Will the next Unicorn Emerge from the Industrial IoT market in Japan?

TRENDSThe “Internet of Things (IoT)” is a crucial concept that we need to update our perception of, as it has evolved significantly over the years. Initially, the term referred to connecting consumer appliances such as air conditioners and refrigerators to the internet to improve people’s lives. However, in the present day, the term “IoT” is seen less frequently and is considered a buzzword that has lost its significance.

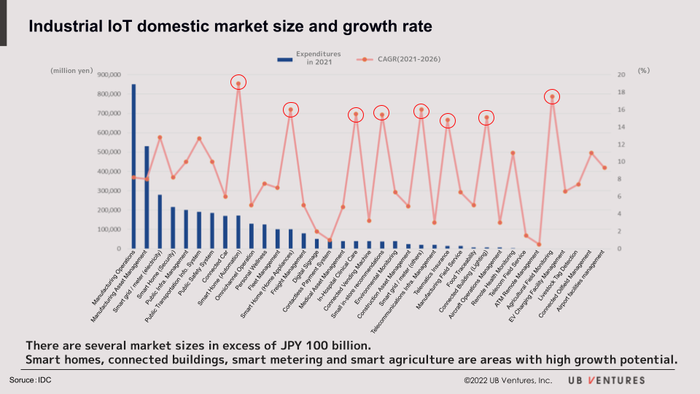

On the other hand, the Industrial IoT (IIoT) is expected to see a global investment of 2.7 trillion yen by 2021, led by the Connect Building, among others. IIoT, including manufacturing, is attracting companies’ attention as it is expected to have a significant impact on the Japanese economy, and investment in this area is steadily increasing.

UB Ventures considers IIoT a growing market in Japan and a top priority theme for the future. This article provides an overview of the new IoT market and its potential.

Market Scale and External Environment of the Giant Industrial IoT

Despite our lack of awareness, the industrial IoT has already penetrated the world. According to the research firm IDC, IoT investment in key industries in Japan, such as manufacturing operations and connected cars, has already reached hundreds of billions of yen in actual spending.

Many markets are expected to grow two to three times or more in size in the future, with a projected 6-year compound annual growth rate (CAGR) approaching 20%. This growth is not limited to the manufacturing industry, which includes factories and facilities, but also extends to office buildings where people usually conduct their daily business.

For example, in building management operations, engineers with specialized knowledge of electrical systems, air conditioning, boilers, etc., spend much of their time on physical operations, such as visually checking equipment, inputting data into excel, and reporting internally and externally, limiting the resources they can spend on value-added operations.

IoT technology using hardware sensors, known as “connect building,” makes it possible to visualize building conditions, convert them into data, and control them in the cloud, thereby reducing manpower and enabling data-based analysis.

The trend of machines, devices, and equipment being connected in real time to improve operational productivity and create new value is now inevitable, and Japan’s major industries cannot grow without IoT.

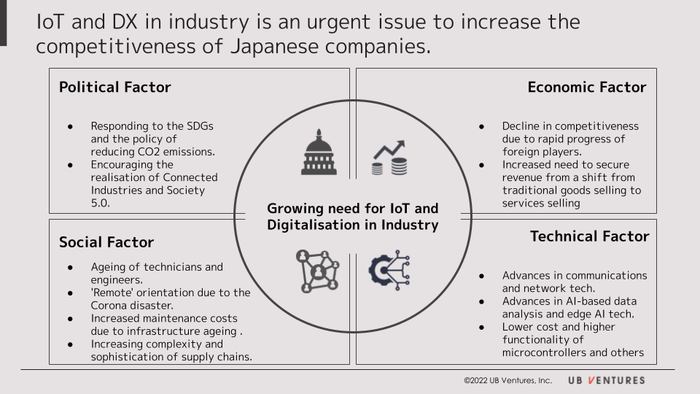

The trend of machines, devices, and equipment being connected in real-time to improve operational productivity and create new value is now inevitable, and Japan’s major industries cannot grow without IoT. The development of industrial IoT is also required by environmental factors surrounding Japan, such as political factors like the SDGs trend and the visualization of environmental data associated with CO2 emission reductions, economic factors such as the shift to services in the manufacturing industry, and social factors such as labor shortages and the passing on of skills. The IoT has high expectations placed on it, making rapid social implementation an urgent task. Technological factors for spreading the growth of industrial IoT are driving its diffusion.

