The State of Vertical SaaS in Japan

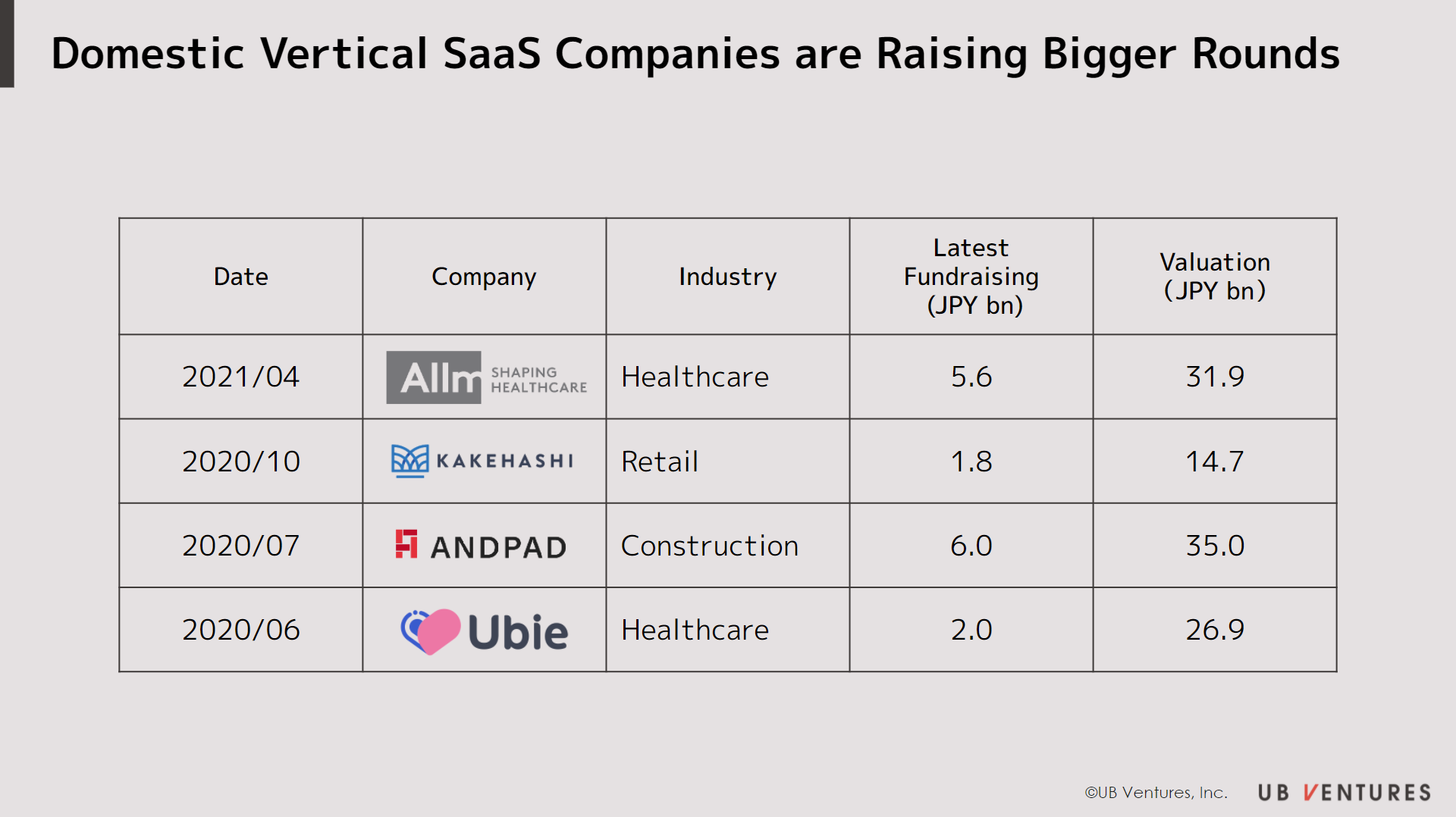

TRENDSWith the emergence and maturity of the SaaS ecosystem across Japan, there has naturally been an unprecedented rise also in vertical SaaS. Recently in 2020, there was a series of undisclosed large fundraising rounds by vertical SaaS startups such as Andpad, Kakehashi, and Ubie. Furthermore, in March 2021, SpiderPlus (TYO:4192), a vertical SaaS startup which provides construction blueprints and on-site property development management services, went public on the Mothers Section of the Tokyo Stock Exchange, with the company’s market capitalization exceeding JPY 50bn.

With this rapid technological adoption, what is the state of Japan’s vertical SaaS startups, in terms of product growth and fundraising? To this end, this article will conduct a qualitative and quantitative analysis of the current SaaS ecosystem, focusing specifically on the top vertical SaaS startups in Japan.

① Comparison of US / Japanese Vertical SaaS Startups

To put the scale of markets in perspective, it would be prudent to note that the current market capitalization of all listed Japanese SaaS companies is approximately equivalent to one-tenth that of the US’. To better understand this relative scale, it would be helpful to look at both markets in terms of overall market size as market capitalizations of each top company.

