Latest SaaS Trends in SEA

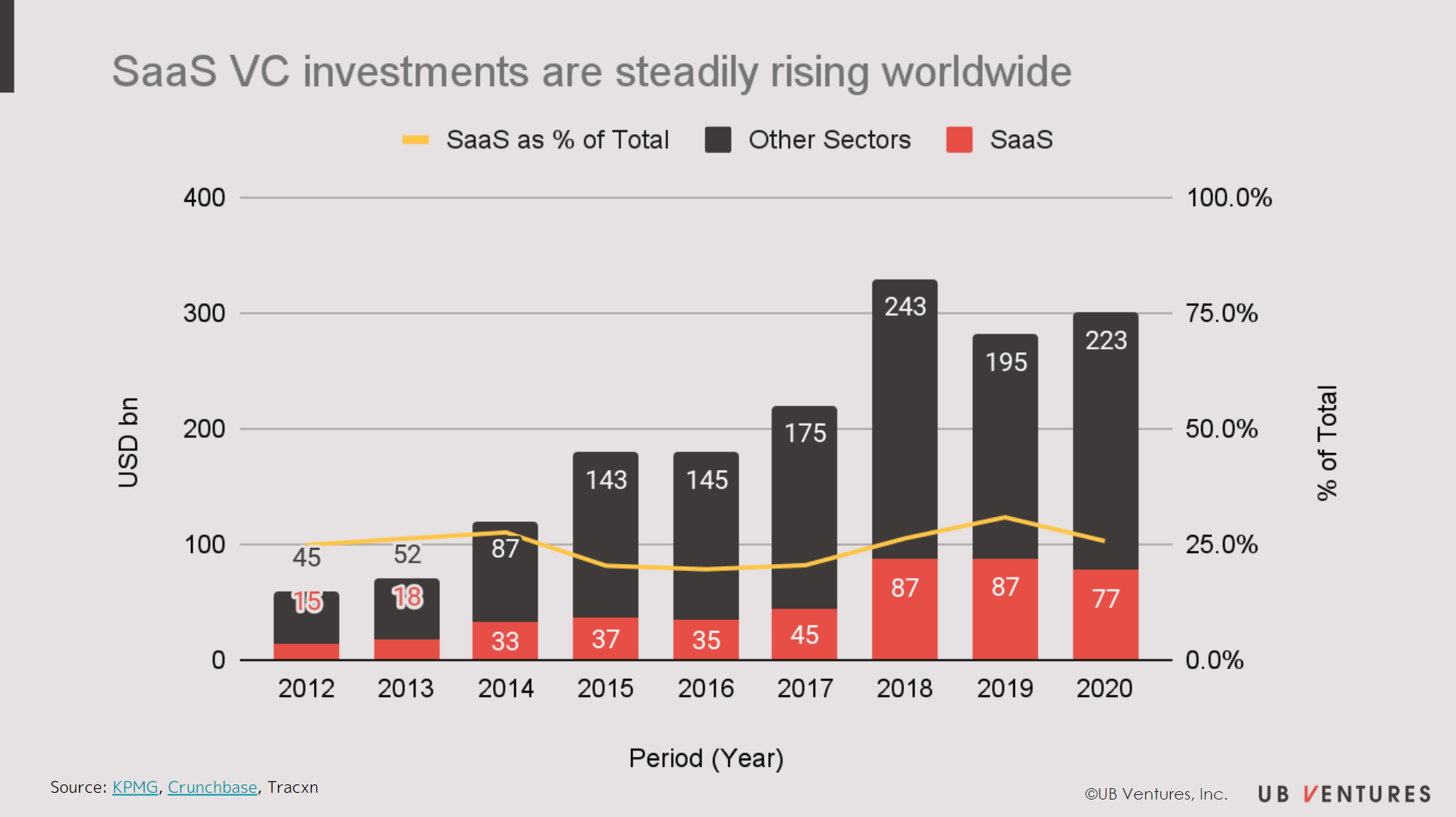

TRENDSAs technology rapidly continues to drive innovation around the world, we similarly are bearing witness to the democratization of capital flows in the form of venture capital into technology startups across markets globally. On a whole, VC investments continue to rapidly rise year-on-year, from $60bn in 2012 to $301bn in 2020, at a 24.4% CAGR. SaaS investments, as a core sub-segment within VC, has followed the same growth trajectory, steadily growing every year, from $15bn in 2012 to $77bn in 2020, at a similar 23.7% CAGR. The capital market share of SaaS has remained relatively consistent, comprising approximately 25% of all VC investment annually.

