Has SaaS become a recognized industry in Japan?

SCALINGSaaS are generally seen as SMEs, not large companies that have achieved scale.

When I had asked someone in Japan about the possibility of investing into SaaS companies here, this was the unexpected answer that I had gotten.

Indeed, there are SaaS companies that appear to be doing relatively well, with large private companies such as From Scratch (now known as DataX) and SmartHR, as well as publicly listed companies such as Sansan and freee.

We do recognise that the SaaS has attracted media attention in recent years, as though the ecosystem has already been established within the industry; however, when we do look at objective figures, we realize that the scale of the industry is still not large yet.

In this article, by looking at key data sets, we will be providing an overview of the current state of SaaS in Japan, as well as key points that we believe will pave the way for the industrialization of SaaS in Japan.

Current State of SaaS in Japan

Let us begin by making a comparison of the market presence of Japanese SaaS companies with respect to the overall market size, in terms of market capitalization.

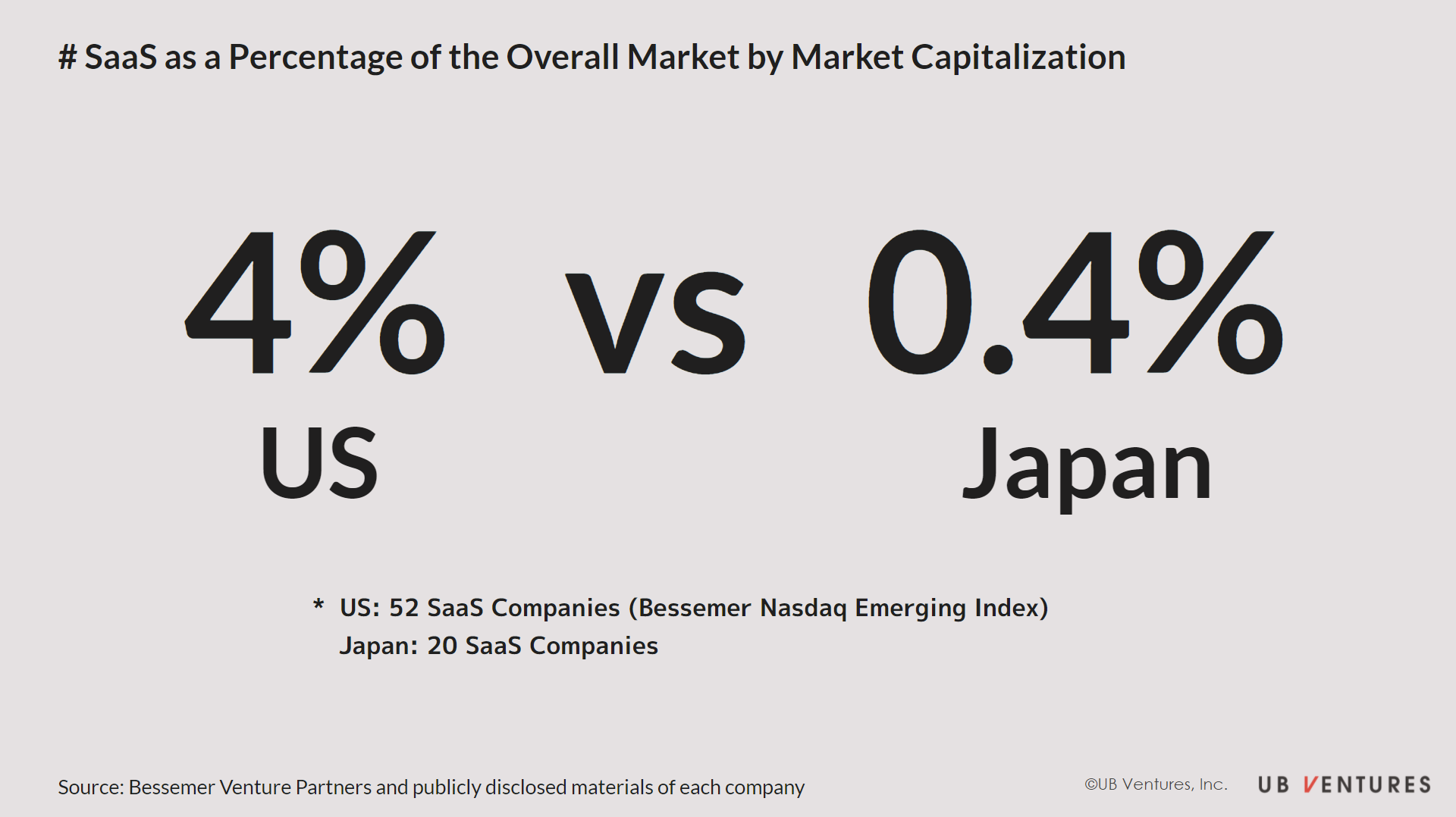

■ 1/10 of the total stock market in the United States

When comparing the market capitalization of SaaS companies to the total market of major stock exchanges, we see that SaaS companies occupy 4% of the US total market, but 0.4% of Japan’s total market (as of 21 Aug 2020). US figures are based on the BVP Nasdaq Emerging Cloud Index, comprising 52 listed equities representative of SaaS. Yet, this basket does not include companies such as Microsoft and Google; so the SaaS products of those companies are taken into account as well, it is clear that SaaS as an industry has matured to occupy a comparably large scale in the US.

On the other hand, although SaaS does have a nascent presence in emerging public equities on the Mothers section of the Tokyo Stock Exchange, it admittedly still remains a sub-sector of the overall IT industry when looking at the market as a whole.

■ Domestic SaaS companies that cannot make it into the top 100 companies by market capitalization

Next, let us have a closer look at the scale of individual SaaS companies.