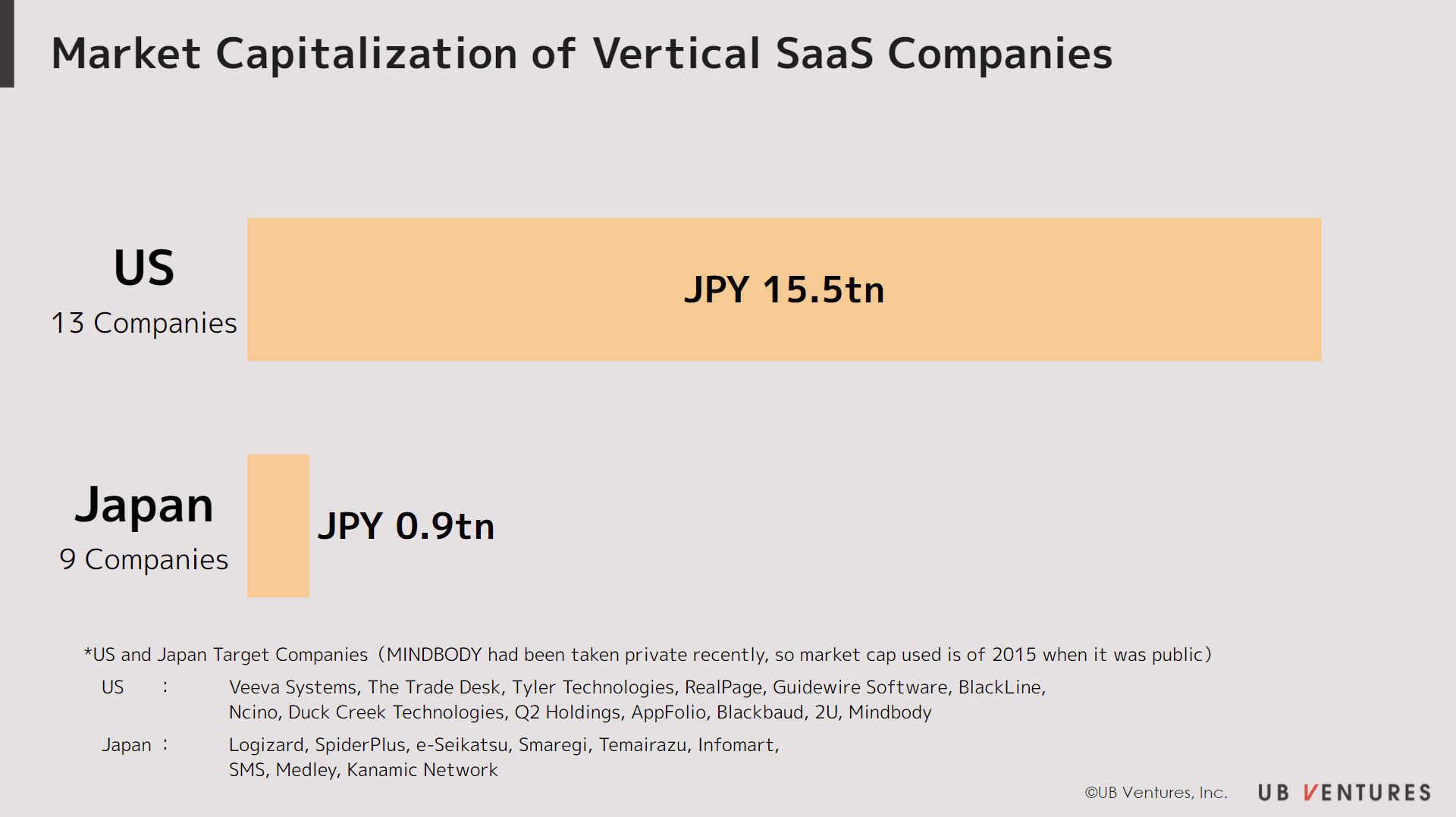

■ Comparison of Listed Companies by Overall Market Size

As with horizontal SaaS, vertical SaaS companies in the US are larger than those of Japan’s, both in terms of valuation as well as number of companies. The vertical SaaS index, compiled by Bessemer Venture Partners (BVP), comprises 31 US SaaS companies with a combined market capitalization of approximately JPY 70tn. To provide a more accurate sense of comparative scale, 13 of these, similar to the current make-up of top vertical SaaS in Japan which are mainly 2B, accounts for JPY 15.5tn; this, alone, approximates the total market capitalization of all TSE companies falling under construction or precision-manufacturing sectors.

Currently in Japan, the number and size of listed vertical SaaS companies are still limited, with a total of 9 companies; examples include SMS (TYO: 2175) and Medley (TYO:4480), whose main business lines fall within the healthcare and pharmaceutical sectors.

On the other hand, the number and scale of vertical SaaS companies listed in Japan are limited. There are currently a total of 9 listed companies, including startups such as SMS and Medley, whose main business is recruitment for the long-term care and medical industry. To put this in perspective, the total valuation of these companies still does not exceed JPY 1tn.

Nonetheless, with the growth rate of horizontal SaaS companies having increased by over 400% in the last 3 years, it would be worthwhile to also closely monitor the similar growth of vertical SaaS over the coming years as well.