The Technological Foundations for the Development of Industrial IoT are in Place

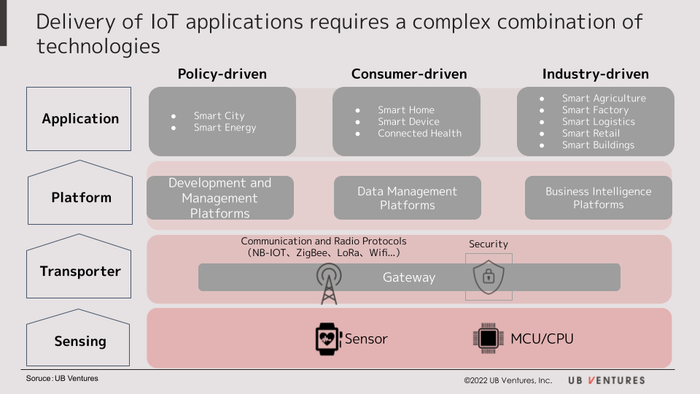

Industrial IoT can only be implemented through technological development and cost reduction at each level of the hierarchy: sensing, transport, platform, and application.

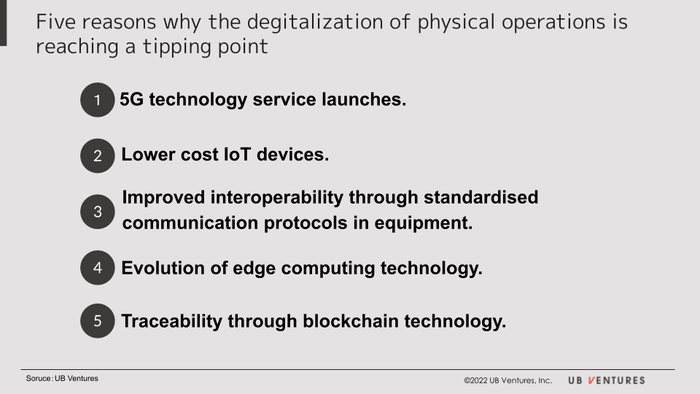

Here, we summarize five key points of transition for the Industrial IoT to reach a breakthrough.

The continuous evolution of factors such as the expansion of 5G in the communications domain, which requires high capacity and immediacy; the evolution of information processing technology, including the evolution of edge computing; the improvement of security through the development of communication protocols and blockchain technology; and the lowering of IoT device prices are all contributing to the establishment of industrial IoT as “actually usable” technology.

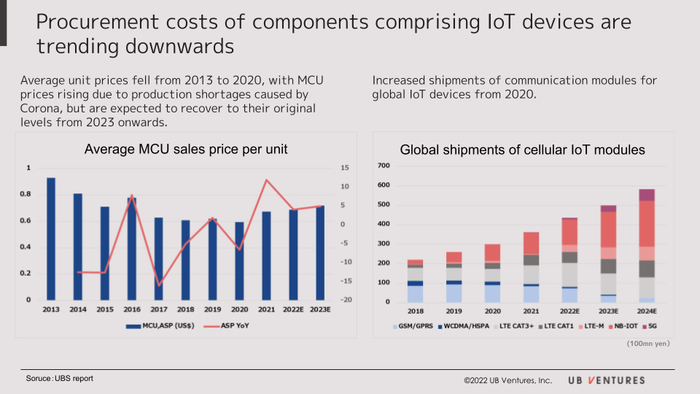

For example, MCU (microprocessor-based control unit) prices, which are essential for IoT, have intermittently decreased from 2013 to 2020 (and have recently increased slightly due to the impact of the new coronavirus), and are becoming more versatile even as shipment volumes increase.

Over the past two decades, technological advances have led to the rapid development of consumer goods, such as smartphones, including improvements in hardware, lower device prices, and better internet speeds. The future of the industrial IoT market is expected to witness similar growth, which will bring an end to analog or human operations.

Investment in Domestic IoT Startups

In the industrial IoT market, including the manufacturing industry, large Japanese and foreign companies have been aggressively investing growth capital in this area, with frequent reports of investments exceeding 100 billion yen by companies such as Hitachi, Ltd. and Sony Corporation.

