This article is a summary version of UB Venture’s “SaaS Annual Report 2022 – The Key to Industry Transformation –” which outlines the state of the Japanese and Asian SaaS markets and related trends in 2022.

The full report can be downloaded from the form at the bottom of this article.

On publication of the SaaS Annual Report

Osamu Iwasawa, Managing Partner, UB Ventures

In 2022, listed SaaS companies suffered a dramatic fall in stock prices. IPOs struggled, and the appetite of global crossover investors receded after a period of trend-setting activity.

Has the era of emerging SaaS come to an end?

Looking at the fundamentals, the number of listed SaaS companies with ARR (annual recurring revenue) exceeding JPY 10 billion has increased to seven, with top players reaching JPY 20 billion.

Private vertical SaaS companies have been undergoing robust growth and large-scale fundraising. The amount of funds raised by private SaaS companies reached a record high of JPY 206.3 billion.

SaaS is increasingly being used not only by early adopters but also the majority segment, namely regional companies and SMBs, an indication of its steady progress toward becoming an established industry.

I suggest that we view 2022 as a year of going back to the basics of management: quality of growth, profit-earning capacity, and sound capital efficiency, which had previously been obscured by the SaaS bubble.

This report consists of four parts: “Overview,” a summary of the latest data on the SaaS market; “Insight,” which describes the latest trends; “Vertical SaaS Landscape Updates,” an analysis of the growth factors of the rapidly expanding vertical SaaS market; and “SaaS Meets Industrial IoT,” which highlights the emerging trend of integration between hardware and SaaS.

It is UB Venture’s identity, and mission, to build hypotheses based on precise data and facts in order to capture trends and uncover insights that guide future action.

This Annual Report is the product of the combined efforts made by the members of UB Ventures. This page provides a summary version of the report, and I would be delighted if you take the time to look through the full report as well.

– Overview –

Many trends were observed in the fast-growing SaaS industry in 2022.

In order to provide a bird’s-eye view of the ever-changing industry, the Overview chapter contains quantitative analyses from various perspectives, including ARR, valuation multiples, IPO, private market fundraising, M&A, and efficiency in ARR acquisition.

The contents below are highlights from the full report.

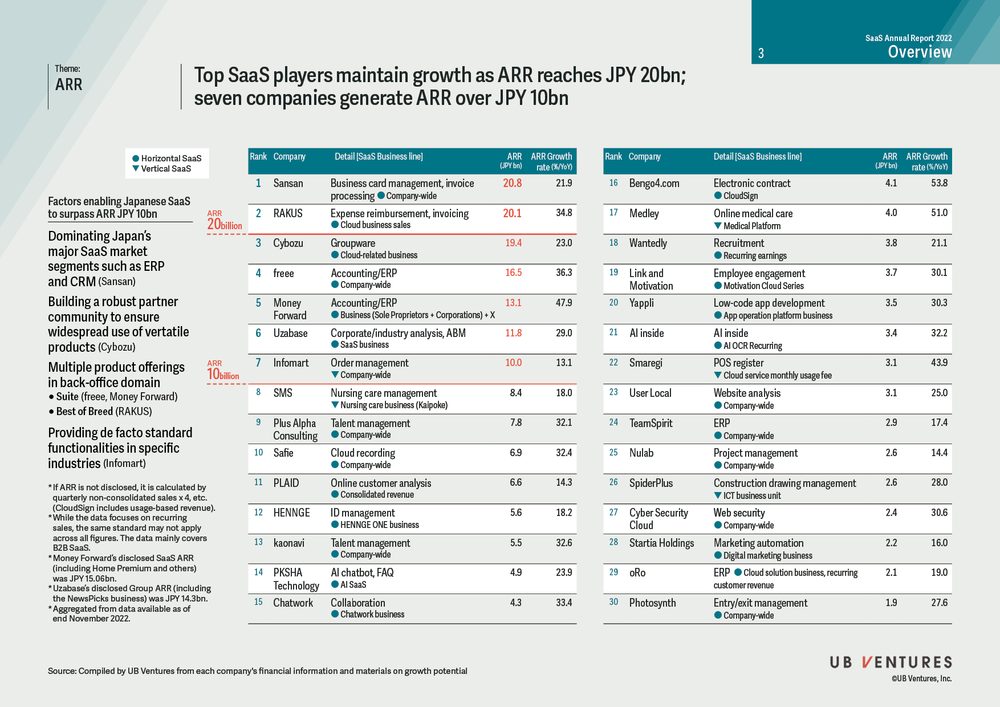

1. ARR: Top SaaS players maintain growth as ARR reaches JPY 20bn; seven companies generate ARR over JPY 10bn

Up to several years ago, JPY 10 billion in ARR was considered a benchmark for SaaS companies to be recognized as major players. By the end of 2022, the number of listed SaaS companies exceeding that figure has increased to seven, with top players including Sansan and RAKUS continuing to grow beyond expectations with ARR over JPY 20 billion.

SaaS companies keep expanding as they adopt new growth methods, including multiple product offerings, M&A, and integration with AI technologies.