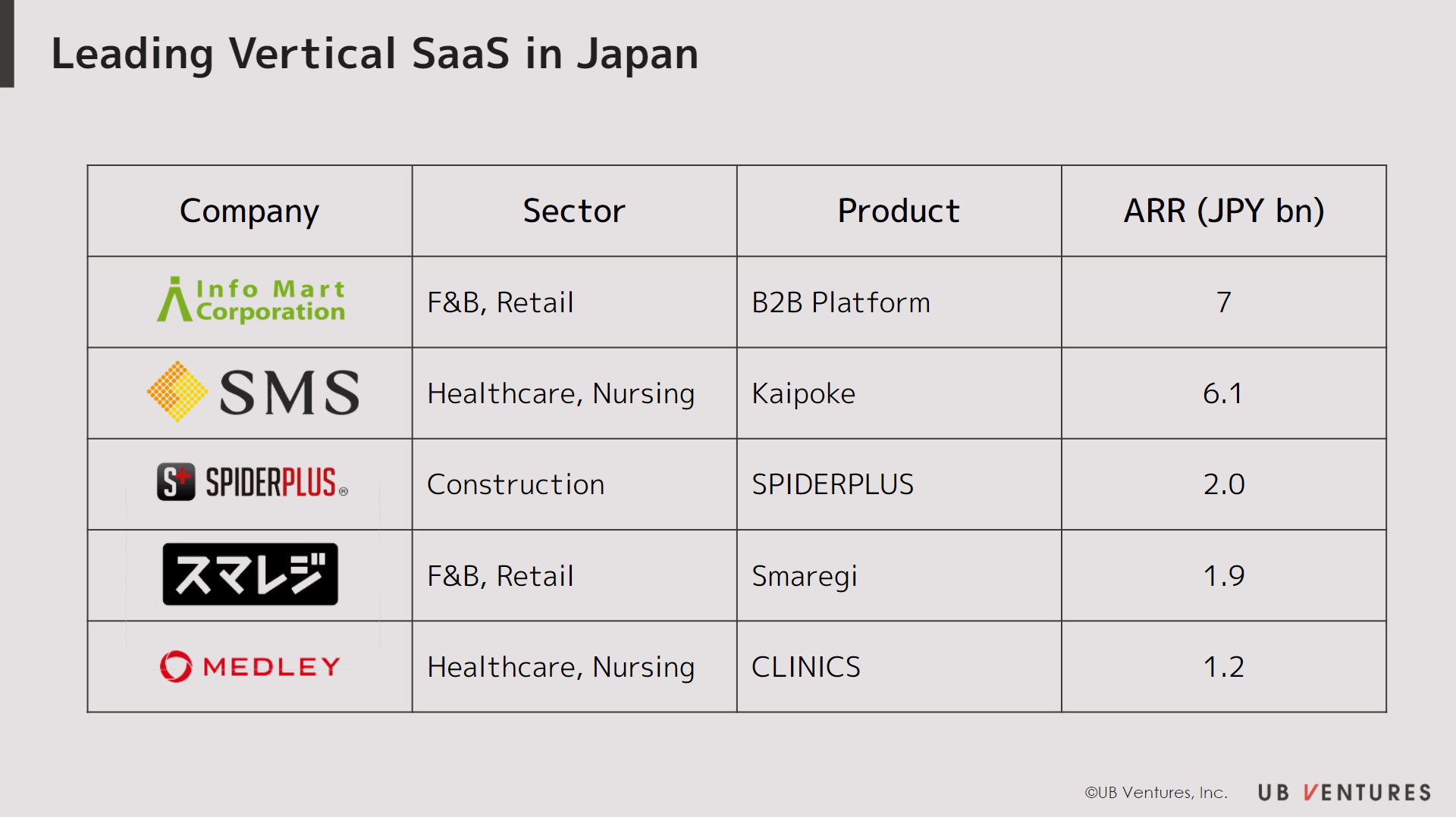

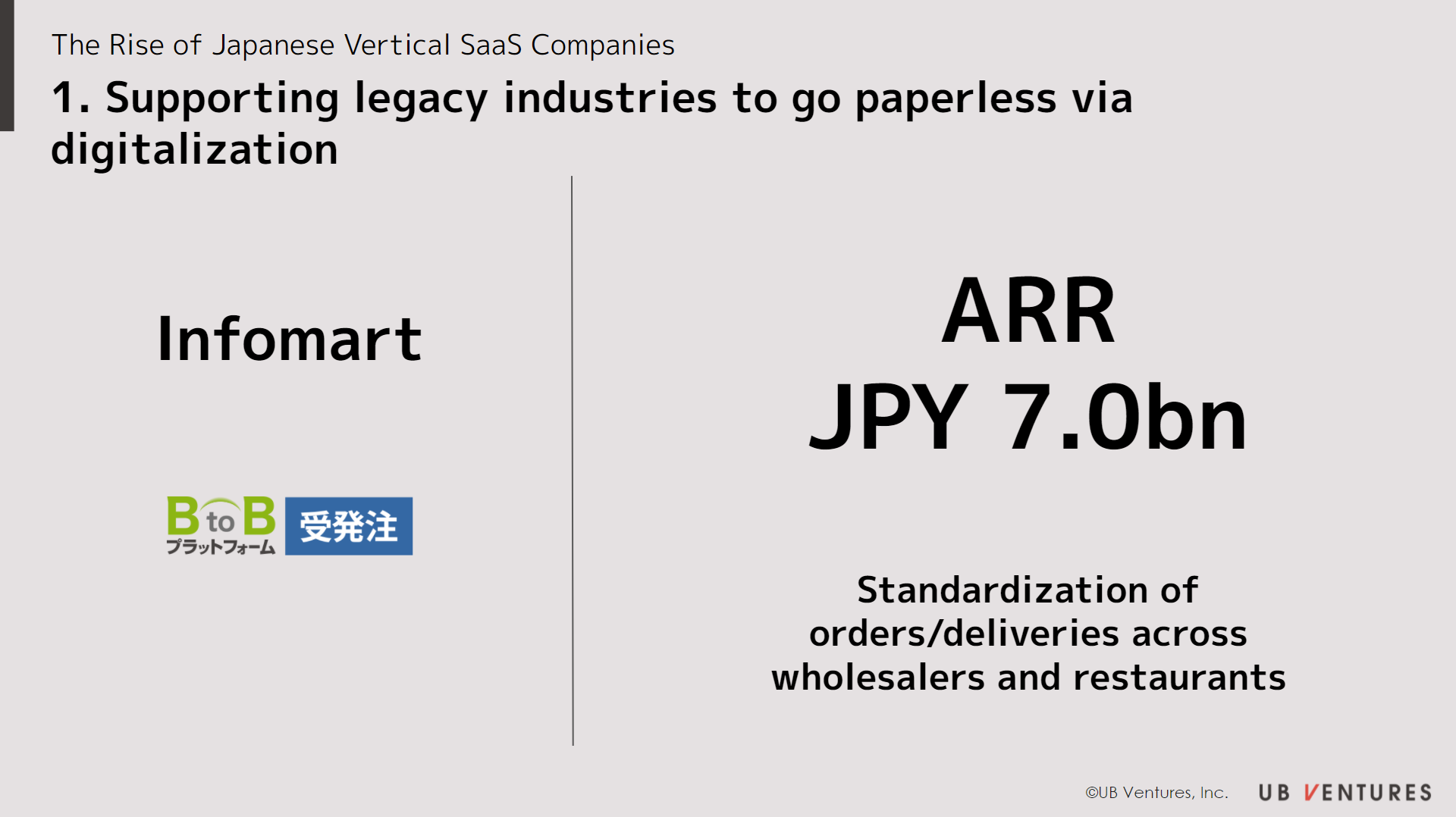

Looking at specific companies in Japan, the estimated ARR of Infomart’s (TYO: 2492) B2B platform that provides wholesale food and restaurant ordering services has reached JPY 7bn, while the nursing care platform “Kaipoke” provided by SMS has achieved an ARR of JPY 6.2bn, occupying top positions amongst all vertical SaaS companies in Japan.

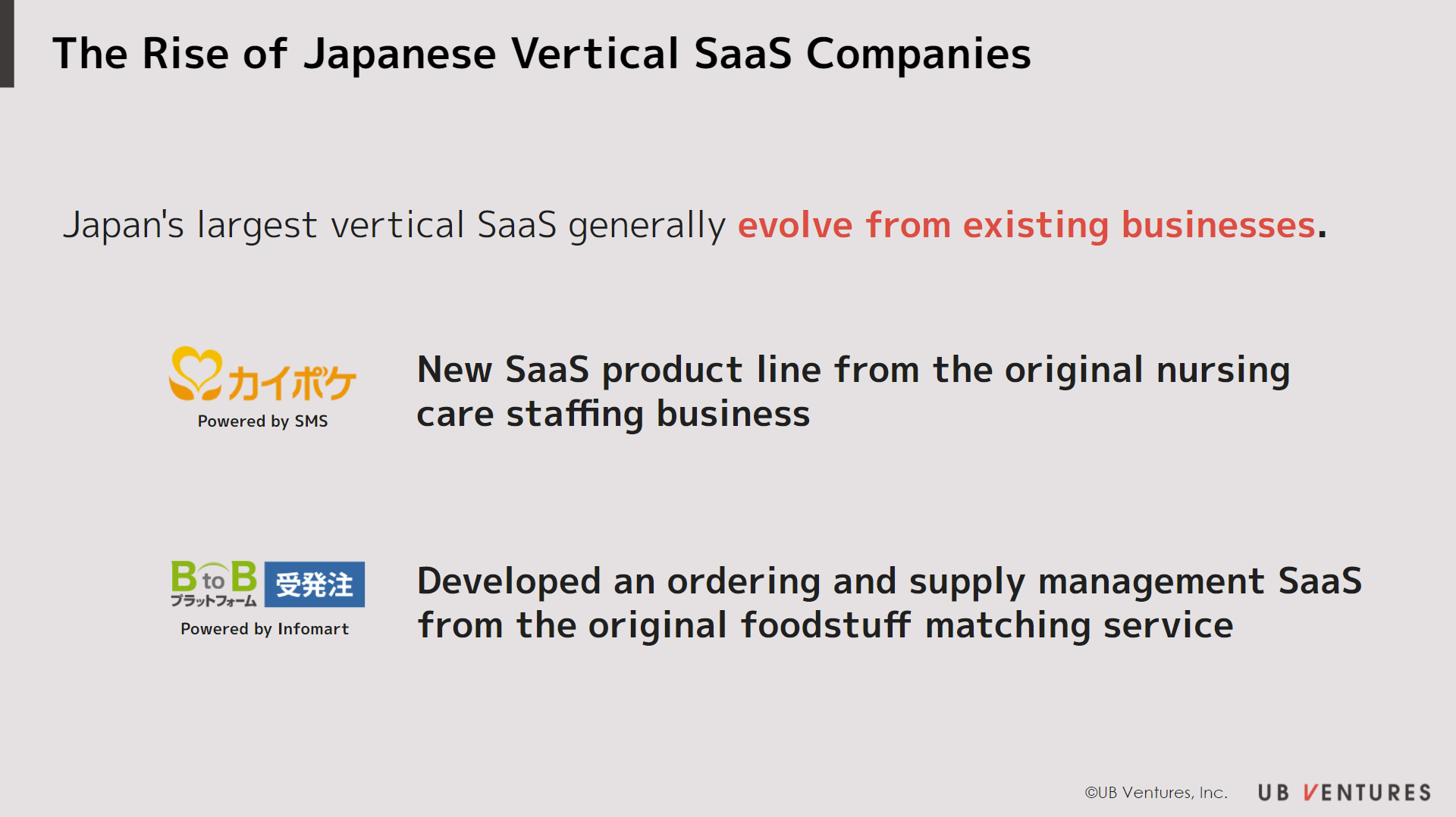

Many of these leading vertical SaaS companies in Japan are admittedly often results of organic digitalization from within, with existing companies developing new SaaS products in order to better meet the needs of their current industry, thereby complementing their key business lines.

However, there are also some examples of SaaS IPOs with funding from venture capital, including Smaregi (TYO: 4431) which listed in 2019, and Spider Plus which listed in March 2021, both of whom had received Series A funding.

At this juncture, we have yet to see any successful vertical SaaS startups that had achieved rapid growth by having received seed-stage VC investments. This is however expected to change rapidly in the coming years, as more and more listed SaaS companies lead technological innovation across multiple industry sectors.