In the startup space, Safie, a cloud security platform, and Photosynth, an access control system, went public in 2021. SORACOM, which provides a platform for building and operating IoT systems, was acquired by KDDI in 2017, and filed for listing in November of 2022. Furthermore, the amount of investment in unlisted companies is gradually increasing.

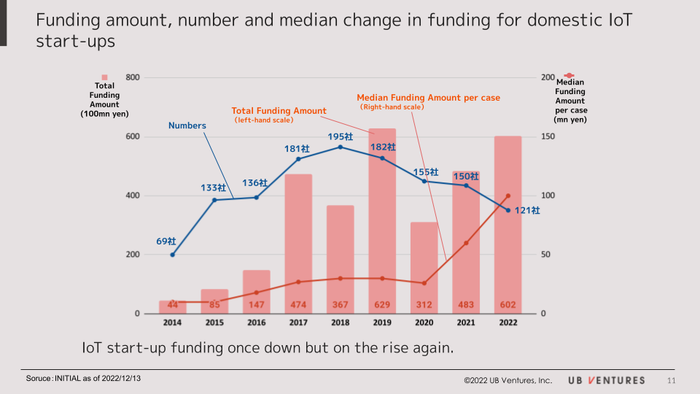

The chart depicted above illustrates the funding generated by domestic IoT startups, the number of cases, and the median value per case. Despite a temporary decrease in investment following the Corona Disaster, the overall investment in IoT startups is trending upward, with projections indicating a total investment of over 600 billion yen by 2022. Notably, the median funding amount per deal has doubled compared to the previous year, indicating a trend towards larger deals.

While these figures do not yet measure up to those of unicorn-scale startups, recent procurement deals by companies in the manufacturing and hardware sectors suggest that investment in this area is gaining momentum. It is anticipated that this acceleration will continue in the near future.

Huge IoT Startups Emerging in the U.S.

In Japan, the IoT market is still relatively unexplored and there are only a few noteworthy startups. However, in the United States, which is a global leader in this industry, there are already several startups that have garnered significant attention.

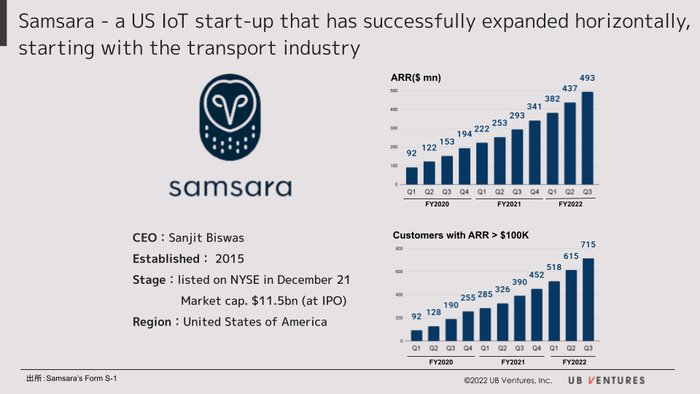

One of the most prominent players in the IoT space is Samsara Inc., a startup founded in 2015 with a market capitalization of $11.5 billion and a planned IPO in 2021. The company provides IoT devices for various industries, including transportation, construction, and manufacturing. By installing devices such as in-vehicle cameras and sensors on vehicles and machinery, users can monitor their equipment’s performance in real time.

When it first launched, the company specialized in the transportation industry and offered products with all-in-one hardware and software functions. However, it has since expanded and established a unique position in the market by providing a one-stop solution that resolves data silos in various areas, including vehicle monitoring, driver safety assurance, and back-office operations.

Through aggressive investments in sales and marketing and partner strategies, Samsara has acquired more than 13,000 customers and has been particularly focused on larger customers with an annual recurring revenue of $100,000 or more (over 700 companies). Just before going public, the company had an annual recurring revenue of $493 million.

The need to launch a startup with “Business x IT x Engineering team management

The industrial IoT market is an attractive target for startups due to the continuous investment of hundreds of billions of yen in the future. However, the entry barriers are high in terms of field expertise, capital investment, R&D costs, and reliability.