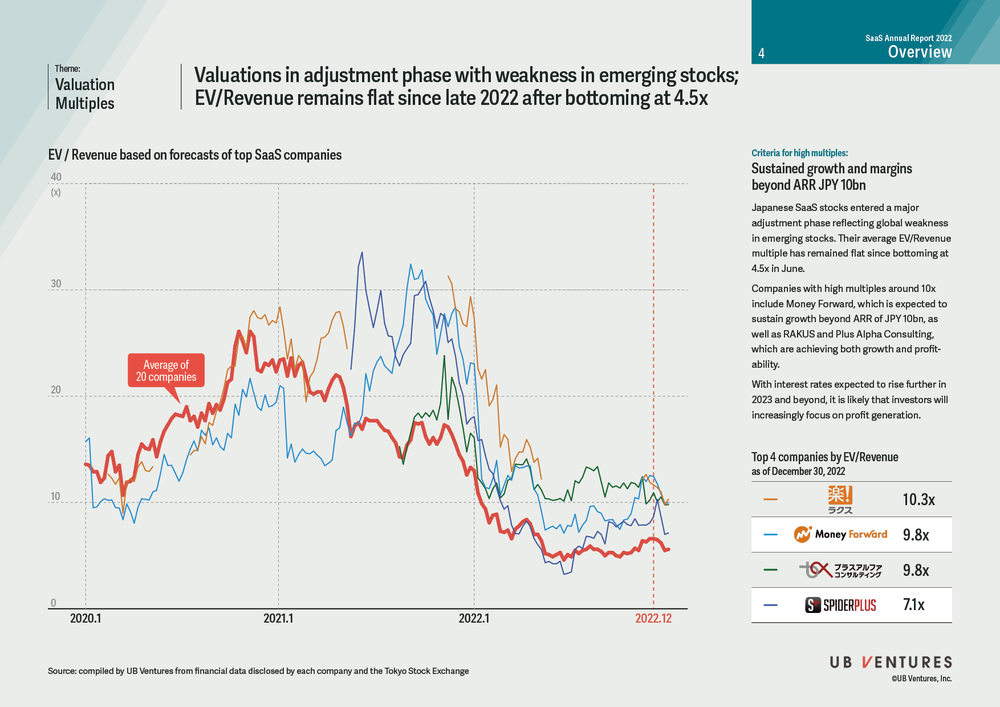

2. Valuation multiples: Valuations in adjustment phase with weakness in emerging stocks; EV/Revenue remains flat since late 2022 after bottoming at 4.5x”

Japanese SaaS stocks entered a major adjustment phase reflecting global weakness in emerging stocks. Their average EV/Revenue multiple has remained flat since bottoming at 4.5x in June.

Companies with multiples around 10x include Money Forward, which is expected to sustain growth beyond ARR of JPY 10bn, as well as RAKUS and Plus Alpha Consulting, which are achieving both growth and profitability.

With interest rates expected to rise further in 2023 and beyond, it is likely that investors will increasingly focus on profit generation.

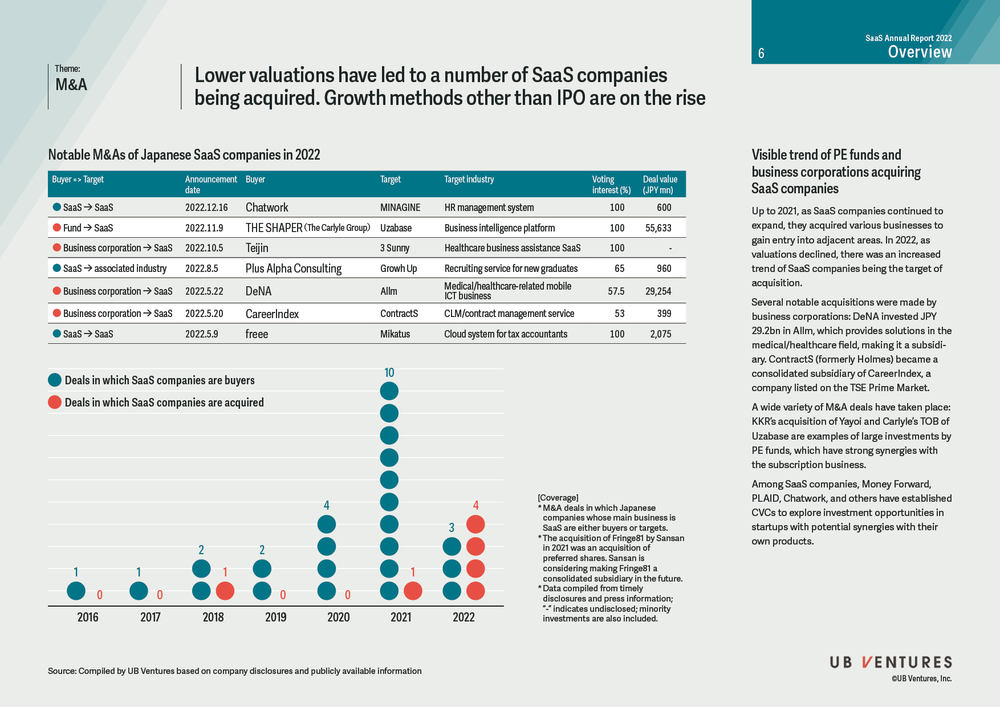

3. M&A: Lower valuations have led to a number of SaaS companies being acquired. Growth methods other than IPO are on the rise

Up to 2021, as SaaS companies continued to expand, they acquired various businesses to gain entry into adjacent areas.

In 2022, as valuations declined, there was an increased trend of SaaS companies being the target of acquisition. Several notable acquisitions were made by business corporations: DeNA invested JPY 29.2bn in Allm, which provides solutions in the medical/healthcare field, making it a subsidiary. ContractS (formerly Holmes) became a consolidated subsidiary of CareerIndex, a company listed on the TSE Prime Market.

A wide variety of M&A deals have taken place: KKR’s acquisition of Yayoi and Carlyle’s TOB of Uzabase are examples of large investments by PE funds, which have strong synergies with the subscription business.