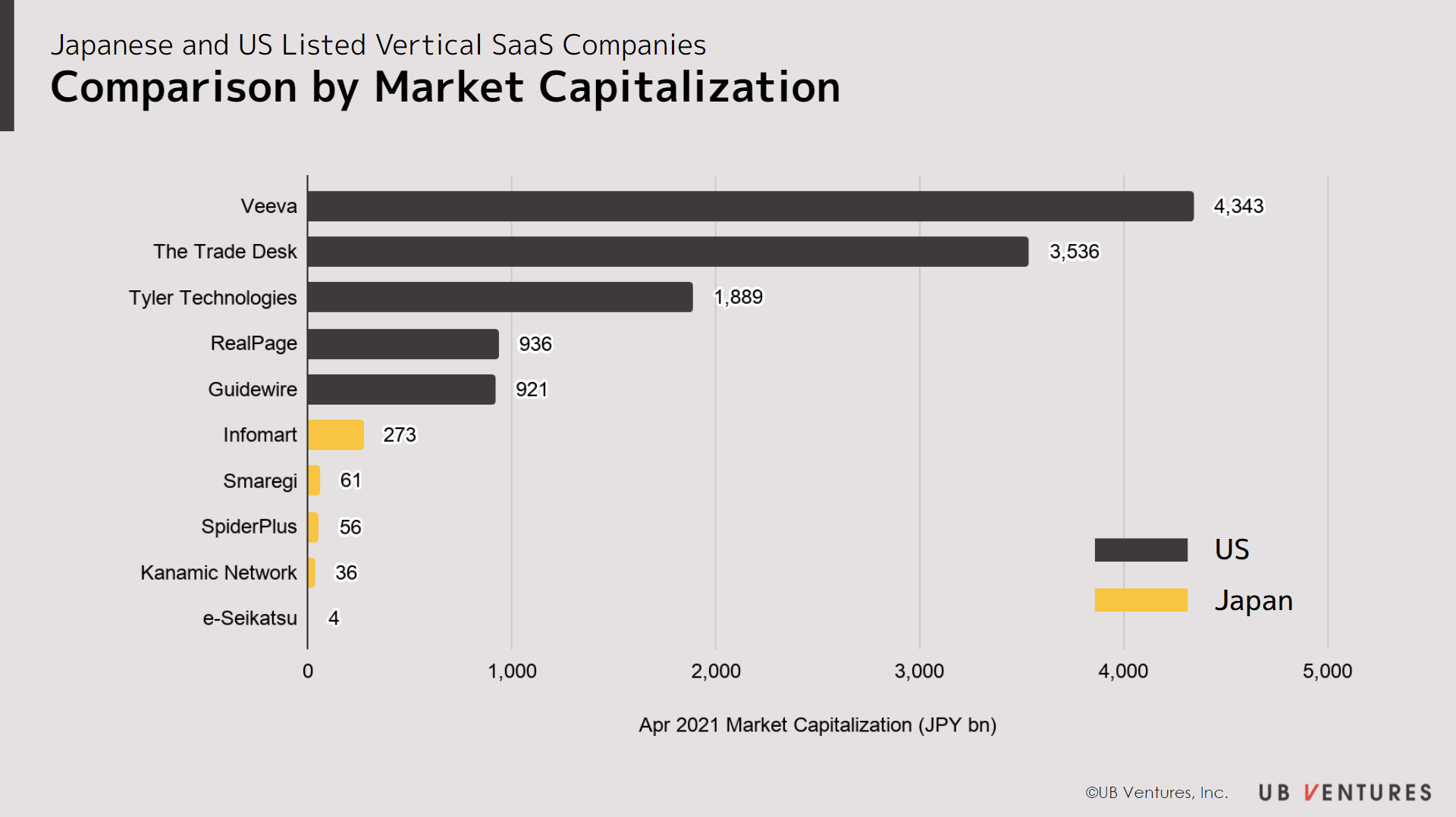

■ Comparing Listed Companies by Valuations

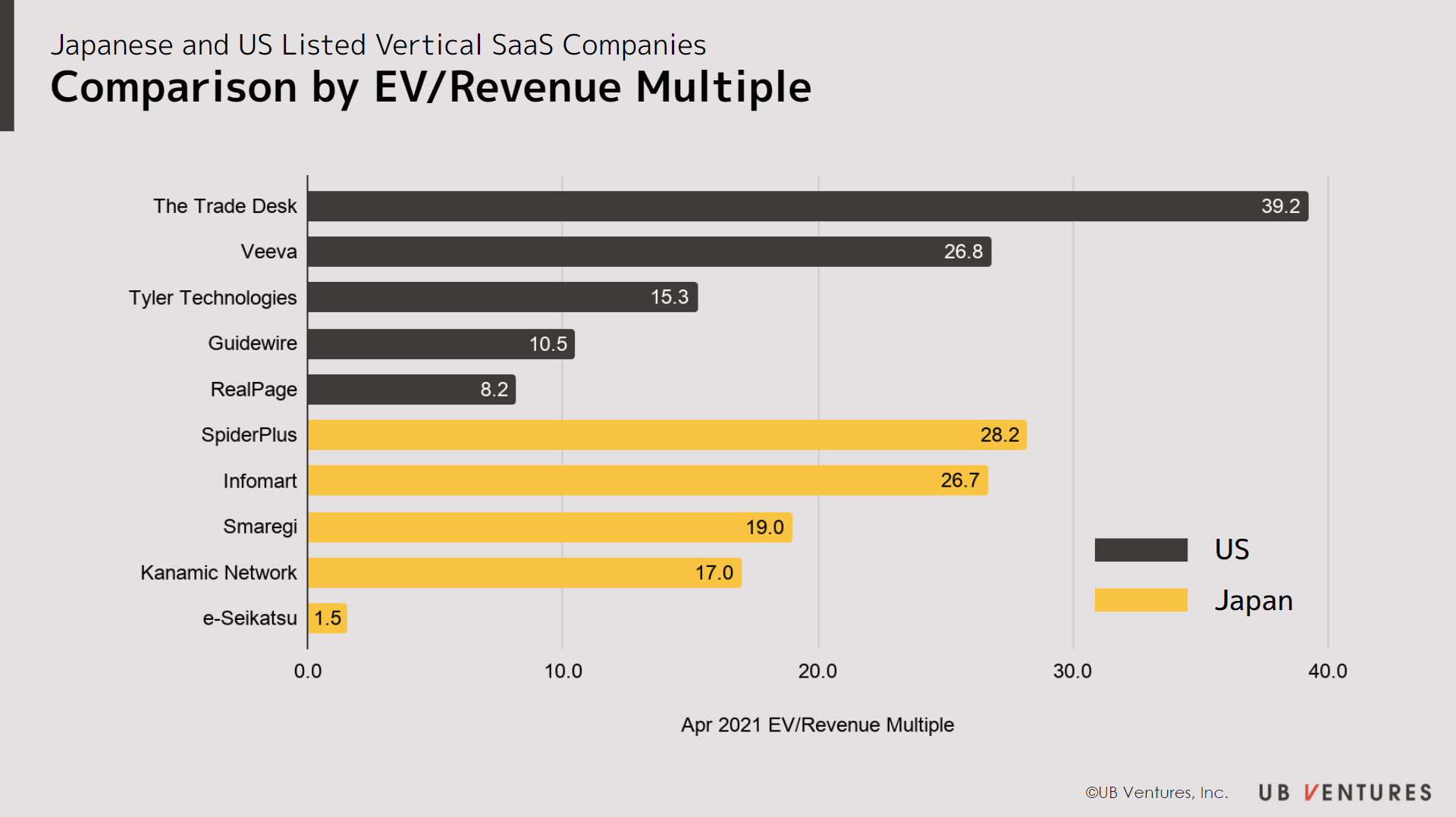

Recognizing that Japanese vertical SaaS market is currently limited by both number and size, it would be useful to conduct a deeper analysis on the valuations of the top listed vertical SaaS companies.

If we are to compare each of the listed vertical SaaS companies by market capitalization, it is obvious that US valuations far outperform Japan’s. In the US, there are several companies with a market capitalization of over JPY 1tn, topped by Veeva Systems, a software provider for the pharmaceutical industry, valued at JPY 4.3tn. In Japan, Infomart is currently the largest vertical SaaS company, with a market capitalization of JPY 272.7bn. By and large, most of the vertical SaaS companies are considered small/mid-cap stocks with market capitalizations of less than JPY 100bn, still not sufficiently appealing as an asset class for institutional investors.

Nonetheless, if we look at the EV/Revenue multiples, we see that Japan demonstrates performance comparable to that of the US, with top companies exceeding 20x. Amongst these companies, Infomart has >50% of its shareholding held by overseas investors, indicating that even for Japan, industry-specific vertical SaaS players are valued without any specific discount. Needless to say, these current valuations are likely to influence the perceived value of domestic vertical SaaS startups, providing a precedent for a conducive and hopefully stable capital environment whereby future vertical SaaS can expect to be fairly valued by the market in terms as they seek future IPO exits.

■ Roundup of Japanese vertical SaaS startups

It is evident that there is a growing number of vertical SaaS startups emerging in Japan playing catch-up with their US predecessors. Based on publicly available data, including seed rounds, there are ~100 vertical startups that have raised funding over the past 5 years, amongst which there are more than 10 startups at Series C and later, which are expected to IPO in the coming years.

In the past year especially, there has been a series of multi-billion yen deals announced. Andpad, a construction management SaaS which had previously raised JPY 4bn in a Series C round in July 2020, recently received a fresh round of JPY 2bn injection from overseas investors including Minerva Growth Partners, Sequoia Capital China, and other overseas investors in an extension round in October 2020.