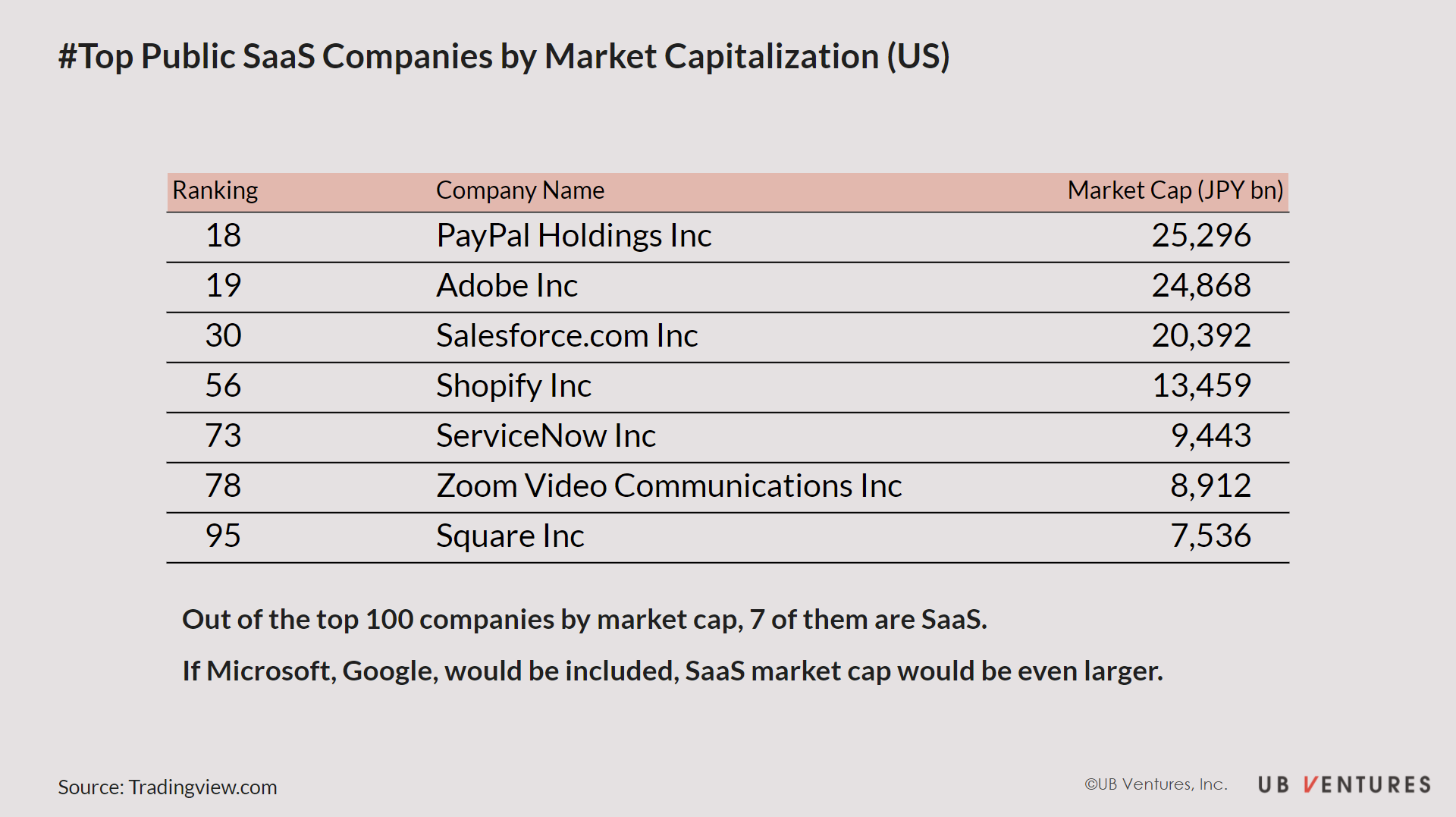

Looking at the US stock market, we see that PayPal, Adobe and Salesforce have a market capitalization of over JPY 20tn, and overall, 7 out of the top 100 companies in the US are SaaS.

This is in contrast with other industries, for example, in automobiles, where only Tesla is ranked, or the banking industry, which only comprises 3 companies, including JP Morgan. We see that SaaS in the US has overtaken other traditional industries to lead the transformation of the overall industries; a clear symbolic example of such representation could be seen when Salesforce was selected to be part of the Dow Jones Industrial Average.