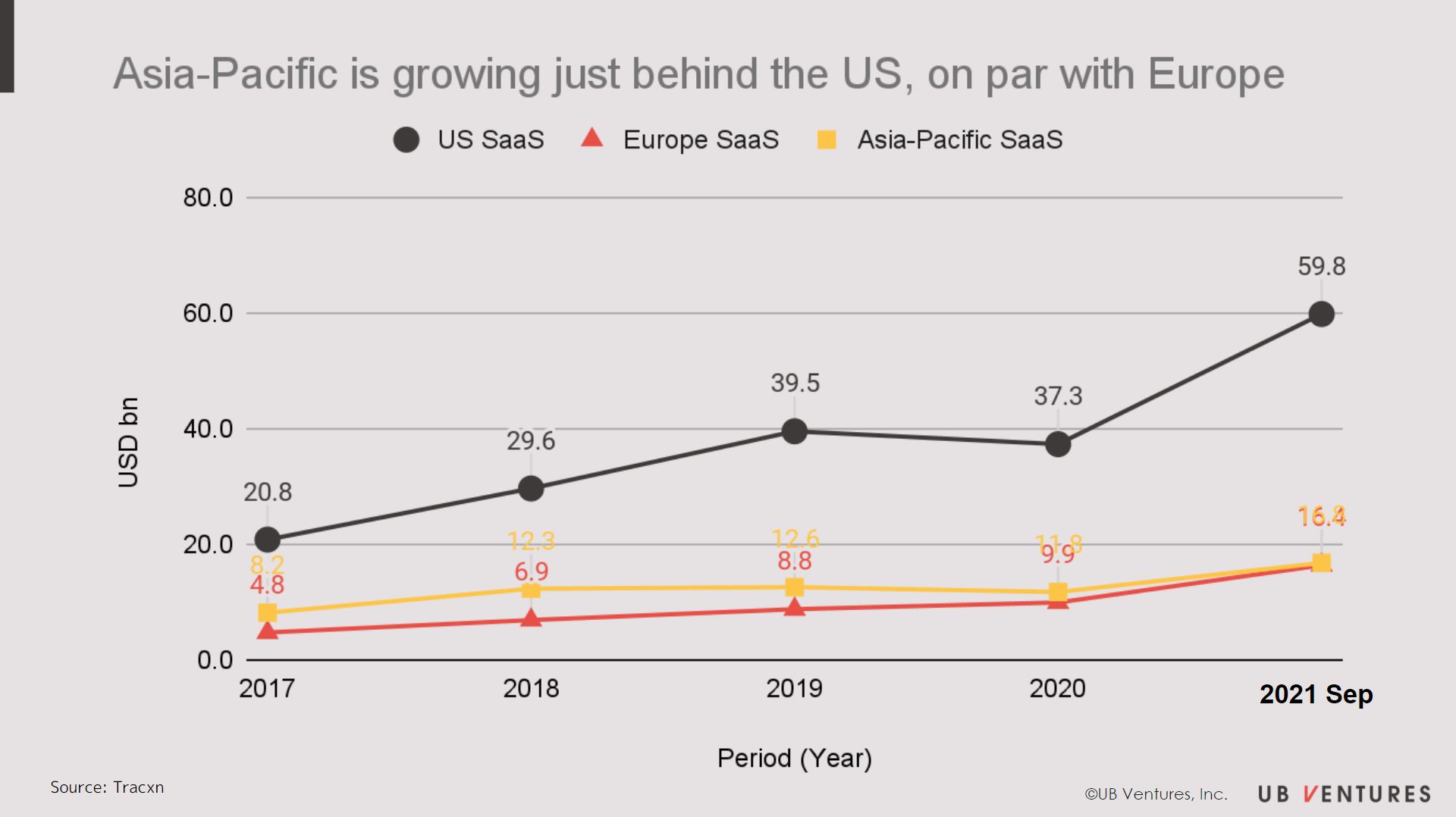

VC investments into SaaS across US, Europe and Asia-Pacific

If we are to further breakdown venture capital flows of SaaS investments by region, we notice two main trends. Firstly, US SaaS investments continue to lead by a large margin at $59.6bn by 2021, making up about ~50% of total SaaS investments globally, and are likely to continue dominating in the future, due to the maturity of capital and technology markets. Secondly, we also notice that Asia-Pacific SaaS is on par with European SaaS as a whole, consistently at $16.8bn and $16.4bn respectively in 2021, keeping up a steady pace just behind the US.