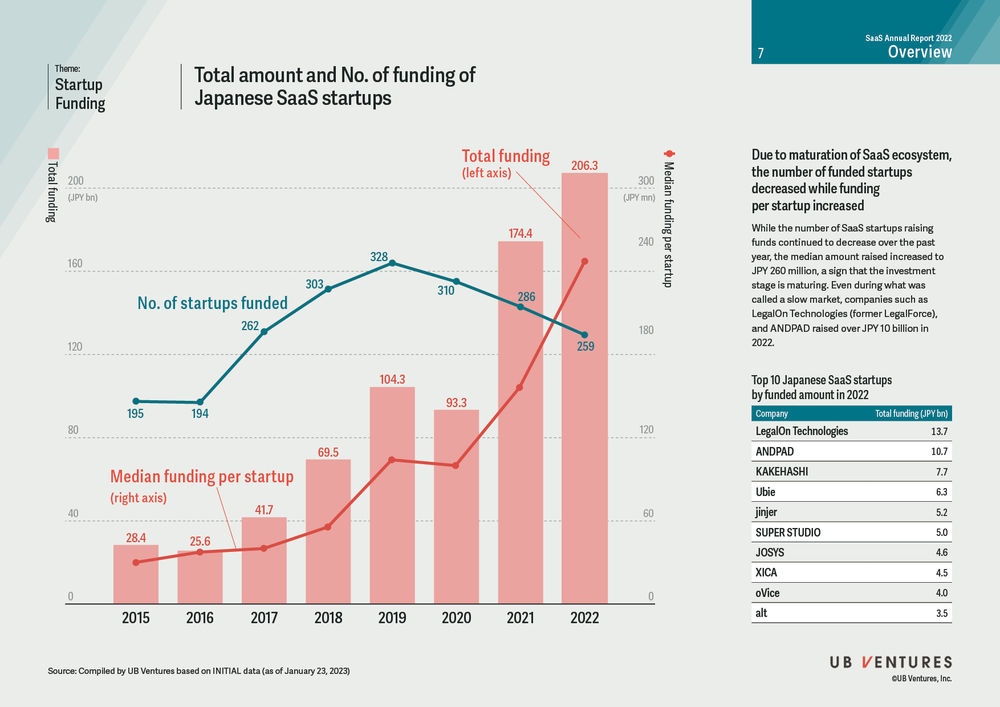

4.Startup funding: Due to maturation of SaaS ecosystem, the number of funded startups decreased while funding per startup increased

While the number of SaaS startups raising funds continued to decrease over the past year, the median amount raised increased to JPY 260 million, a sign that the investment stage is maturing.

Even during what was called a slow market, companies such as LegalOn Technologies (former LegalForce), and ANDPAD raised over JPY 10 billion in 2022.

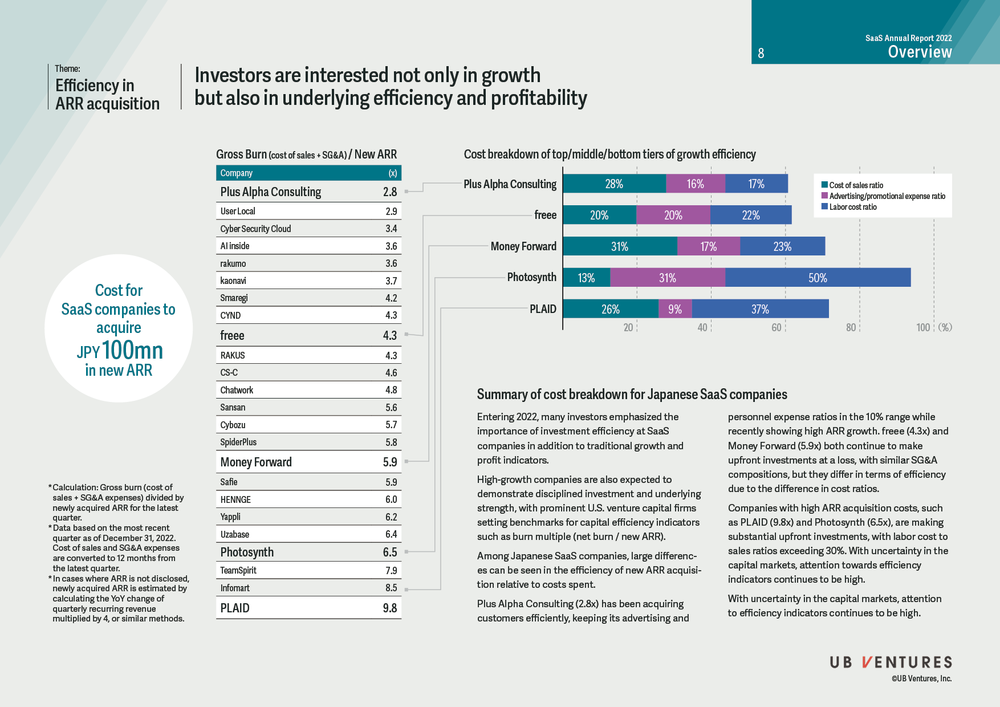

5. Efficiency in ARR acquisition: Investors are interested not only in growth but also in underlying efficiency and profitability

Entering 2022, many investors emphasized the importance of investment efficiency at SaaS companies in addition to traditional growth and profit indicators.

High-growth companies are also expected to demonstrate disciplined investment and lean growth, with prominent U.S. venture capital firms setting benchmarks for capital efficiency indicators such as burn multiple (net burn / new ARR).

Among Japanese SaaS companies, large differences can be seen in the efficiency of new ARR acquisition relative to costs spent.

Plus Alpha Consulting (2.8x) has been acquiring customers efficiently, keeping its advertising and personnel expense ratios in the 10% range while recently showing high ARR growth. Companies with high ARR acquisition costs, such as PLAID (9.8x) and Photosynth (6.5x), are making substantial upfront investments, with labor cost to sales ratios exceeding 30%.

With uncertainty in the capital markets, attention towards efficiency indicators continues to be high.