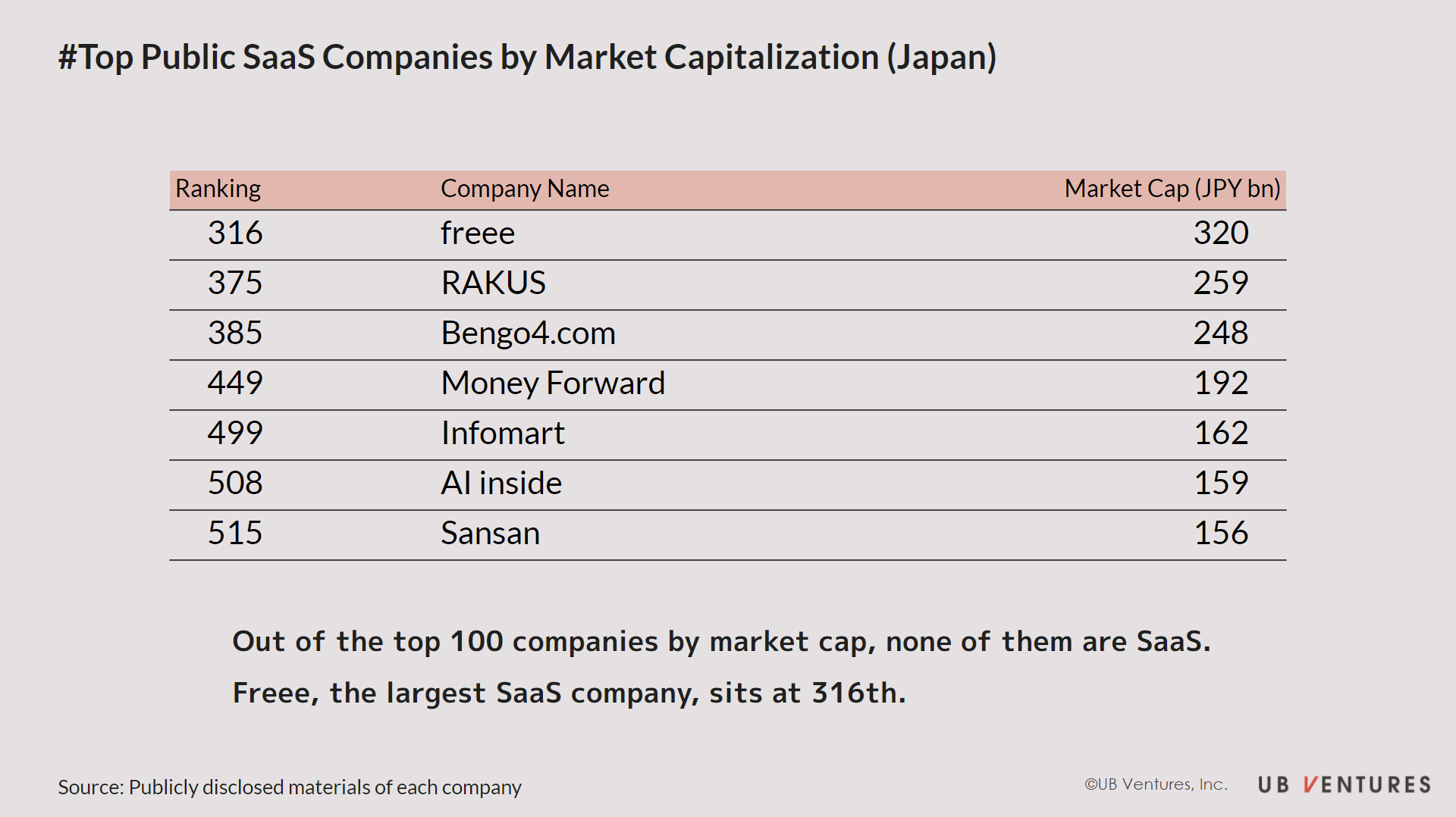

On the other hand, when we look at the market in Japan, the top SaaS company by market capitalization is freee at over JPY 320bn, but it does not rank within the top 100 companies in Japan. At present, there is no SaaS company represented in the Nikkei 225 – the market has yet to witness the birth of a SaaS company which has reached a scale truly representative of Japan.

■ 90% of Revenue generated domestically within Japan

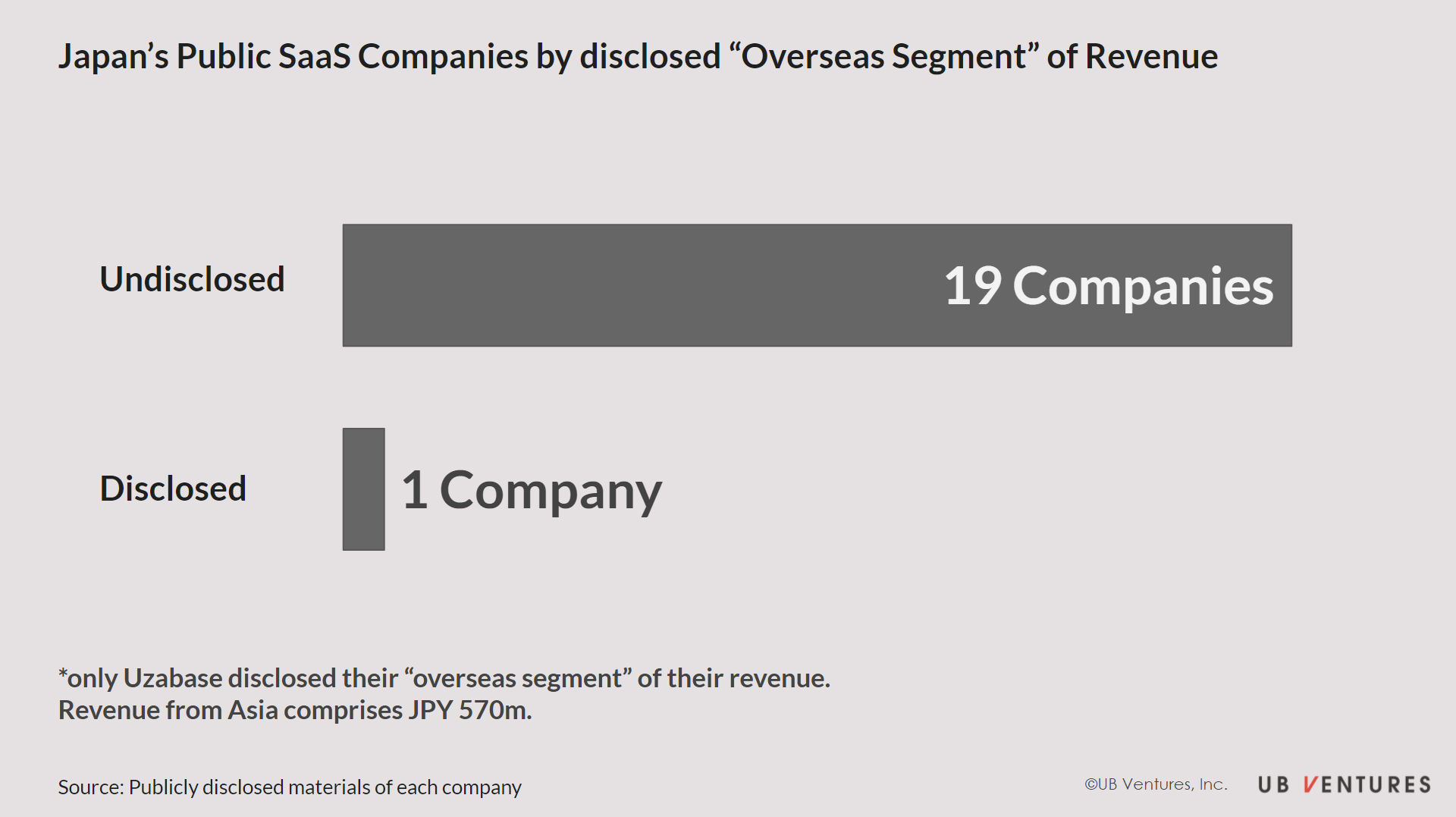

Although SaaS companies tend to attract attention due to the latest technologies and products employed, the present state of affairs is that most of the companies in Japan are still almost wholly focused on the domestic market.

Generally in Japan, if a listed company records 10% or more of its sales in a specific region outside of Japan, it will be disclosed under a separate “overseas segment”. However, even within 2020’s financial disclosures of the 20 listed major SaaS companies in Japan, only 1 company, Uzabase, has disclosed an overseas segment. As for the other 19 companies, since there was no disclosure of an overseas segment, it is assumed that they are primarily still focused on the domestic Japanese market – so it is safe to say that more than 90% of SaaS revenue for Japan is still primarily from the domestic market.

