

SCALING

Has SaaS become a recognized industry in Japan?

-

SCALING

A list of “Don’ts” when building SaaS: Lessons learnt from engaging with 200 startups

-

SCALING

METRICS

TRENDS

SaaS Annual Report 2021

-

SCALING

TRENDS

3 Successful Strategies of Top Logistics Startups in SEA

-

TRENDS

SEA-Specific Vertical SaaS

-

TRENDS

Latest SaaS Trends in SEA

-

TRENDS

The State of Vertical SaaS in Japan