– SaaS Insight –

In this report, the “SaaS Insight” chapter covers changes in trends and topics highlighted in 2022.

The report provides a detailed outlook on the market potential of SaaS, which SaaS companies need to consider in order to bridge the chasm, as well as diversifying methods of financing and partnership strategies to capture the majority segment.

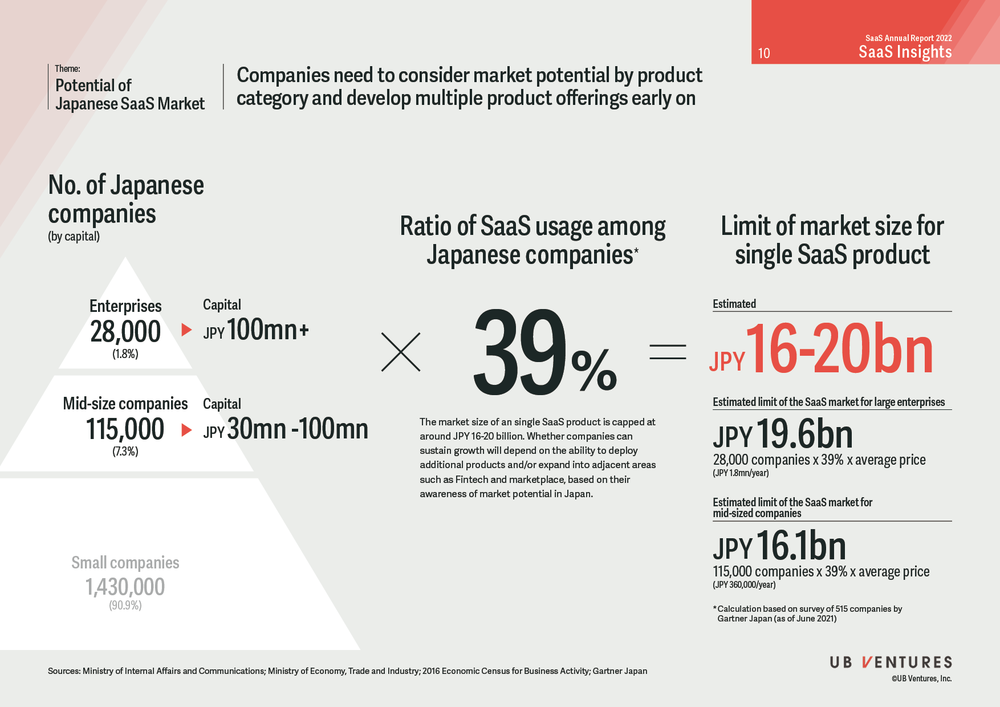

6. Japanese SaaS market potential: Companies need to consider market potential by product category and develop multiple product offerings early on

Currently, the market size of a single SaaS product is capped at around JPY 16-20 billion. Whether companies can sustain growth will depend on the ability to deploy additional products and/or expand into adjacent areas such as Fintech and marketplace, based on their awareness of market potential in Japan.

7. PLG:How can PLG products overcome the chasm particular to Japan?

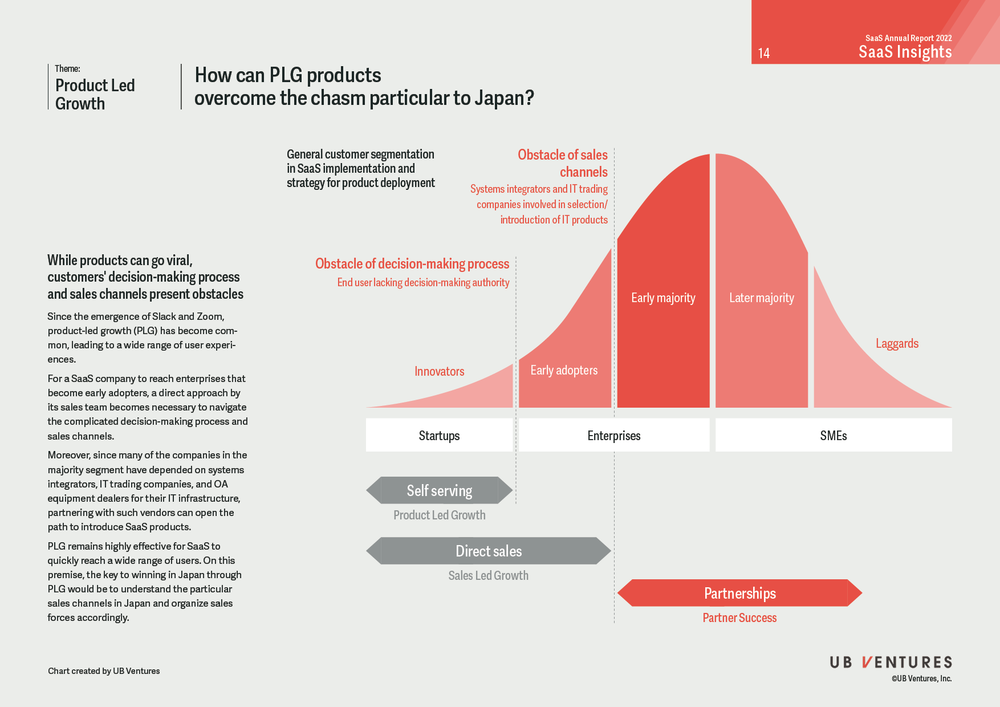

Since the emergence of Slack and Zoom, product-led growth (PLG) has become common, leading to a wide range of user experiences.

Meanwhile, in Japan, companies that have full initiative from the selection of products to final decision-making is limited to the innovator segment, which mainly consists of startups.