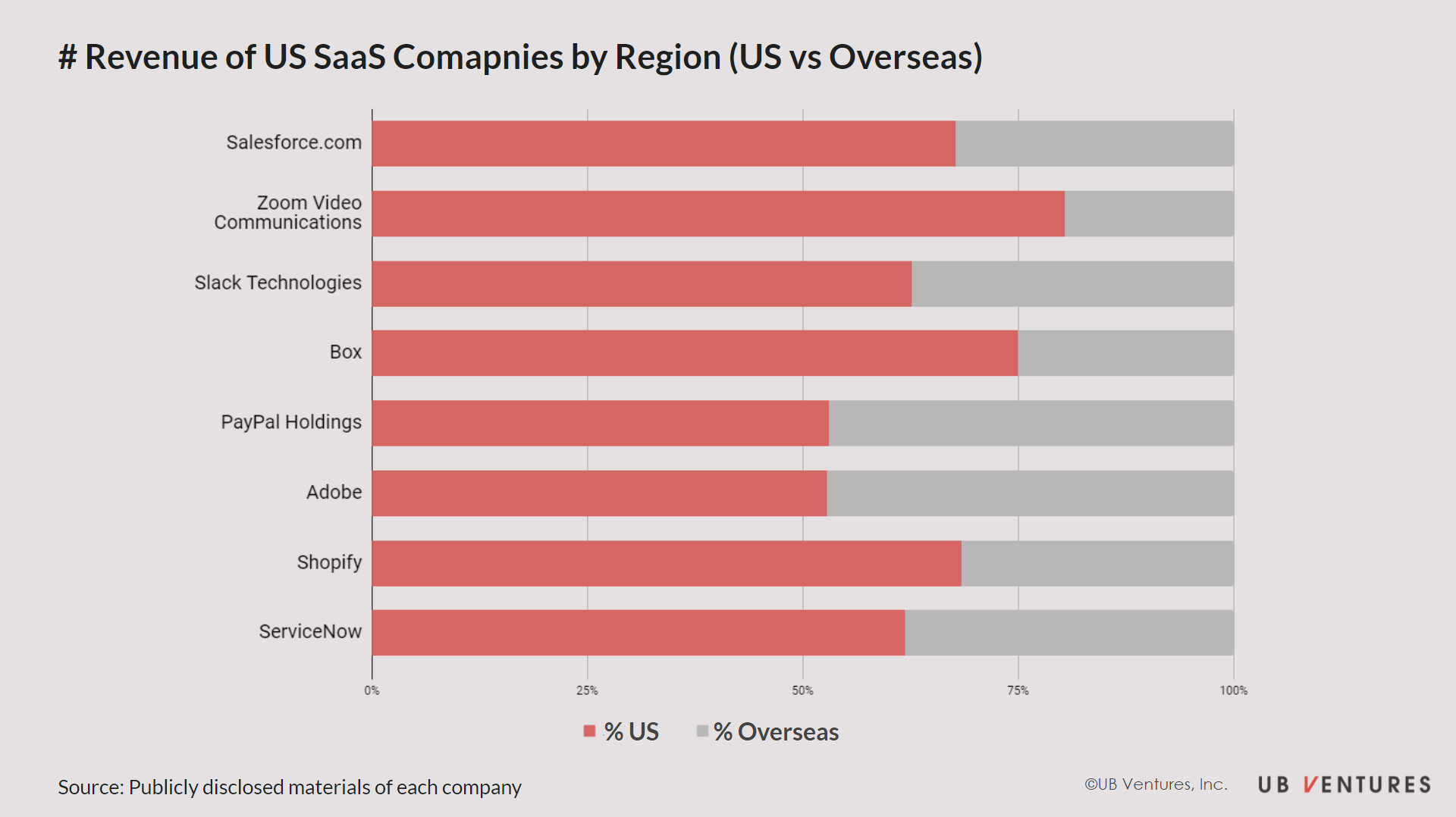

Nonetheless, we see that on the other hand, US companies often seek to expand their reach by aggressively focusing on global expansion, on top of acquiring a large market share domestically.

When we look at individual companies in Japan, we do see hints at global expansion, such as Cybozu’s Kintone (PaaS product) which has reported relatively high customer satisfaction in the US, or Uzabase’s SPEEDA financial database, which has achieved sales of JPY 500m. Producing such companies and products remains one of the largest challenges in the SaaS industry in Japan today.

3 Points for the Industrialization of SaaS in Japan

From the points covered above, we now have a better understanding of the current state of SaaS in Japan by looking at both Japan and US SaaS companies.

In light of this, how shall we delineate a clear strategy for SaaS in Japan, such that it would grow to 4% of total market capitalization – i.e. to be on par with the US market proportions?

At UBV, we believe that the key to industrialization is the aggressive growth of the SaaS startup ecosystem in Japan.

By looking at the trajectories of growth of Japan’s SaaS companies, as well as their deep focus on domestic revenue drivers so far, we believe that it is imperative for SaaS companies to consider the following 3 points to which we believe would spur the industrialization of SaaS in Japan.