In recent years, we have indeed been witnessing a rise in the number of large scale later-stage financings, with participating investors including private equity houses and overseas institutional investors. With the maturity of the ecosystem, this trend is likely to continue, and we expect to see more of these kinds of large deals for Japanese vertical SaaS startups in the future.

② The Evolution of Vertical SaaS

Admittedly, SaaS is generally seen as a business amongst entrepreneurs and startups, but in the vertical SaaS space especially in Japan, we have seen organic evolution stemming from existing industry players that have traditionally provided on-premise services before gradually shifting these services to the cloud.

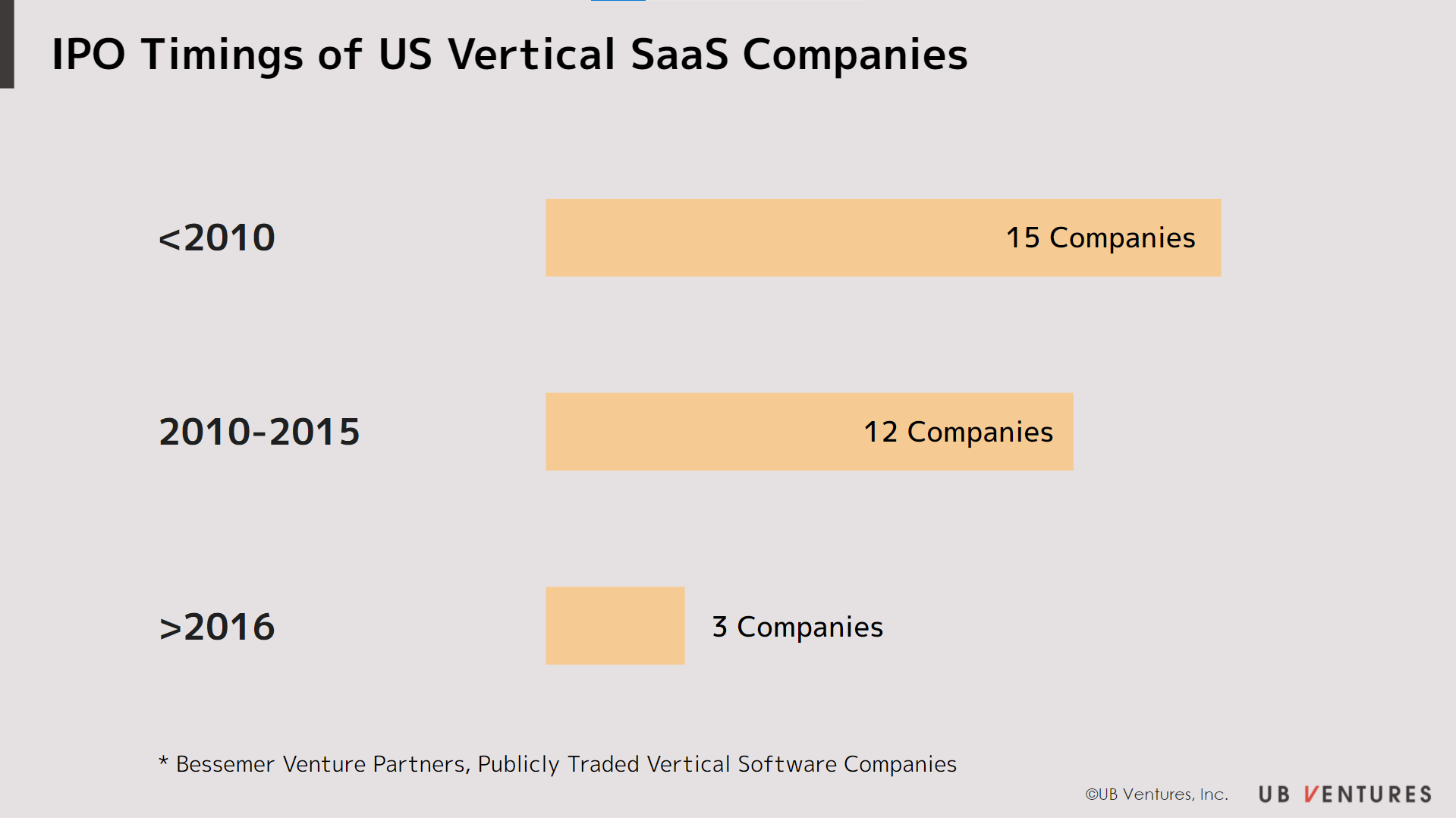

The chart above outlines the number of US IPOs of vertical SaaS companies based on recent time periods as benchmarked by BVP. Companies, such as Autodesk, that have long provided software for specific industries, have been moving their services to the cloud in recent years, while startups such as Veeva Systems, which follows in the footsteps of Salesforce, have more recently emerged since the 2010s.

For Japan, most of the leading players in vertical SaaS evolved from existing businesses. Most of the top runners in Japan began entering the SaaS ecosystem as they started launching SaaS products built upon their existing traditional business lines, or at most, were new business lines established but still closely related to their original business.

While these vertical SaaS companies generally provide solutions deeply specific to their respective industries, with the advancement of digitalization trends they also started to complement such existing solutions with better technologies powered by cloud, eventually falling within this newfound category which we now refer to as vertical SaaS.

Although SaaS tends to be associated with young startups and emerging companies in general, it is also important to remember that SaaS is definitionally first and foremost a technological and business model. Therefore, especially in Japan, we see SaaS being adopted as a new business product offerings within pre-existing IT companies with existing customer base and deep industry expertise. Therefore, for emerging vertical SaaS startups, close collaboration with such existing incumbents would be the key to success.