For a SaaS company to reach enterprises that become early adopters, a direct approach by its sales team becomes necessary to navigate the complicated decision-making process and sales channels.

Moreover, since many of the companies in the majority segment have depended on systems integrators, IT trading companies, and OA equipment dealers for their IT infrastructure, partnering with such vendors can open the path to introduce SaaS products.

PLG remains highly effective for SaaS to quickly reach a wide range of users.

On this premise, the key to winning in Japan through PLG would be to understand the particular sales channels in Japan and organize sales structures accordingly.

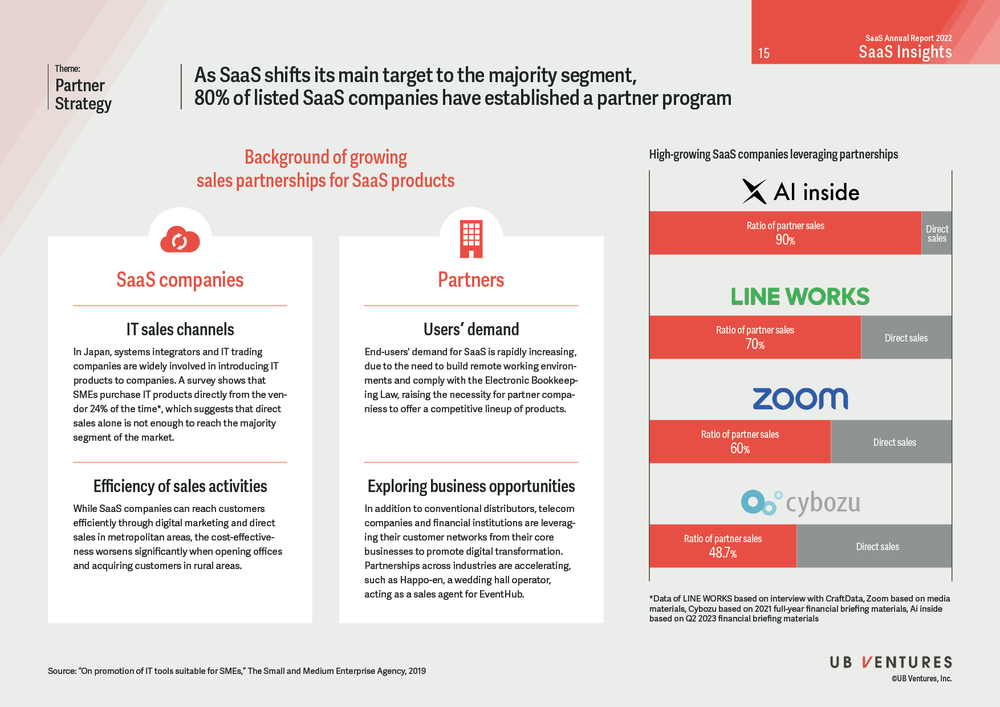

8. Partner strategy: As SaaS shifts its main target to the majority segment, 80% of listed SaaS companies have established a partner program

Before the advent of SaaS, software sales channels were widely covered by IT/OA trading companies and systems integrators, which provided servers, network construction, maintenance services, etc.

Such partner companies specializing in IT services often have nation-wide sales networks, and can become powerful channels for SaaS companies that do not have offices in local regions.

Additionally, entities with large customer bases, such as financial institutions, mobile carriers, and telecom companies, are increasingly offering SaaS solutions to support their customers’ digitalization efforts.

Accounting/tax firms are also acting as consultants and sales agents through services provided by freee and Money Forward.

– Vertical SaaS Landscape Updates –

Vertical SaaS is no longer a small market: Such momentum was seen in 2022.

Amid a challenging environment for financing, later-stage companies such as ANDPAD and KAKEHASHI raised large funds, and are rapidly enhancing services in non-SaaS business domains.

Many startups are entering the ERP system market, where dynamic trends are expected in 2023.

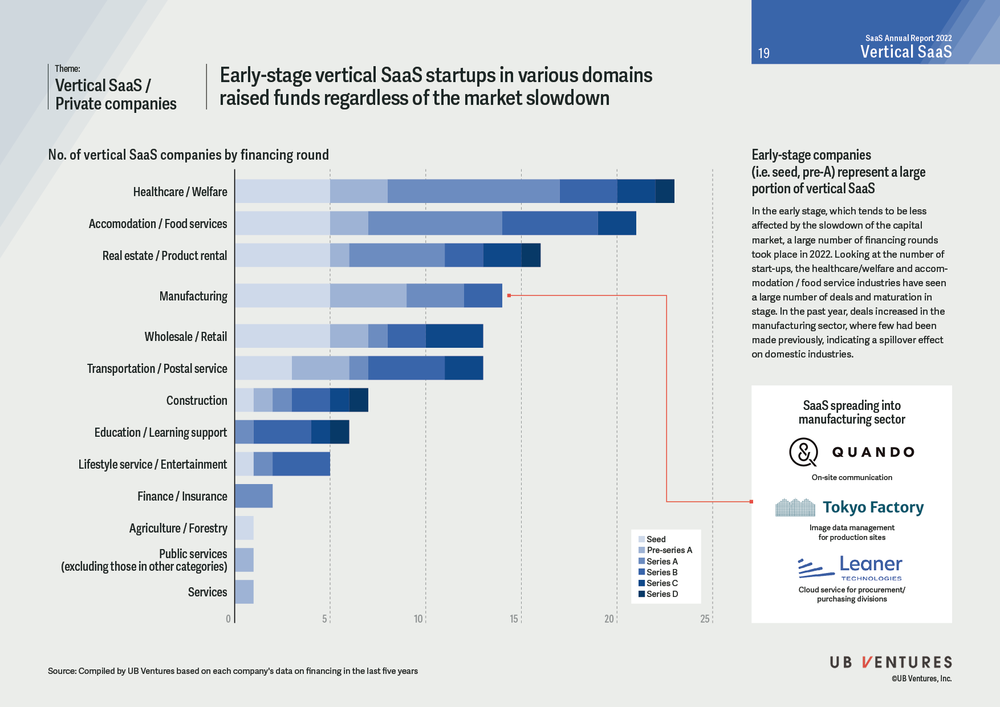

9. Vertical SaaS Funding: Early-stage vertical SaaS startups in various domains raised funds regardless of the market slowdown

In the early stage, which tends to be less affected by the slowdown of the capital market, a large number of financing rounds took place in 2022.