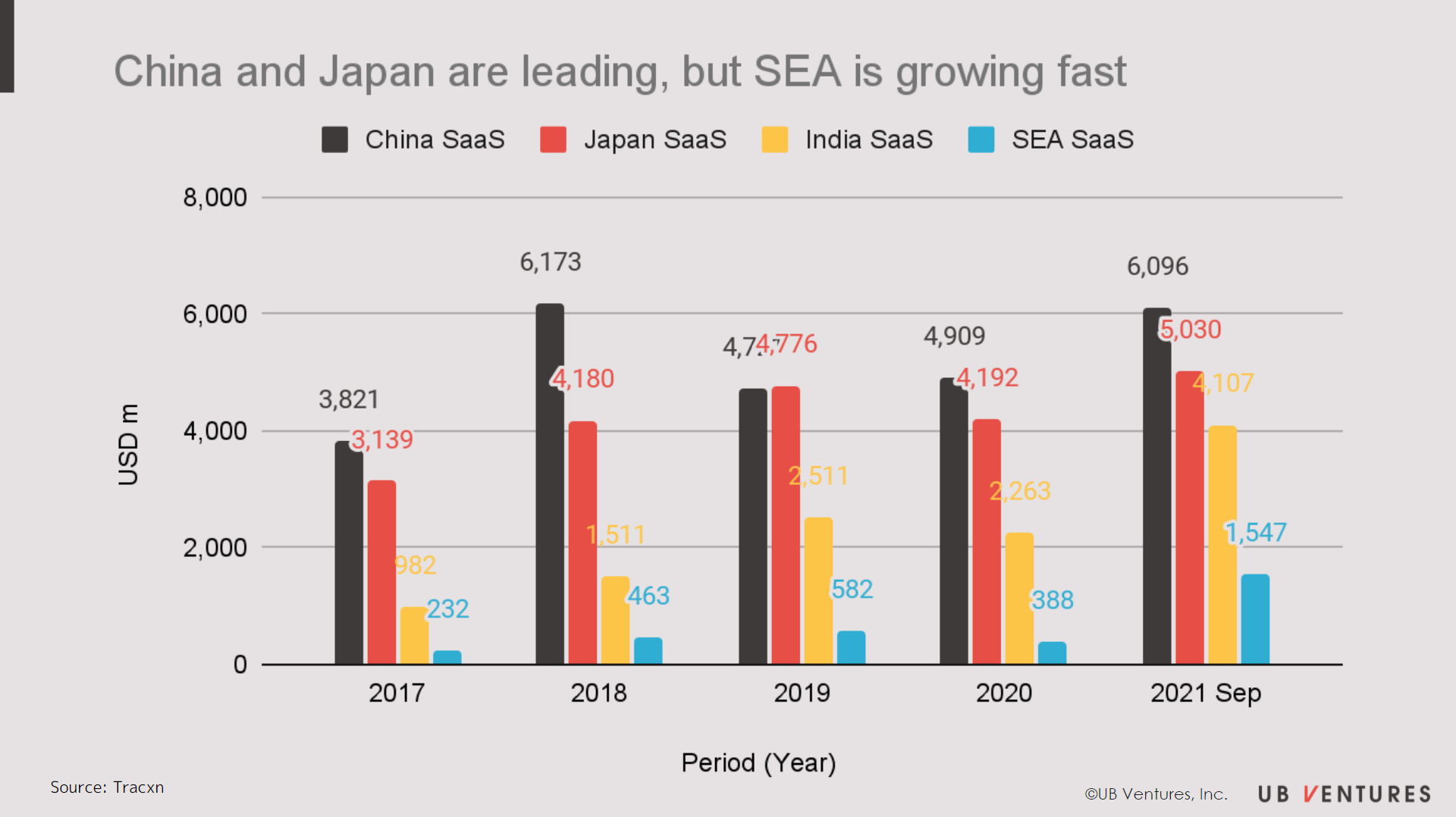

SEA records the highest growth in SaaS VC investments

Diving more deeply into the Asia-Pacific, we see that VC SaaS investments in the region have predominantly been driven by VC investments into China and Japan SaaS respectively. In the Asia-Pacific, China and Japan lead SaaS investments by volume, naturally due to a larger and more mature market, consistently attracting 8-16x more than SEA investments. However, in terms of growth, SEA has grown far more quickly from $232m in 2017 to $1.5bn in 2021 at the fastest rate of 60.7% CAGR, higher than India’s 43.0% growth, and far outstripping China’s and Japan’s more modest growth at only 12.4% and 12.5% respectively.