③ Value Proposition of Vertical SaaS

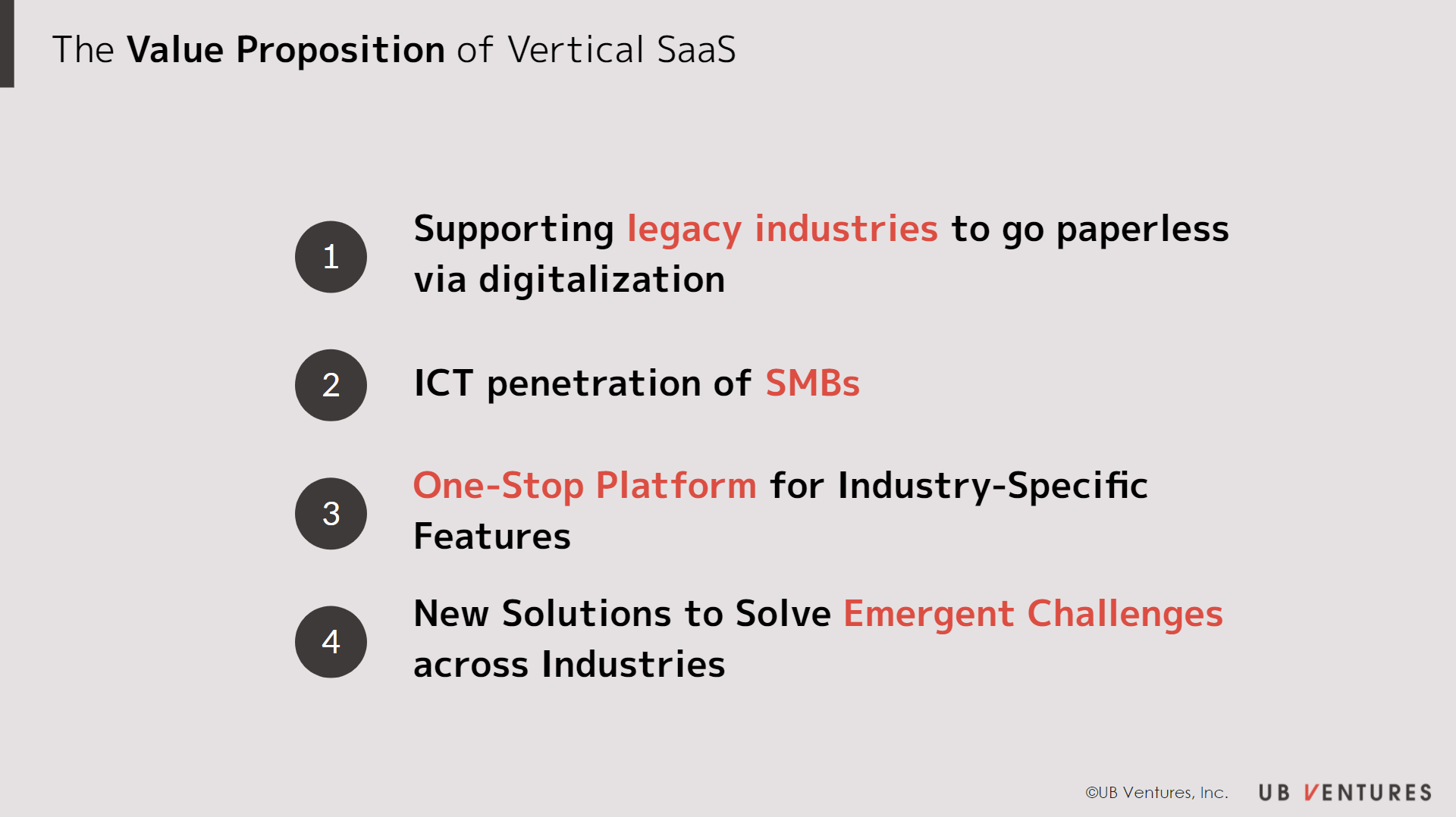

The value proposition of vertical SaaS, as opposed to horizontal SaaS, is the ability to solve industry-specific problems. We will further dissect this value proposition further in to four specific categories below.

1. Supporting legacy industries to go paperless via digitalization

Last year, the Nikkei Shimbun ran a special report covering the inefficiencies that still exist in the corporate world today; this report wrote about how a subsidiary of Kao corporation, a sundries and beauty manufacturer, still receives 1,300 faxes from business partners every day, highlighting the very fact that such analog means of communication through paper mail, telephone and fax, is still rife across corporate Japan, even now. While it is unlikely that entrenched industry practices will change overnight, with the government’s promotion of IT services, we do see hints of change gradually taking place in respective industries.

This is precisely the kind of inefficiency that has been plaguing the order and delivery processes at wholesalers and restaurants. Infomart’s B2B Platform was conceived as a way of quickly addressing this issue through digitalization.

The platform streamlines ordering and delivery of food ingredients between wholesalers and restaurants by digitizing the invoicing process. This has since become firmly established as industry standard, with over 40,000 companies ever since.

Various inefficiencies that exist in the transactions between manufacturers, wholesalers, and retailers are still prevalent regardless of industries, presenting themselves as opportunities for new startups to come up with solutions for.

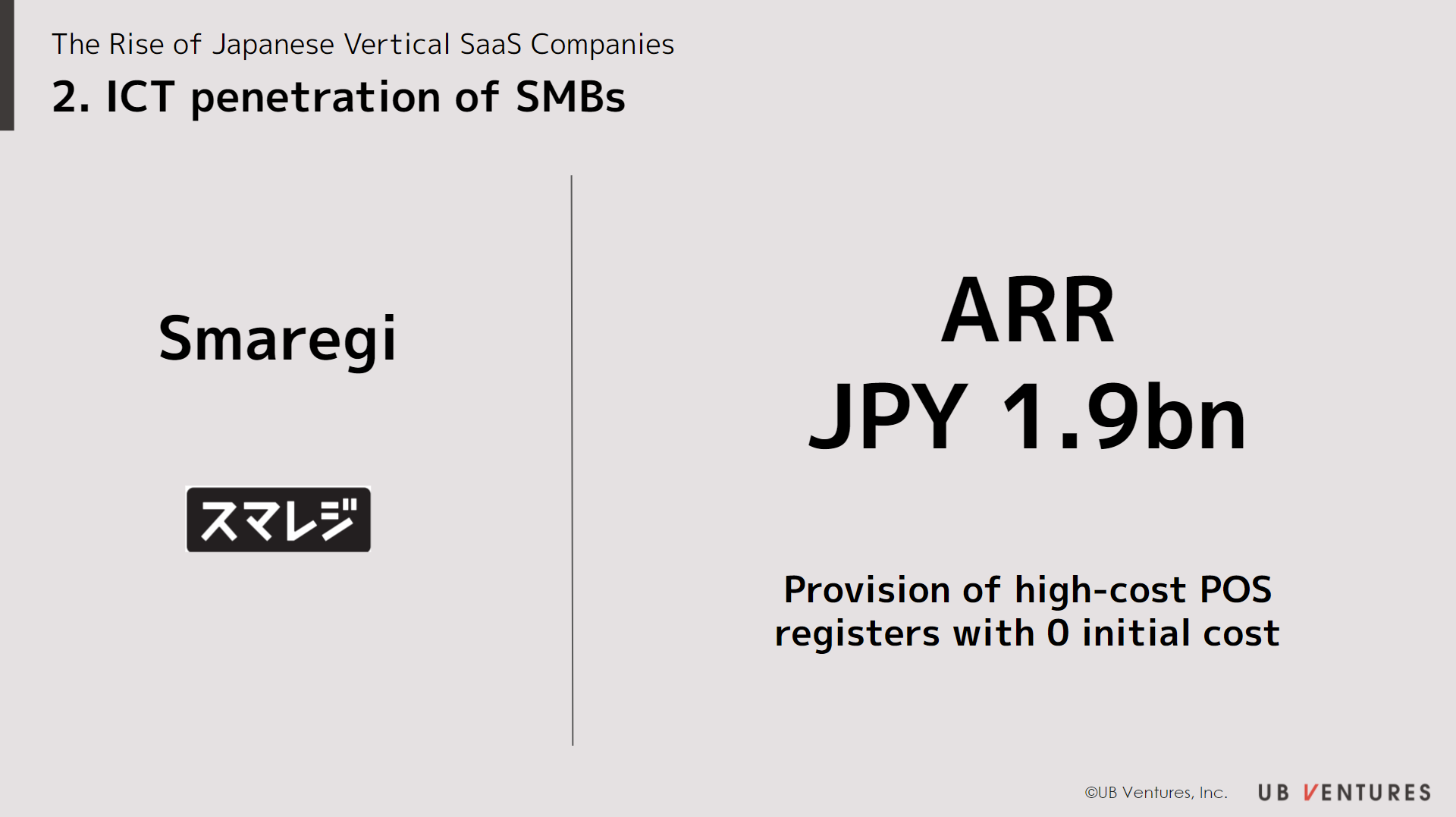

2. ICT penetration of SMBs

In the past, the high initial cost of ERP and MA tools meant that while they could be adopted by large companies with the ability to allocate such resources, these high initial barriers to entry made it difficult for SMBs to adopt such technologies due to the cost and difficulty of operationalization.

With the emergence of SaaS products, these have enabled what can be deemed as what we can refer to as, the “democratization of digitalization”. By lowering the initial cost and operational resources required to incorporate such tools into their business lines, we see cloud services becoming easily accessible to SMBs as well, providing functionality that is inexpensive, easy-to-use and highly scalable.

This democratization of digitalization trend is similarly proliferating across vertical SaaS as well, such as the consumer retail and F&B industries, which require on-site manual operations at storefronts.

Smaregi, which has been providing cloud-based POS storefront registers since 2011, has adopted a freemium model used to improve the efficiency of payment and management operations of the stores, with its main target group as medium-sized restaurant businesses. With up to 23,000 active users in the 3rd quarter of FY April 2021, the company is rapidly leading the charge for the democratization of cloud technology within the F&B industry, with future plans to expand beyond 300,000 stores over the next 10 years.