Looking at the number of startups, the healthcare/welfare and accommodation / food service industries have seen a large number of deals and maturation in the stage. In the past year, deals increased in the manufacturing sector, where few had been made previously, indicating a spillover effect on domestic industries.

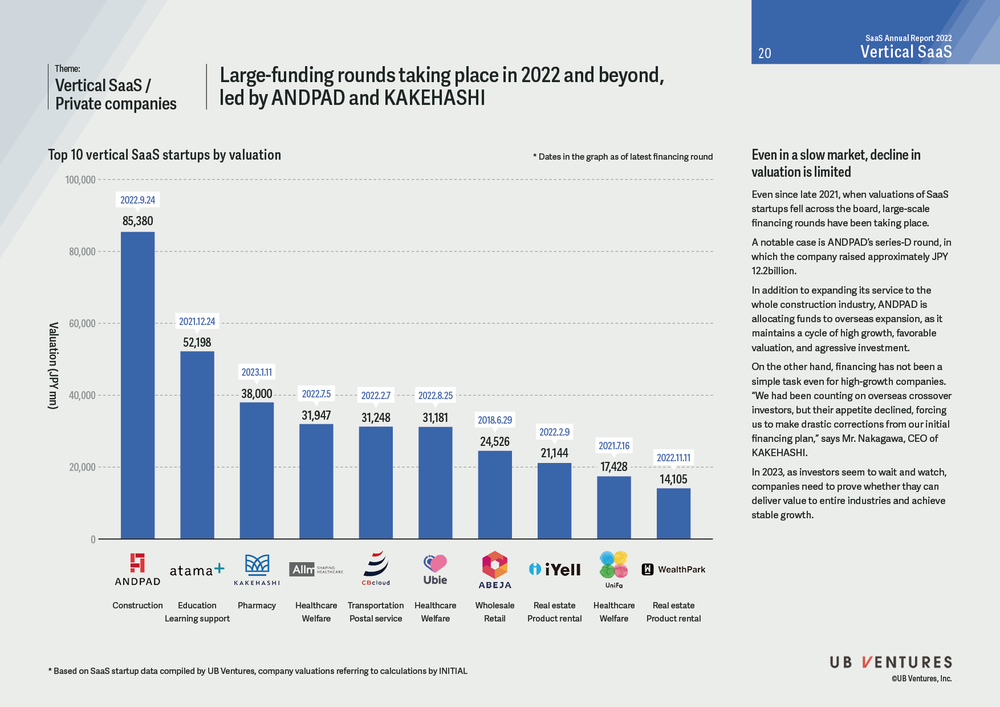

10.Vertical SaaS Funding: Large-funding rounds taking place in 2022 and beyond, led by ANDPAD and KAKEHASHI

Even since late 2021, when valuations of SaaS startups fell across the board, large-funding rounds have been taking place.

A notable case is ANDPAD’s series-D round, in which the company raised approximately JPY 12.2billion.

In addition to expanding its service to the whole construction industry, ANDPAD is allocating funds to overseas expansion, as it maintains a cycle of high growth, favorable valuation, and aggressive investment.

On the other hand, financing has not been a simple task even for high-growth companies. “We had been counting on overseas crossover investors, but their appetite declined, forcing us to make drastic corrections from our initial financing plan,” says Mr. Nakagawa, CEO of KAKEHASHI.

In 2023, as investors seem to wait and watch, companies need to prove whether they can deliver value to entire industries and achieve stable growth.