1) Replacement: Replacing existing software

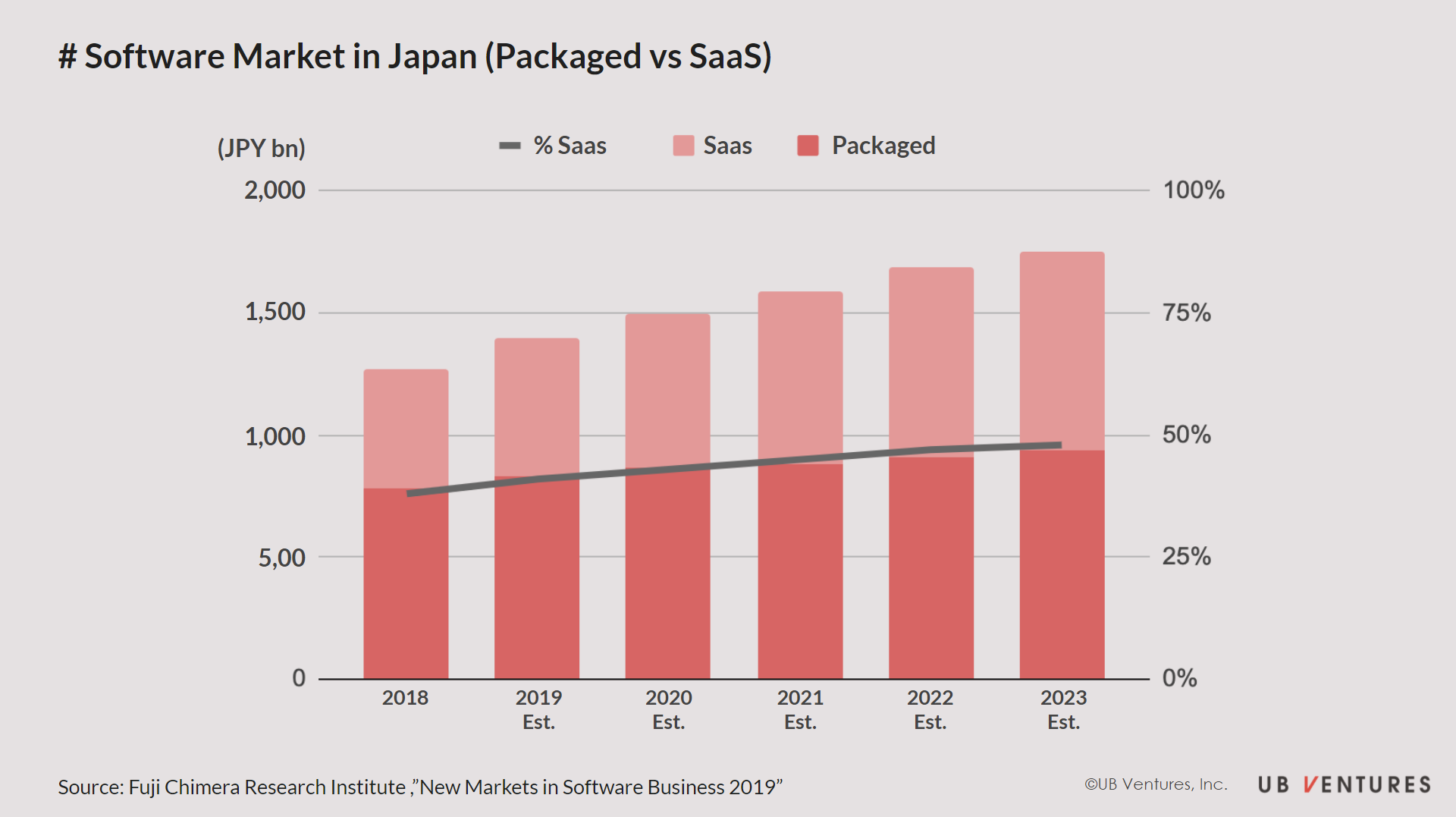

The replacement of packaged / on-premise software with SaaS has been the primary backdrop for growth in SaaS companies in Japan so far. As shown in the chart above, it is evident that the % of SaaS sales is increasing year-on-year – as this trend steadily grows, we can expect SaaS to overtake packaged adoption in the near future.

Some instances where SaaS has replaced older packaged software that were popular in the 2000s include: freee’s “freee Accounting”, RAKUS’ “Rakuraku Seisan”, amongst others, where the clear advantages lie in them being cloud-based, low-cost, and easy-to-understand.