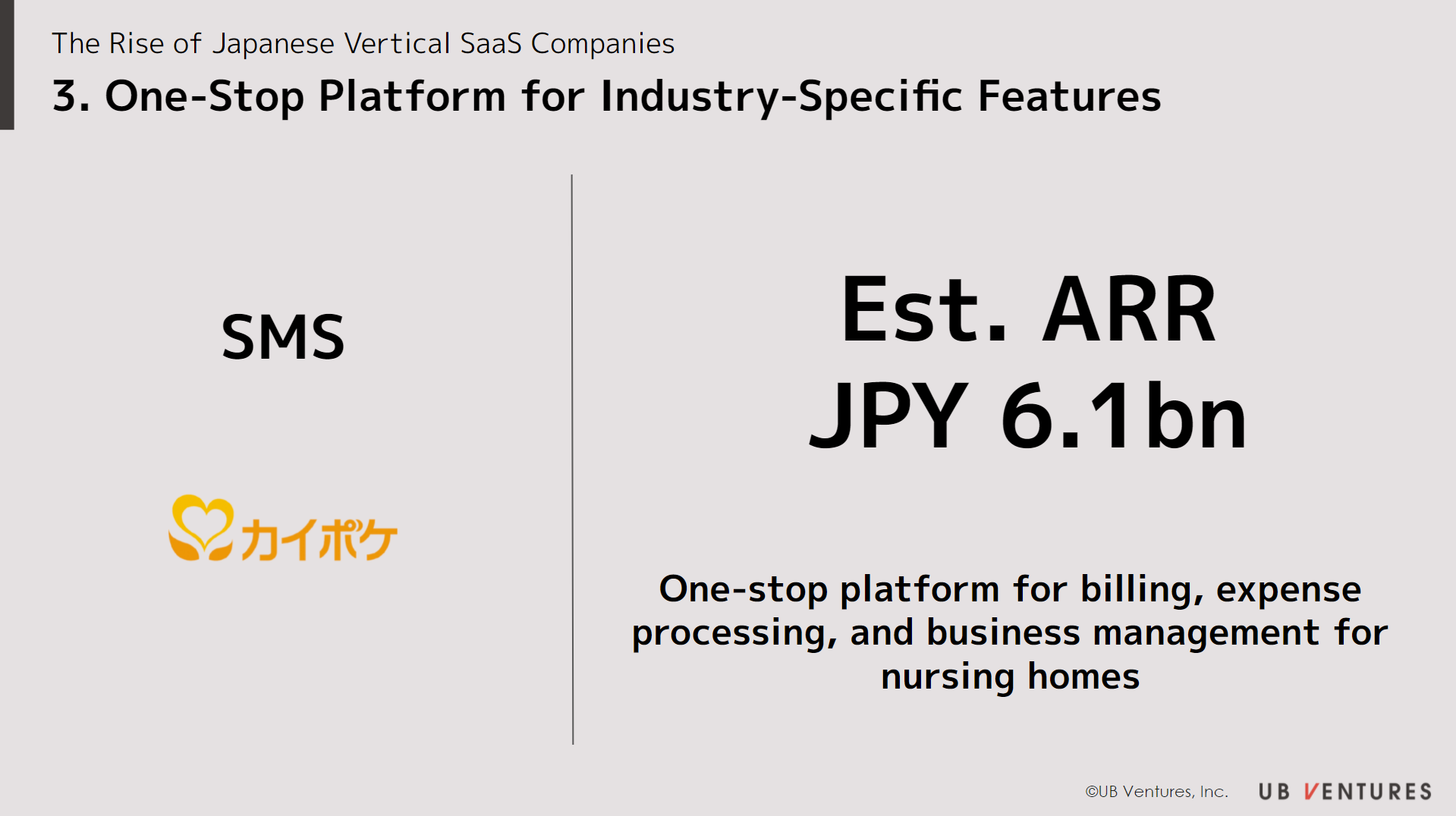

3. One-Stop Platform for Industry-Specific Features

A core value proposition of vertical SaaS is how it creates a dynamic and scalable platform within a specific industry. Notably, vertical SaaS has the unique characteristic of being able to improve ARPU and scale ARR through the provision of various industry-specific features, amidst the fact that TAM and no. of potential customers is generally smaller than horizontal SaaS counterparts.

Since 2008, SMS, a vertical SaaS company involved in healthcare, has been providing insurance billing services for nursing care via its platform, Kaipoke (formerly known as Kaipokebiz), which simplifies the complex industry-specific workflow processes, for nursing business operators.

With the ultimate goal of improving the efficiency of insurance billing processes within the nursing care sector, Kaipoke’s platform functionalities have successively expanded, coming together as a holistic, one-stop platform that enables nursing care businesses to perform various tasks such as manage HR, staffing, accounting and sales orders, amongst other processes. With an estimated ARR for the 3rd quarter of FY March 2020 is JPY 6bn, growing by more than 20% year on year, SMS’ Kaipoke is positioned as one of the more successful examples of a vertical SaaS product with a specific industry focus.

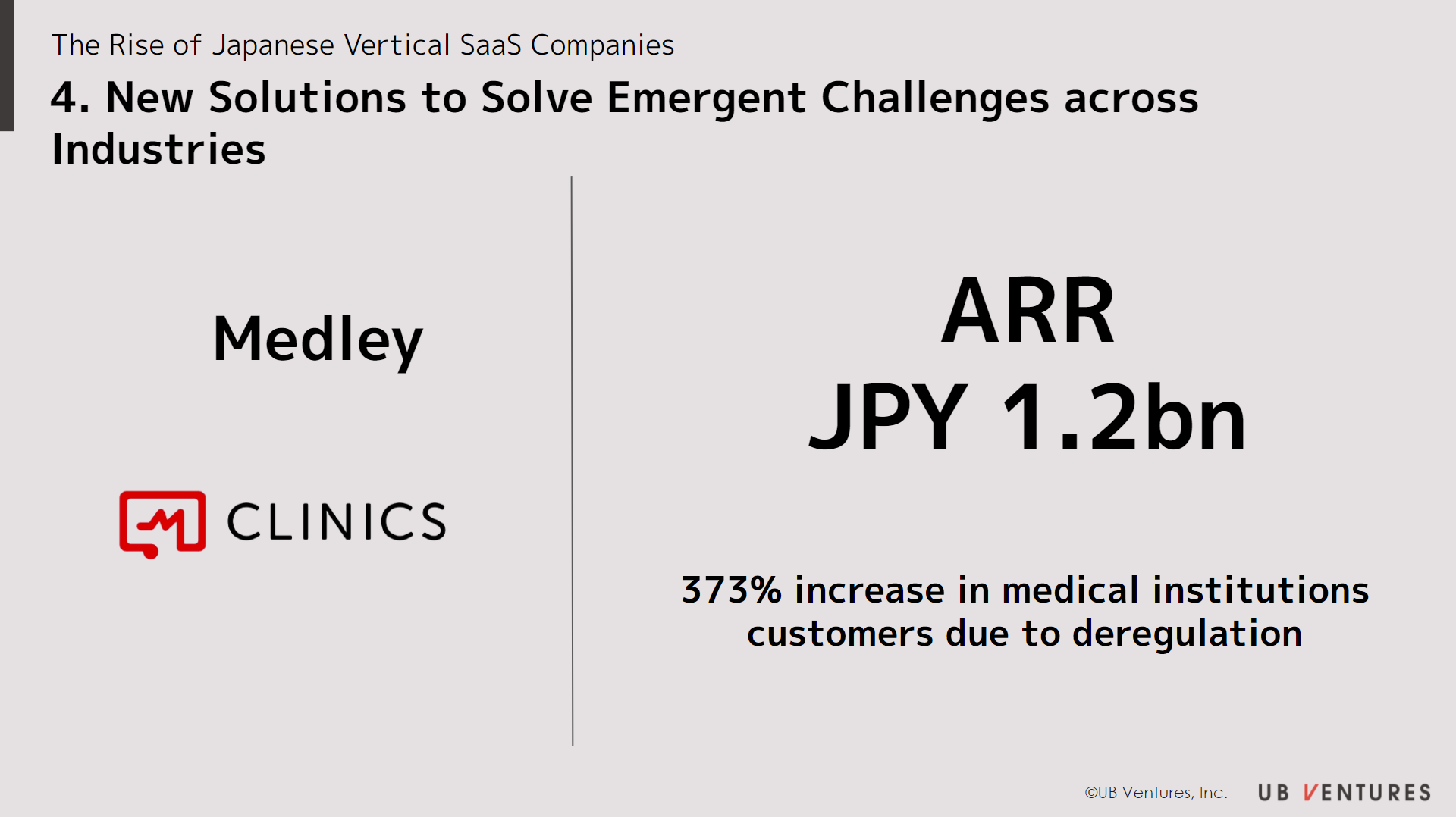

4. New Solutions to Solve Emergent Challenges across Industries

With structural shifts rapidly occurring on the macro landscape, such as the decline in overall working population demographics, as well as a change in work styles spurred by the pandemic, as well as regulatory reforms in terms of IT and technology adoption, it is imperative that we seek to implement newer solutions now more than ever.