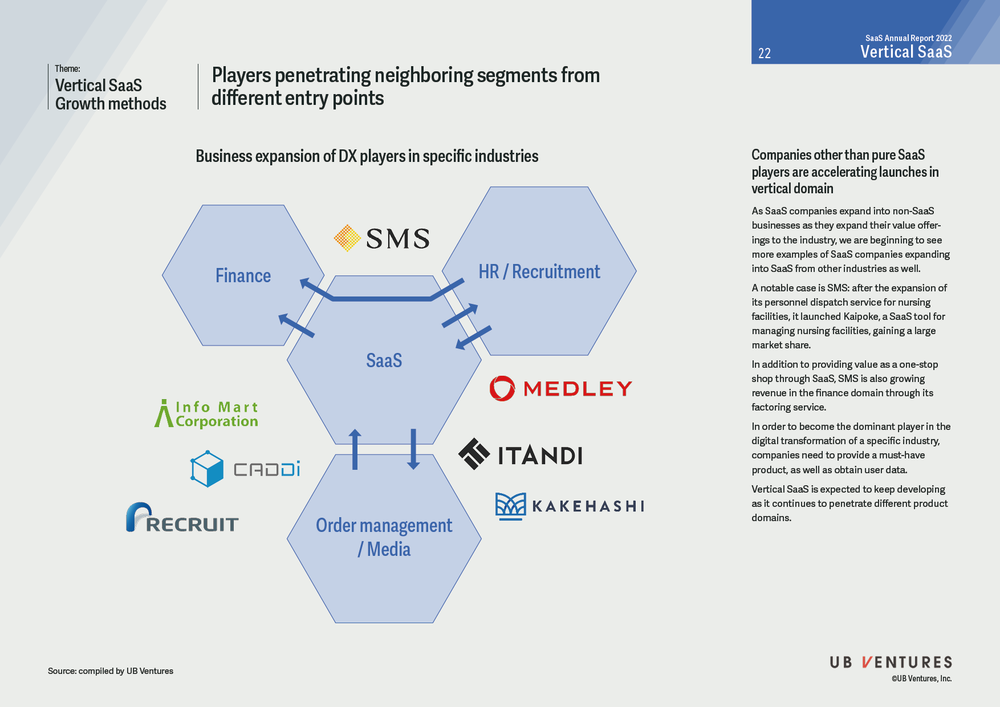

11. Vertical SaaS growth methods: Players penetrating neighboring segments from different entry points

While SaaS companies are delivering a wider range of values in different industries, we are also seeing more cases where companies with other core businesses expand into SaaS.

A notable case is SMS: after the expansion of its personnel dispatch service for nursing facilities, it launched Kaipoke, a SaaS tool for managing nursing facilities, gaining a large market share.

In addition to providing value as a one-stop shop through SaaS, SMS is also growing revenue in the finance domain through its factoring service.

In order to become the dominant player in the digital transformation of a specific industry, companies need to provide a must-have product, as well as obtain user data.

Vertical SaaS is expected to keep developing as it continues to penetrate different product domains.

– SaaS meets Industrial IoT –

IoT (Internet of Things) is one of the most important concepts that we need to update our understanding of.

When the term became widely recognized in Japan back in 2015, it was understood in a BtoC context as the connection of electrical appliances such as air conditioners and refrigerators to the internet, making consumers’ lives more convenient. Now, seven years later, there seems to be less talk about IoT, and it may be seen as a buzzword that has run its course.

Meanwhile, domestic non-IT sectors are facing the urgent need to grow out of conventional business models (i.e., selling things without after-market touch-points) and transition to a subscription model. Utilization of data obtained from devices and equipment can be the key that determines success of their growth strategies.

Within this trend, we would like to focus on the potential of SaaS combined with IoT, particularly in the industrial domain.

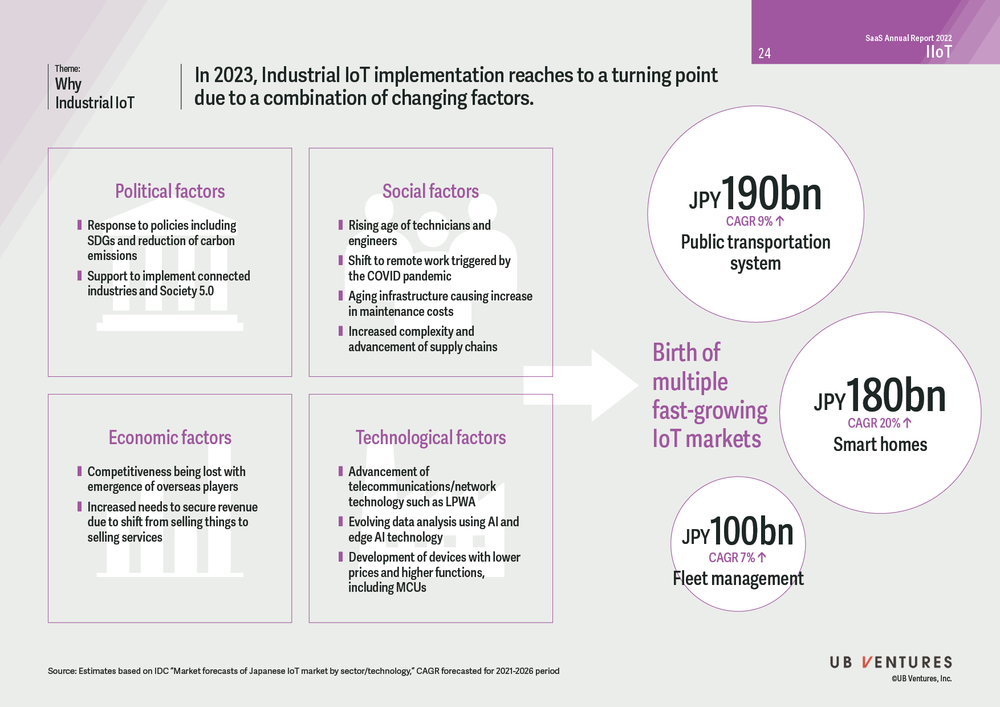

12. Why Industrial IoT: In 2023, Industrial IoT implementation reaches a turning point due to a combination of changing factors.

Why is this the right time to turn our attention to Industrial IoT?

Because major changes are happening simultaneously in the environment surrounding companies and society, triggering the birth of rapidly growing markets.

A range of factors have raised expectations for IoT and its rapid implementation in society: political factors, such as trends related to the SDGs and the visualization of environmental data associated with CO2 emission reduction; economic factors, including the shift to service-centered businesses in the manufacturing sector; and social factors, such as labor shortages and the need to transfer skills. Moreover, technological factors are driving the expansion and growth of Industrial IoT.