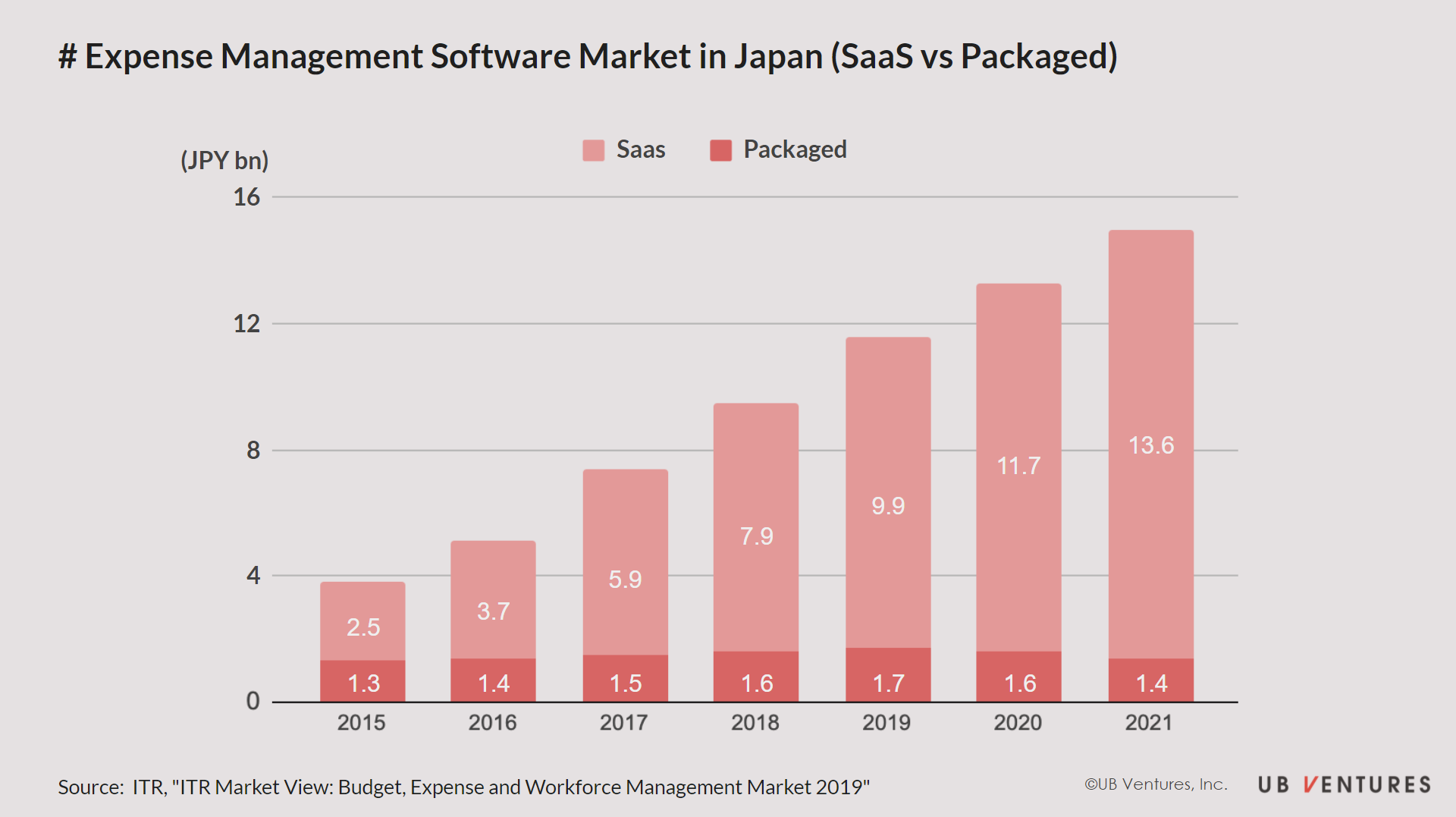

When it comes to expense and settlements, SaaS has already overtaken on-premise software with an estimated market share of 90%, and in terms of HR / personnel attendance, Saas has achieved 50% market share, indicating that software adoption is already underway.

In terms of actual replacement, the level of difficulty replacing packaged software differs greatly depending on these aforementioned fields, as well as the overall complexity of the business and the level of security features required, which therefore means that the requirements for SaaS similarly differ on a case-by-case basis.

If the percentage of SaaS adoption rapidly increases in general, or if SaaS solutions could effectively tackle and replace packaged software in complex fields, these would make it possible to catalyze a greater market share for SaaS in Japan. Moreover, when we look at the unique silo-ed characteristics of the systems specific to each of these industries, one of which would be manufacturing which still primarily operates on legacy infrastructure, there lies huge potential for vertical SaaS to provide software solutions in these areas as well.

2) Expansion: Expanding across the enterprise market

In recent years, the replacement of packaged software by SaaS has made great progress across SMEs, but it remains the reality that the enterprise market still remains relatively untapped – this is a key area where massive potential opportunities lie for SaaS to make inroads by aggressively scaling and expansion.

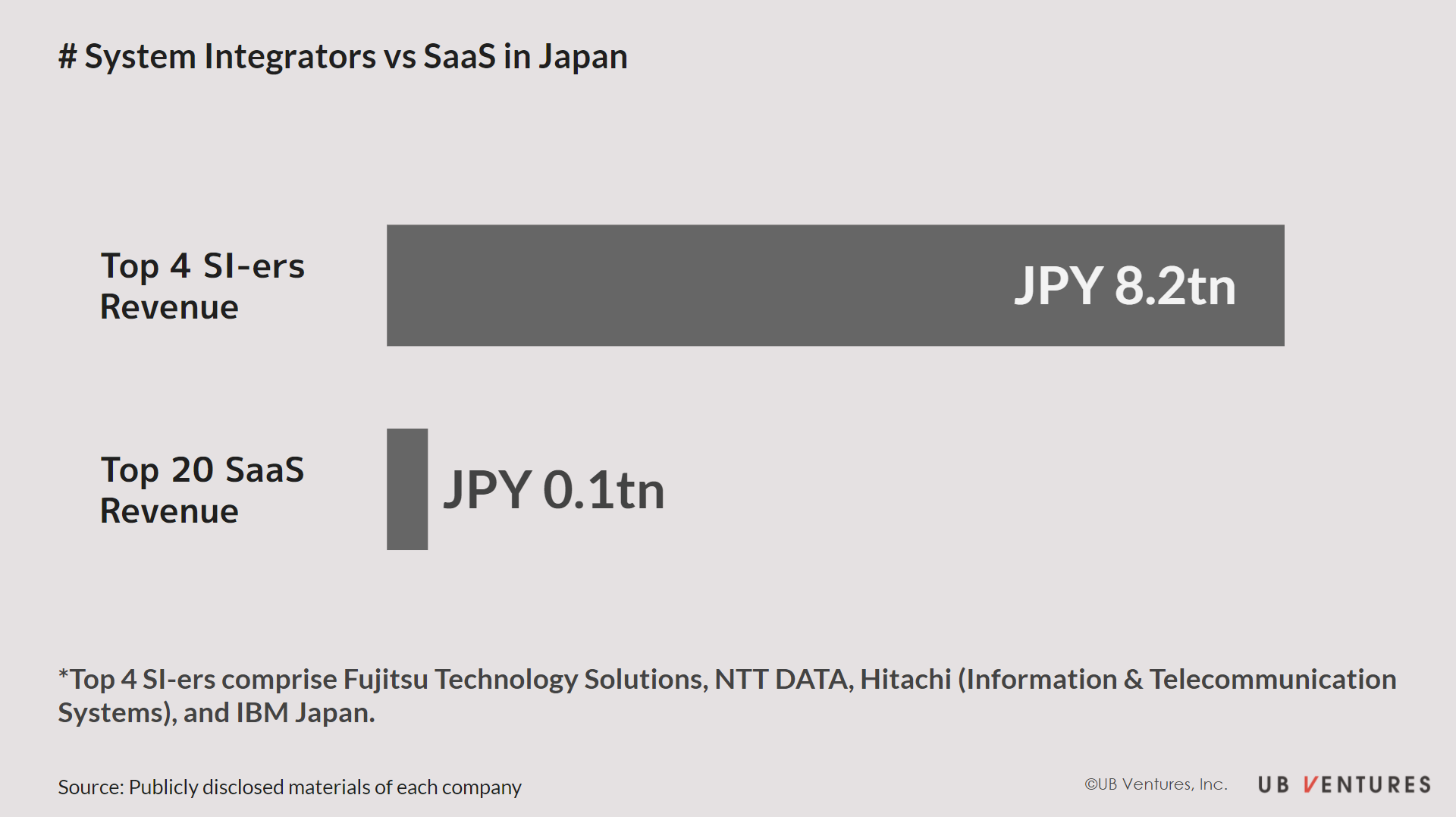

Until now, enterprise systems have primarily been created, implemented, and maintained by what we call System Integrators (SI) in Japan; noticeably, there is a marked distinction between the scale of revenue of these SI-ers, compared to SaaS.

The total revenue of the big 4 SI-ers in Japan make up JPY 8.2tn, but the total sales of the top 20 domestic SaaS companies in Japan make up JPY 100bn, which is less than 2% in comparison. Even with the assumption that SaaS is rapidly growing at this point in time, and that we should perhaps use LTV as a more relevant metric rather than annual revenues, but even, there is still a huge and obvious market difference overall.