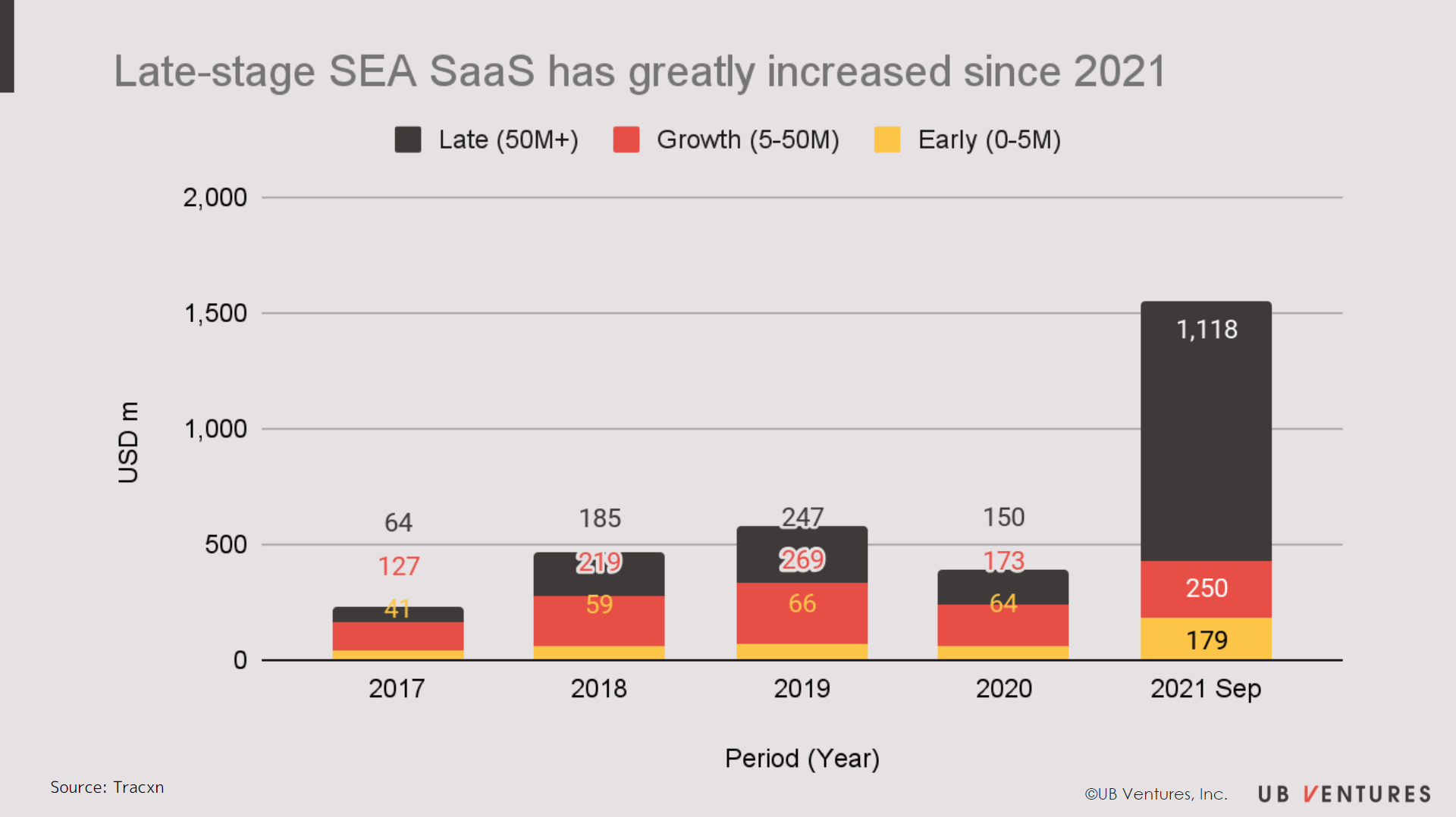

Late Stage SEA SaaS has Rapidly Grown in 2021, Especially Vertical SaaS

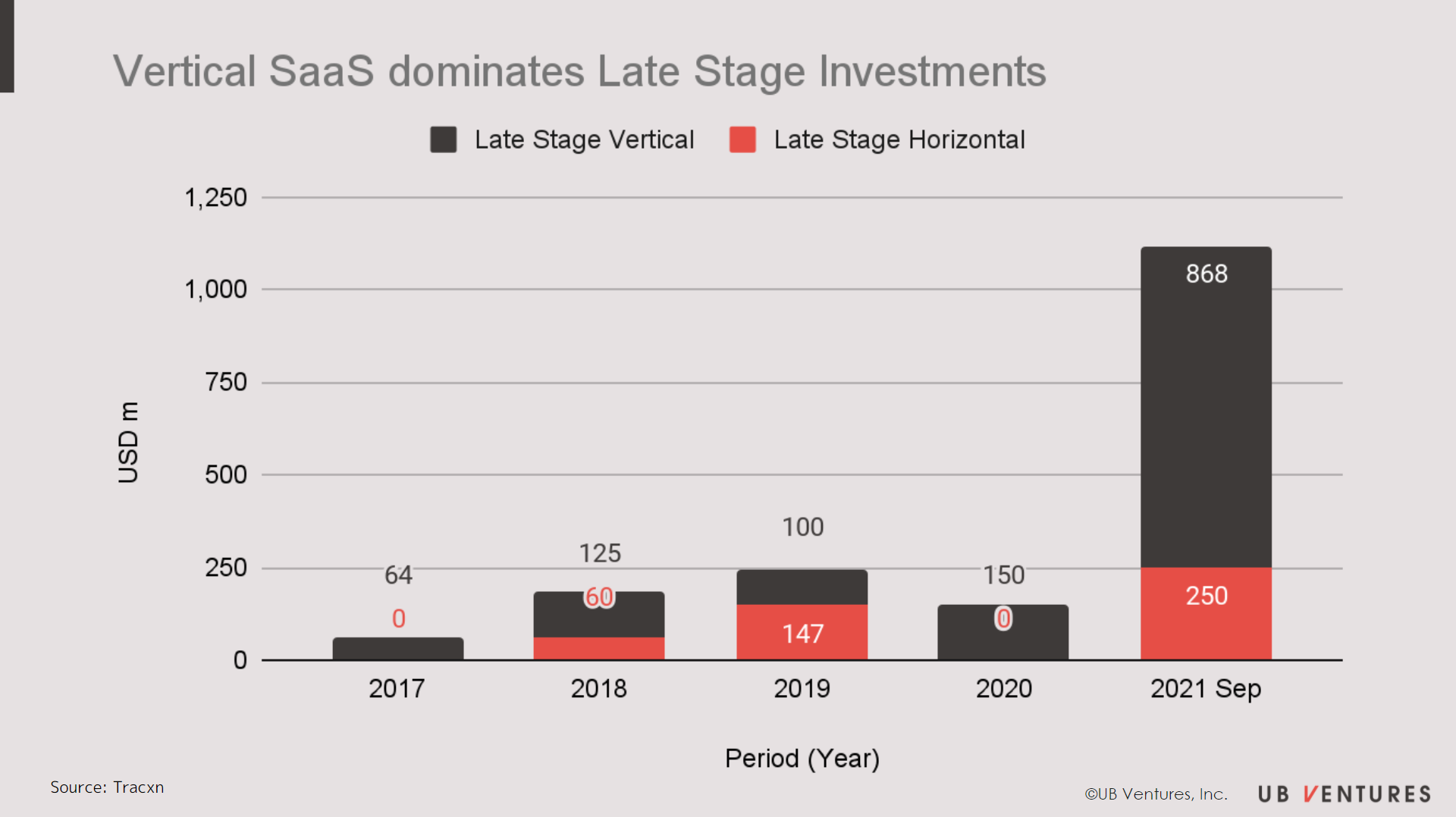

What has been driving the explosive growth of SEA SaaS of late, especially in 2021? If we are to further break down this explosive trend by stage, we recognise that this has been attributed to a rapid increase in large capital deployments into late stage SEA SaaS startups. Notwithstanding the structural shrink in VC investments we witness in 2020, which has occurred across the board due to the unexpected spread of the pandemic, we see that late-stage SaaS investments in 2021 to date has already beaten 2019’s figures by 4.5x, reaching an all-time record high of $1.1bn.

If we further zoom into only late stage SaaS startups of SEA, we see that vertical SaaS has consistently been receiving the majority of VC funding. Specifically, of approximately $50~150m per year since 2017, but especially exploding to $868m in 2021, almost 3.5x the $250m of pure horizontal SaaS.