For instance, last year, in response to the ongoing spread of covid-19, the Ministry of Health, Labor and Welfare (MHLW) had announced the deregulation of online medical services in April 2020.

Within the backdrop of such regulatory change, CLINICS, an online medical treatment service provided by Medley, responded to the new and urgent needs by significantly expanding the number of medical institution users from 1,187 at the end of 2019, to 5,614, a +373% increase in the span of just one year.

When it comes to startups, whose lifeline is the speed of execution in delivery value, it is of utmost important to be aware and act fast to leverage upon changes in the macro trends especially in the regulatory environment, with Medley as a prime case in point.

④ Growth Strategies of Vertical SaaS

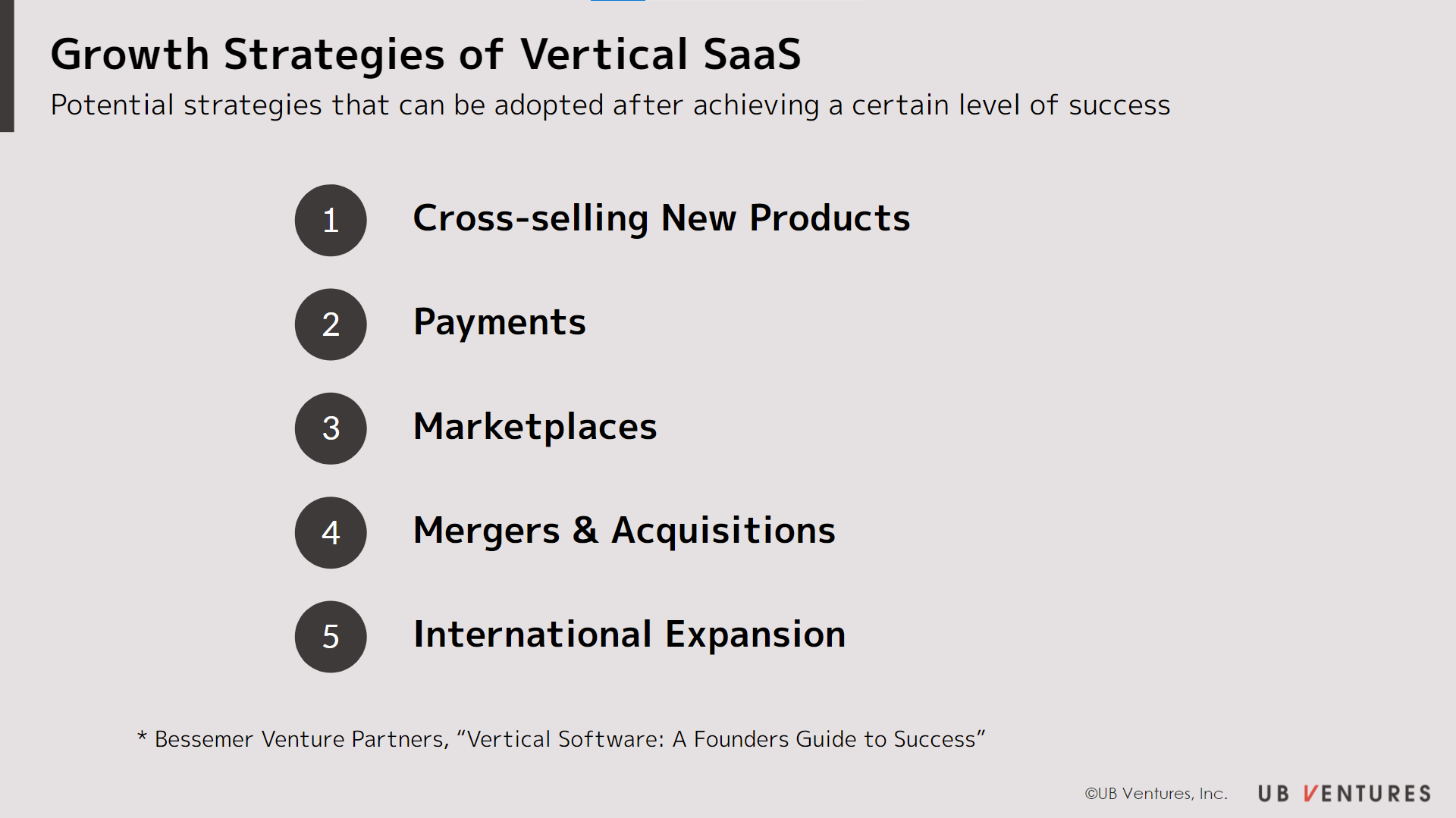

A final value proposition of vertical SaaS is the growth strategies that they are able to follow, compared to horizontal SaaS. BVP outlines the following strategies that they can employ once their product has achieved a certain level of validification or success.

These five patterns are merely a summary of the types of growth strategies that are employed by US vertical Saas, but we are also beginning to see similar developments amongst later-stage vertical SaaS companies in Japan as well.

In March 2020, Kakehashi, a pharmaceutical vertical SaaS company, issued a statement announcing that it plans to acquire all the shares of Pharmarket, a subsidiary of Septeni Holdings, and restructure it into its own consolidated subsidiary. With this M&A strategy, Kakehashi seeks to reduce the risk of drug shortages and inventory risks, thereby expanding upon the value of its business support services on its existing cloud-based drug history platform, Musubi, by providing further secondary distribution support of pharmaceutical products.

With an ever increasing number of SaaS startups raising larger rounds and publicly listing, it is likely that we will see the rise of even more vertical SaaS companies such as Kakehashi in the near future.

Here at UB Ventures, we are committed to the long-term development of vertical SaaS in Japan, through hands-on support and data-driven analysis. Please feel free to contact us if you are interested in fundraising or discussing your business.

*1 Ten lessons from a decade of vertical software investing,

Bessemer Venture Partners

*2 “Over-reliance on fax machines plagues Kao, impeding

digitization amidst Covid-19” (Trans.) – Nikkei Shimbun

*3 Vertical Software: A Founders Guide to Success,

Bessemer Venture Partners

By Akio Hyafune | UB Ventures Chief Analyst

Translation by Jorel Chan | UB Ventures Associate

2021.05.27

Here at UB Ventures, we regularly deliver useful content on both Japanese and global startup trends, as well as hands-on experience from our very own venture capitalists and specialists. Please feel free to contact us via the CONTACT page if you would like to be in touch. Click here to follow UB Venture’s SNS account!

-

SCALING

METRICS

TRENDS

SaaS Annual Report 2023-2024

-

SCALING

METRICS

TRENDS

SaaS Annual Report 2022 – The Key to Industry Transformation –

-

TRENDS

Will the next Unicorn Emerge from the Industrial IoT market in Japan?

-

TRENDS

Will hanko seals ever disappear from Japan?

-

TRENDS

System Integrators – the Key to Success for SaaS in Japan

-

SCALING

Has SaaS become a recognized industry in Japan?

-

SCALING

A list of “Don’ts” when building SaaS: Lessons learnt from engaging with 200 startups

-

SCALING

METRICS

TRENDS

SaaS Annual Report 2021

-

SCALING

TRENDS

3 Successful Strategies of Top Logistics Startups in SEA

-

TRENDS

SEA-Specific Vertical SaaS

-

TRENDS

Latest SaaS Trends in SEA

-

TRENDS

The State of Vertical SaaS in Japan