*According to industry statistics, revenue of system integrators for software development are estimated to be JPY 5tn.

Since SI-ers provide the full-suite service of planning, development, maintenance, and management of the systems for customer data, it is still relatively unlikely that SaaS startups could possibly replace these entire pre-existing enterprise systems. Nonetheless, it is inevitable in the future that both SI-ers as well as SaaS will be competing and/or collaborating more closely with each other across enterprise clients. For instance, in the past, it was these SI-ers and IT consultants that signed partnership contracts to promote the use of Salesforce within enterprises; in this sense, it is necessary to have a strategy to effectively enter the enterprise market, while at the same time working closely with these existing players.

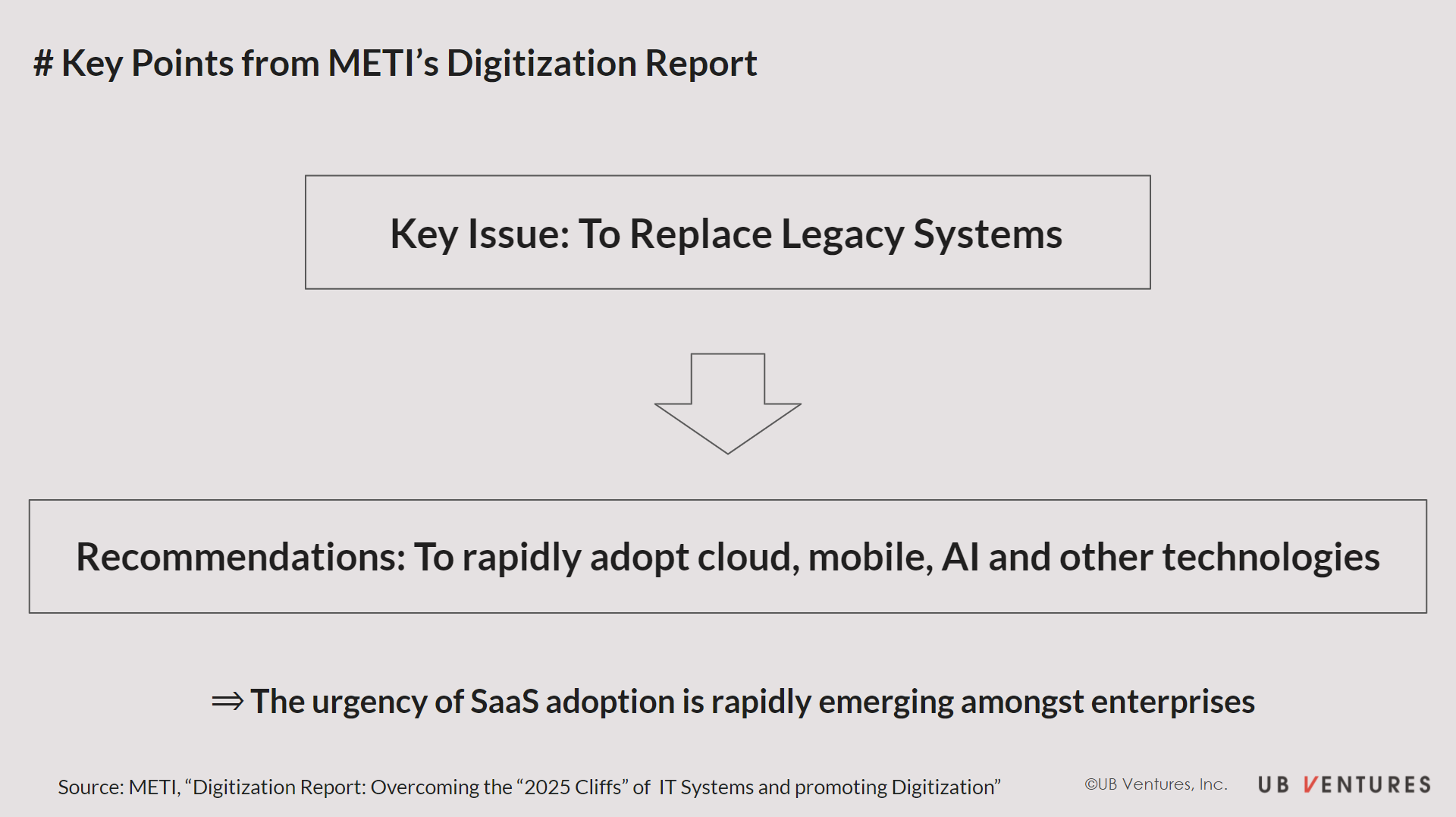

In several digitization reports published by METI in 2018, there was an aim to transform industries that still primarily operate on legacy systems, in order to boost real GDP to over JPY 130tn by 2030. The need for SaaS is undeniably increasing for large enterprises, such as the requirements for cloud computing technologies. Indeed, it is challenging for SaaS startups to iterate and develop their capabilities alone; it is in partnerships and closer collaborations with these enterprises who need digitalization solutions, that we see a potential strategy for SaaS startups to effectively penetrate the enterprise market with their products while existing alongside the SI-ers.