Top 10 Late Stage SEA SaaS to Watch

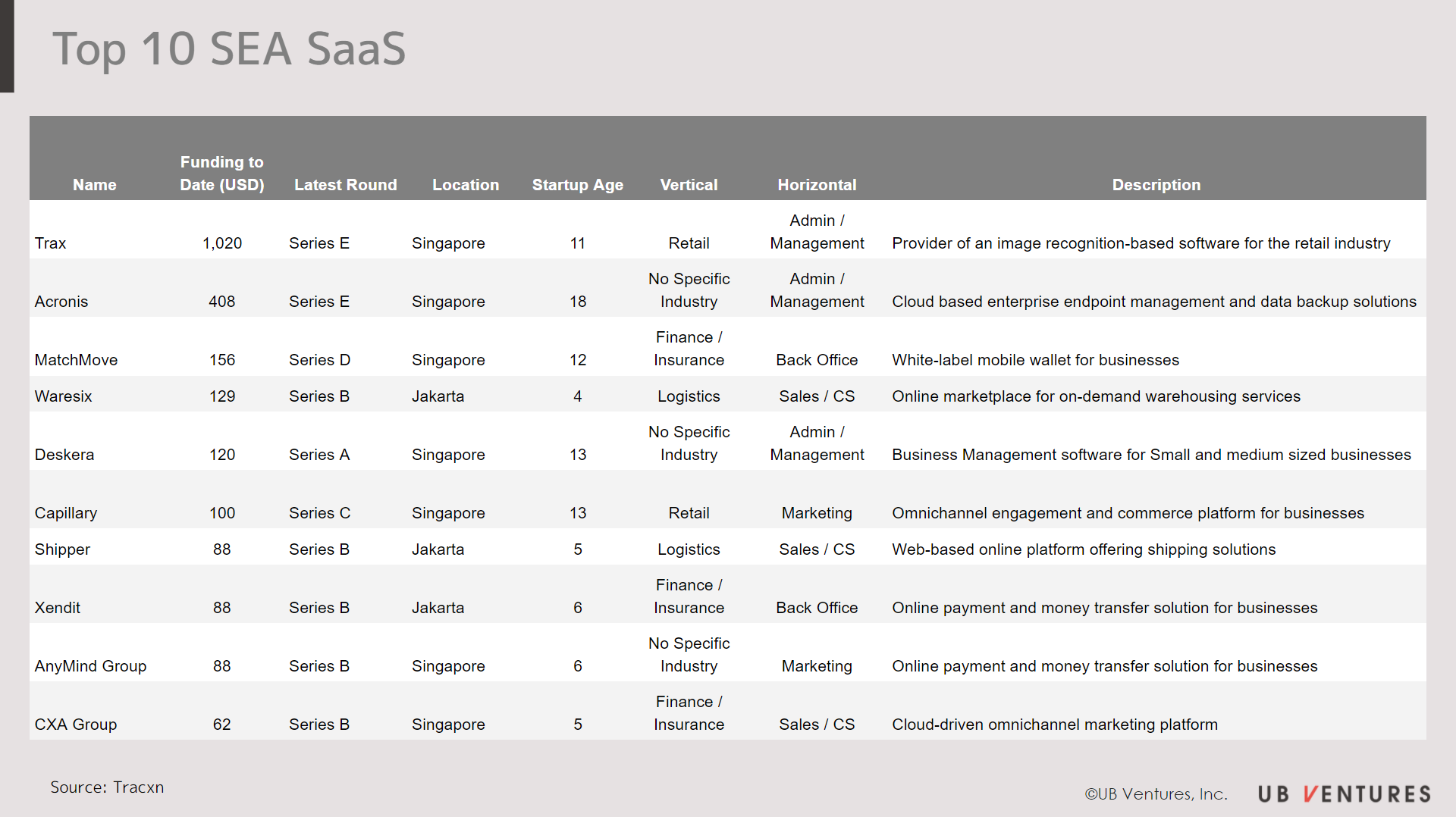

Who are these late stage SaaS startups which are attracting most of the capital deployments in SEA? If we are to take the top 10 late-stage SaaS based on the highest amount of fundraising to date, we can see that while generally more vertical SaaS exists, horizontal SaaS also raises relatively high funding as well. Trax, an image recognition enterprise vertical SaaS platform for the retail industry, has been attracting the most capital of all at $640m in 2021 alone. In second place at $250m in 2021, Acronis is a horizontal SaaS platform that provides end-to-end data management services on the cloud. After these top two contenders, we see that capital distribution is far more even, at approximately $50~$100m per subsequent startup.

Conclusion

Across the world, we have seen a steady growth and maturity of SaaS, as evidenced from the robust growth of VC capital deployments into SaaS over the recent years. Specifically, while we know that SaaS in Asia-Pacific has been predominantly led by China and Japan by volume, we notice that SEA has been growing at a rapid rate, especially in 2021. This explosive growth in SEA SaaS is predominantly due to late stage SaaS capital investments, especially in vertical SaaS, although there are also a handful of horizontal SaaS as well. What exactly are the types of late SaaS that are booming