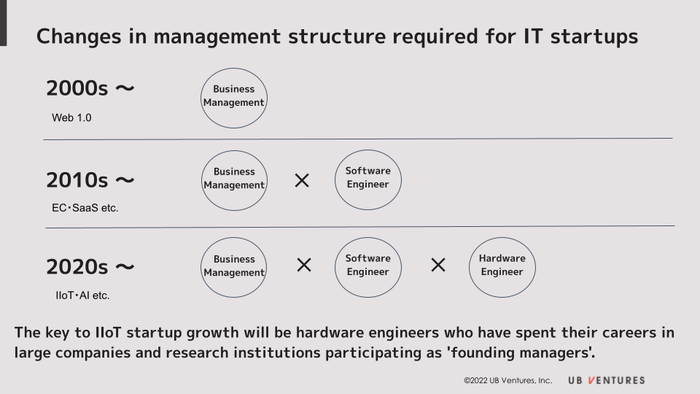

For “have-not” startups, the key to growth in the industrial IoT market lies in team management, which involves collaboration between business-driven individuals and engineering experts who can lead the charge. In Japan, there have been few instances where engineers have been able to independently identify issues and develop potential solutions outside of their organizations. Concerns regarding corporate management and fundraising often compel those with excellent engineering skills and in-depth market knowledge to focus on their careers within the company.

Conversely, IT startups of late have been increasingly collaborating with software engineers and individuals possessing business management expertise.

CADDi, which offers a specialized order and supply platform for the manufacturing industry, may not be directly involved in the IoT market, but it serves as an example of the benefits of bringing together business and engineering expertise. For instance, when Mr. Kato from McKinsey assumed the presidency and Mr. Kobashi, who played a crucial role in developing AirPods and other Apple products in the US, became CADDi’s chief engineer.

In the industrial IoT space, it is crucial to have individuals with a comprehensive understanding of complex technology combinations, including communication, sensing, and hardware manufacturing. However, the attraction and involvement of such skilled talent in domestic startups remain limited, despite Japan’s potential as a manufacturing giant. This presents an opportunity for Japan to produce unicorns that can compete on the global stage.

UB Ventures strengthens investment and dissemination of Industrial IoT

Creating successful industrial IoT startups requires greater maturity and knowledge in both entrepreneurship and growth capital sharing. Although the amount of venture capital investment in startups has increased more than tenfold over the past decade, the majority of this investment has been in the IT domain, such as e-commerce and SaaS, and there has been reluctance to invest in existing and legacy industries.

Lack of expertise, shortage of experienced personnel, and long business cycles are often cited as reasons for the lack of aggressive investment in these areas. To produce growth companies in this market in the future, it is necessary to gain experience, invest, and disseminate information.

UB Ventures has begun investing in companies such as ASIOT, which uses AIoT technology to realize automatic meter reading, and Monochrome, which is working on HEMS. This is part of our effort to support companies that will play a leading role in the industrial IoT of the future.

Up until now, we have focused on disseminating information on BtoB subscription businesses, utilizing the experience of our members in launching SaaS businesses. Going forward, we will strengthen our investment and dissemination in the IoT market in existing industries. We will make every effort to contribute to the production of the next unicorn in the industrial IoT area, which is vital to the foundation of domestic industry.

By Chiamin Lai | UB Ventures Managing Partner

Edited by Akio Hayafune | UB Ventures Chief Analyst

2023.02.27

Here at UB Ventures, we regularly deliver useful content on both Japanese and global startup trends, as well as hands-on experience from our very own venture capitalists and specialists. Please feel free to contact us via the CONTACT page if you would like to be in touch. Click here to follow UB Venture’s SNS account!

-

SCALING

METRICS

TRENDS

SaaS Annual Report 2023-2024

-

SCALING

METRICS

TRENDS

SaaS Annual Report 2022 – The Key to Industry Transformation –

-

TRENDS

Will the next Unicorn Emerge from the Industrial IoT market in Japan?

-

TRENDS

Will hanko seals ever disappear from Japan?

-

TRENDS

System Integrators – the Key to Success for SaaS in Japan

-

SCALING

Has SaaS become a recognized industry in Japan?

-

SCALING

A list of “Don’ts” when building SaaS: Lessons learnt from engaging with 200 startups

-

SCALING

METRICS

TRENDS

SaaS Annual Report 2021

-

SCALING

TRENDS

3 Successful Strategies of Top Logistics Startups in SEA

-

TRENDS

SEA-Specific Vertical SaaS

-

TRENDS

Latest SaaS Trends in SEA

-

TRENDS

The State of Vertical SaaS in Japan