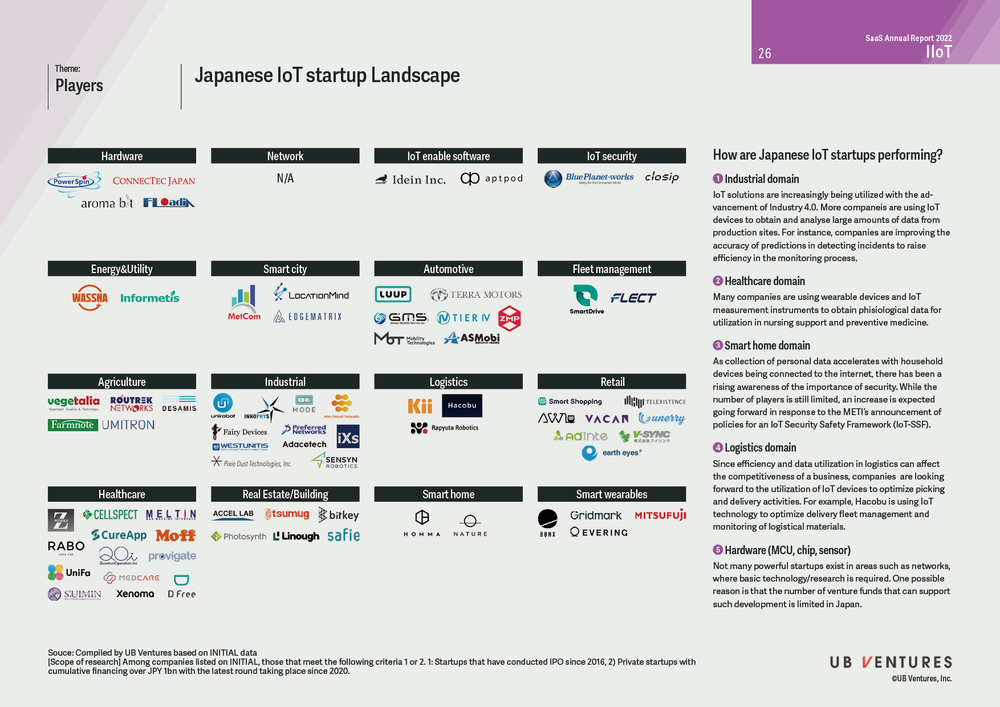

13. Industrial IoT Landscape: How are Japanese IoT startups performing?

1. Industrial domain

IoT solutions are increasingly being utilized with the advancement of Industry 4.0. More companies are using IoT devices to obtain and analyze large amounts of data from production sites. For instance, companies are improving the accuracy of predictions in detecting incidents to raise efficiency in the monitoring process.

2.Healthcare domain

Many companies are using wearable devices and IoT measurement instruments to obtain physiological data for utilization in nursing support and preventive medicine.

3.Smart home domain

As collection of personal data accelerates with household devices being connected to the internet, there has been a rising awareness of the importance of security. While the number of players is still limited, an increase is expected going forward in response to the METI’s announcement of policies for an IoT Security Safety Framework (IoT-SSF).

4.Logistics domain

Since efficiency and data utilization in logistics can affect the competitiveness of a business, companies are looking forward to the utilization of IoT devices to optimize picking and delivery activities. For example, Hacobu is using IoT technology to optimize delivery fleet management and monitoring of logistical materials.

5.Hardware (MCU, chip, sensor)

Not many powerful startups exist in areas such as networks, where basic technology/research is required. One possible reason is that the number of entities that can support budgets for such development is limited in Japan.

Download full report (free) / Disclaimer

You can download the full report (32 pages) after submitting the form below.

We are committed to managing and protecting the personal information we receive in the following manner. By continuing, you are considered to have agreed to the following:

[Collection, Use, and Provision of Personal Information]

UB Ventures, Inc. (“the Company”) may use your personal information to send you this report, to inform you of future content releases, to distribute e-mail newsletters, to invite you to events hosted by the Company, to identify and consider potential investment candidates and LPs, and to respond to your inquiries.

[Provision of Personal Information to Third Parties]

The Company will not provide your personal information to any third party, except with your consent or in accordance with laws and regulations.

[Personal Information Protection Policy]

Please refer to the following link for details of the Company’s personal information management.

UB Ventures, Inc.

Overall direction

Representative Director Managing Partner Osamu Iwasawa

Chief Analyst Akio Hayafune

Content Direction

Representative Director Managing Partner Osamu Iwasawa

Managing Partner Chiamin Lai

Principal Takuya Oshika

Chief Analyst Akio Hayafune

Editing

Senior Associate Shinya Iwashita

Senior Associate Riho Majima

Entrepreneur-in-Residence Takuya Maehashi

Intern Lily Suzuki

Design

Hajime Aomatsu (sukku)

Interviewees

Mr. Yuki Tanaka, Deputy General Manager, Venture Business Division, SBI Shinsei Bank

Mr. Fumihiro Akikuni, COO, PartnerSuccess

Translation

Makiko Migiyama

Data source

INITIAL:https://initial.inc/

Here at UB Ventures, we regularly deliver useful content on both Japanese and global startup trends, as well as hands-on experience from our very own venture capitalists and specialists. Please feel free to contact us via the CONTACT page if you would like to be in touch. Click here to follow UB Venture’s SNS account!

-

SCALING

METRICS

TRENDS

SaaS Annual Report 2023-2024

-

SCALING

METRICS

TRENDS

SaaS Annual Report 2022 – The Key to Industry Transformation –

-

TRENDS

Will the next Unicorn Emerge from the Industrial IoT market in Japan?

-

TRENDS

Will hanko seals ever disappear from Japan?

-

TRENDS

System Integrators – the Key to Success for SaaS in Japan

-

SCALING

Has SaaS become a recognized industry in Japan?

-

SCALING

A list of “Don’ts” when building SaaS: Lessons learnt from engaging with 200 startups

-

SCALING

METRICS

TRENDS

SaaS Annual Report 2021

-

SCALING

TRENDS

3 Successful Strategies of Top Logistics Startups in SEA

-

TRENDS

SEA-Specific Vertical SaaS

-

TRENDS

Latest SaaS Trends in SEA

-

TRENDS

The State of Vertical SaaS in Japan