in SEA, and why have they grown so big? In subsequent articles, UBV will have a closer look at the industries that these successful SEA SaaS are occupying, analyzing their business growth strategies and how they are tackling the various opportunities for growth in SEA.

By Jorel Chan | UB Ventures Associate

2021.10.04

Here at UB Ventures, we regularly deliver useful content on both Japanese and global startup trends, as well as hands-on experience from our very own venture capitalists and specialists. Please feel free to contact us via the CONTACT page if you would like to be in touch. Click here to follow UB Venture’s SNS account!

-

SCALING

METRICS

TRENDS

SaaS Annual Report 2023-2024

-

SCALING

METRICS

TRENDS

SaaS Annual Report 2022 – The Key to Industry Transformation –

-

TRENDS

Will the next Unicorn Emerge from the Industrial IoT market in Japan?

-

TRENDS

Will hanko seals ever disappear from Japan?

-

TRENDS

System Integrators – the Key to Success for SaaS in Japan

-

SCALING

Has SaaS become a recognized industry in Japan?

-

SCALING

A list of “Don’ts” when building SaaS: Lessons learnt from engaging with 200 startups

-

SCALING

METRICS

TRENDS

SaaS Annual Report 2021

-

SCALING

TRENDS

3 Successful Strategies of Top Logistics Startups in SEA

-

TRENDS

SEA-Specific Vertical SaaS

-

TRENDS

Latest SaaS Trends in SEA

-

TRENDS

The State of Vertical SaaS in Japan