3) Innovation: Bringing together technology with SaaS

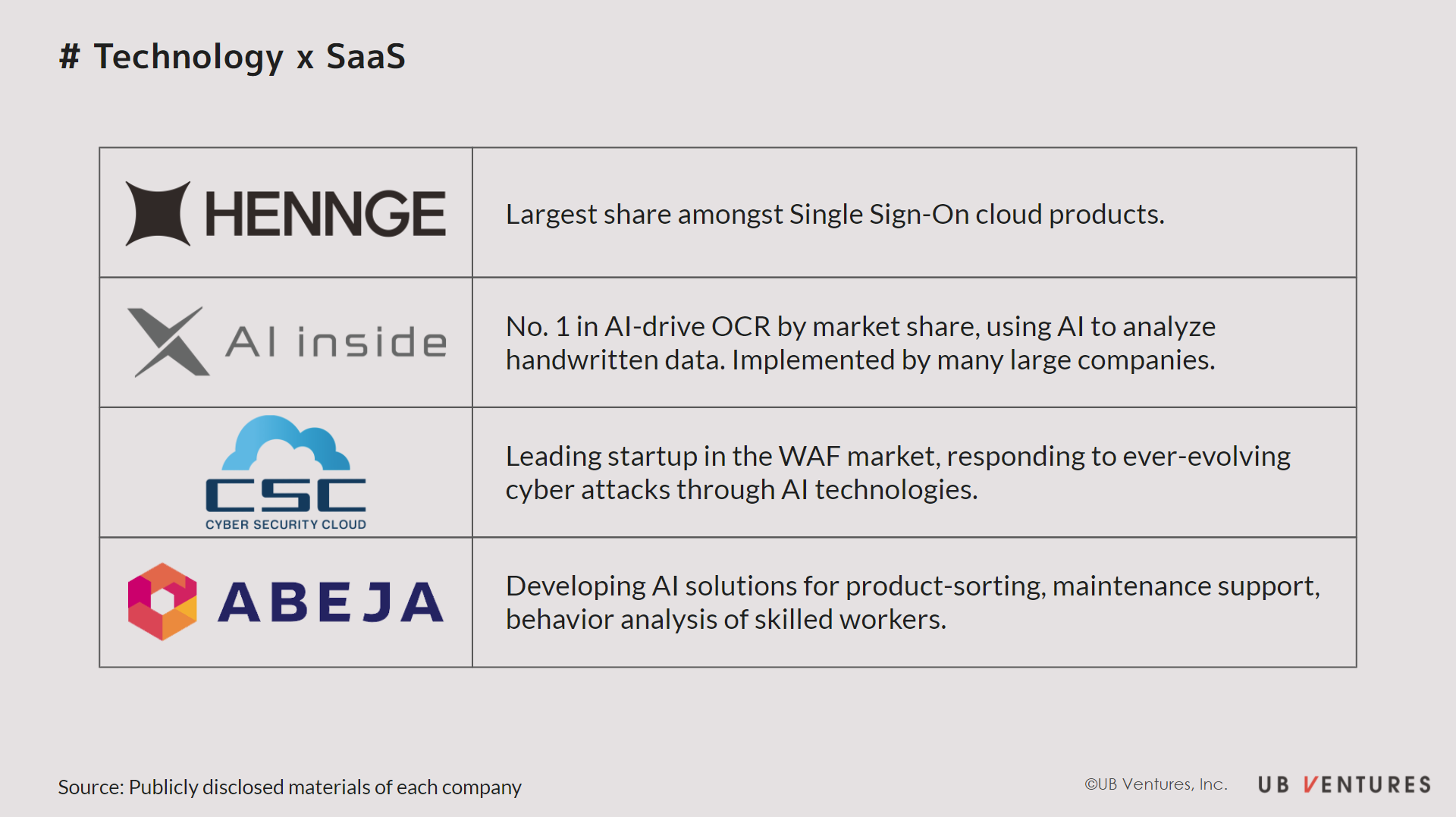

Finally, the 3rd and final point of effectively industrializing SaaS in Japan is focusing on the potential for market creation to be technology-driven. On the public market, we see instances of technologically-driven SaaS companies such as HENNGE, AI inside, Cyber Security Cloud, which have seen relatively rapid increases in their stock prices after being listed, or ABEJA, a startup that has fetched a valuation of over JPY 20bn while staying private. These companies are AI-driven companies that are provided unprecedented technological solutions primarily through the SaaS business model.

If we are to believe that a form of technology-driven market creation can be conceived, then it follows that we could plot a steady growth trajectory without it being overly dependent on other business factors such as the addressable market for SMBs or enterprises.

For instance, AI inside, a company that listed within 4 years since its founding in 2015, has worked with various renowned companies, providing AI-based OCR technology to convert handwritten notes into data, thereby allowing these companies to reduce their costs. As a result of covid-19 and the shift to remote work, we saw the company’s stock momentarily rise in 2019, with JPY 1.59bn in revenue and a market capitalization of around JPY 170bn at that time.

Another AI SaaS company, Cyber Security Cloud – which provides web-based AI security solutions – had also reached a market capitalization of JPY 52bn and a 40x PSR in 2020. In light of this, we do see that there may be potential for these technology-driven SaaS companies to grow, not bound by existing systems, but free to create new markets and increase the scale of Saas as a whole.

With respect to the initial question in the title, “Has SaaS become a recognized industry in Japan?”, the answer would clearly be a “No” based on current data, with the difference being relatively apparent when compared to statistics from the US.

In light of this, we have also discussed the possible opportunities for growth in Japan’s market; however, another separate discussion that is in equal measure necessary would be on how to actually create a truly global SaaS company from Japan.

On the other hand, by looking at the trends in the macro environment, there is an increasing awareness of the necessity for SaaS in Japan; from the digitization strategy of corporates, to the structural shift to remote work, there are abundant opportunities for SaaS startups to create solutions for the Japan market.

Here at UB Ventures, we are dedicated to the mission of promoting SaaS as a recognized industry in the Japan market, not only through our investments, but in our myriad of activities such as running our own entrepreneur-focused programme, Thinka, as well as regularly publishing research contents on the Japan SaaS ecosystem.

By Akio Hayafune | UB Ventures Chief Analyst

Translation by Jorel Chan | UB Ventures Associate

2022.03.04

Here at UB Ventures, we regularly deliver useful content on both Japanese and global startup trends, as well as hands-on experience from our very own venture capitalists and specialists. Please feel free to contact us via the CONTACT page if you would like to be in touch. Click here to follow UB Venture’s SNS account!

-

SCALING

METRICS

TRENDS

SaaS Annual Report 2023-2024

-

SCALING

METRICS

TRENDS

SaaS Annual Report 2022 – The Key to Industry Transformation –

-

TRENDS

Will the next Unicorn Emerge from the Industrial IoT market in Japan?

-

TRENDS

Will hanko seals ever disappear from Japan?

-

TRENDS

System Integrators – the Key to Success for SaaS in Japan

-

SCALING

Has SaaS become a recognized industry in Japan?

-

SCALING

A list of “Don’ts” when building SaaS: Lessons learnt from engaging with 200 startups

-

SCALING

METRICS

TRENDS

SaaS Annual Report 2021

-

SCALING

TRENDS

3 Successful Strategies of Top Logistics Startups in SEA

-

TRENDS

SEA-Specific Vertical SaaS

-

TRENDS

Latest SaaS Trends in SEA

-

TRENDS

The State of Vertical SaaS in Japan