Mothers, IT and the Rise of B2B SaaS

TRENDSIn Japan, by far the most common method of exit for startups is via IPO on the Mothers Index at the Tokyo Stock Exchange. In recent years, there have been 3 structurally observable megatrends on the Mothers Index, namely: 1) The total market cap of startups has rapidly increased, 2) The nature of startups being listed in Mothers are increasingly IT, and 3) specifically, B2B SaaS. These all point to a maturing, diverse emergence of SaaS startups looking to transform the Japanese ecosystem in the coming years through a greater offering of cloud services.

The Mothers Section

What is the Mothers Section? The Mothers Section is one of the various sections that exist on the Tokyo Stock Exchange. The Tokyo Stock Exchange (abbreviated as TSE, or TYO for ticker codes) is the largest stock exchange in Asia, and the third largest worldwide, by aggregate market capitalization of its 3,700+ listed companies, standing at over US$5.6t as of June 2020. The TSE comprises of 5 different sections: The First section (for Japan’s largest companies), the Second section (for middle-sized companies), JASDAQ and Mothers (for emerging high-growth companies), and PRO (established in 2009 jointly with the London Stock Exchange as an Alternative Investment Market or AIM).

The Mothers Section, abbreviated from “Market Of The High-growth and Emerging Stocks”, shares a similar purpose as JASDAQ albeit with different listing requirements primarily due to historical reasons: JASDAQ had been originally part of the Osaka Stock Exchange, which had only recently merged with TSE in 2013 to form the Japan Exchange Group, which now manages the whole of Japan’s stock exchanges. Every section on TSE has different listing requirements, with the First Section being arguably the most rigorous. The Mothers section, on the other hand, has been generally accepted as the index where Japanese startups list. In recent years especially, we have seen a rise of SaaS startups in particular listing on the Mothers. Specifically, in the past 5 years, we have observed the following structural trends:

- Maturing and Consolidating Ecosystem

- The Emergence of IT

- The Rise of B2B SaaS

Trend 1: Maturing and Consolidating Ecosystem

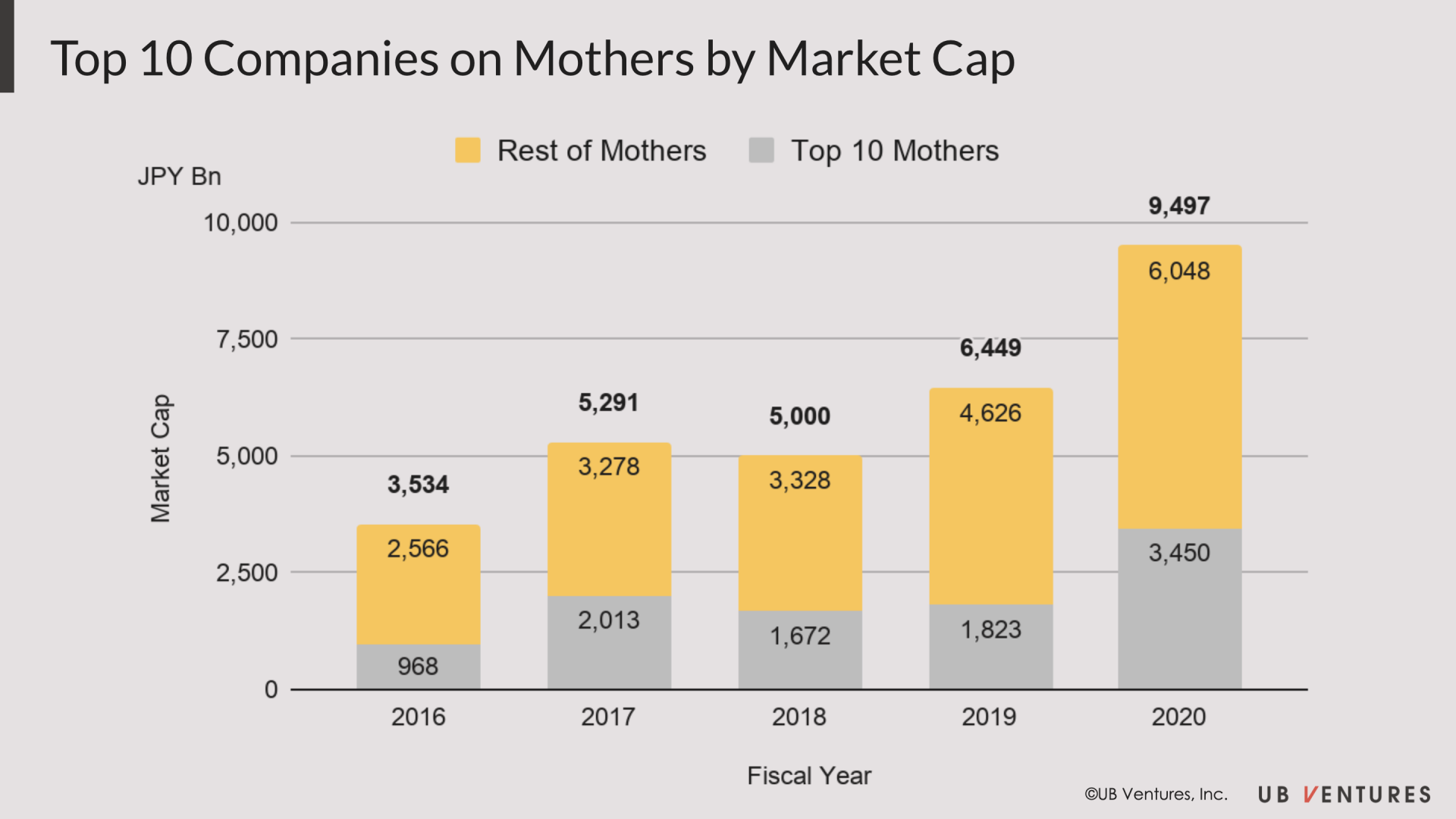

Overall, Japan’s Mothers index has been steadily growing recently. Over the past 5 years, the total market cap of Mothers has increased by 23.8% CAGR from JPY 3.2tn in 2016 to JPY 9.5tn in 2020. In fact, 2020 has been a significant year of growth for Mothers; in this year alone, especially amidst the COVID-19 crisis, Japan’s Mothers index has emerged as the best-performing stock market in Asia of the year as individual investors begin to bet on the accelerated shift to cloud-based services within the overarching investment themes of remote work and digital transformation, largely due to the pandemic.

In particular, the startup ecosystem can also be observed to have consolidated, especially in 2020. While on an absolute market capitalization basis, both the Top 10 companies, as well as the rest of the companies on the Mothers section, have been increasing, in relative terms, we also see a growing % share of market capitalization in the Top 10 Mothers, with the share of Top 10 companies rising from 27.4% (JPY 968bn) in 2016, to 36.3% (JPY 3,450bn) in 2020. With both an absolute increase in the market capitalization of all companies on Mothers, as well as a relative increase in market capitalization share on the Top 10 Mothers, we see both a maturing and consolidating capital market, with a robust infrastructure appropriately allocating capital to support the key handful of later stage companies.

Trend 2: The Emergence of IT

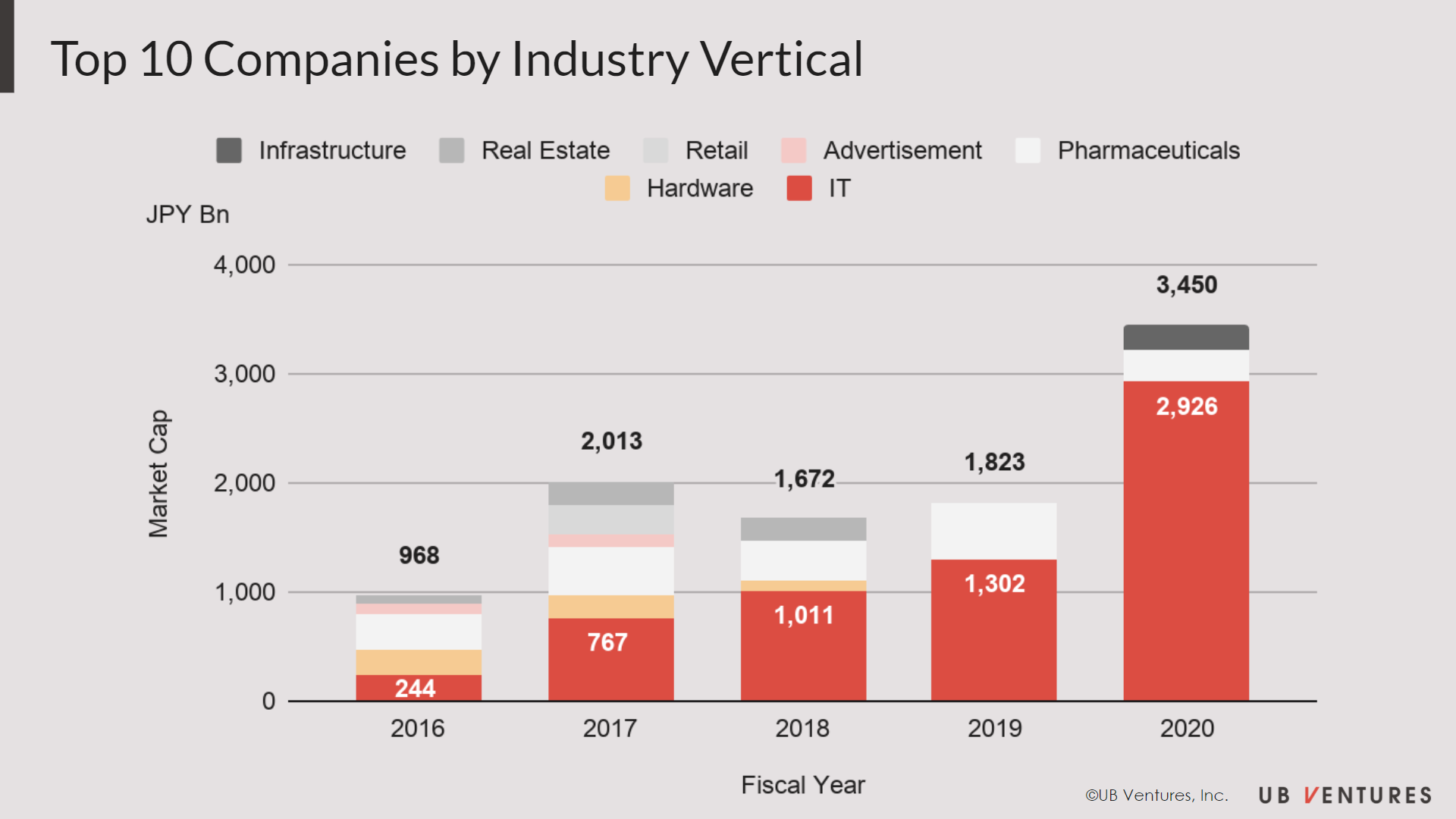

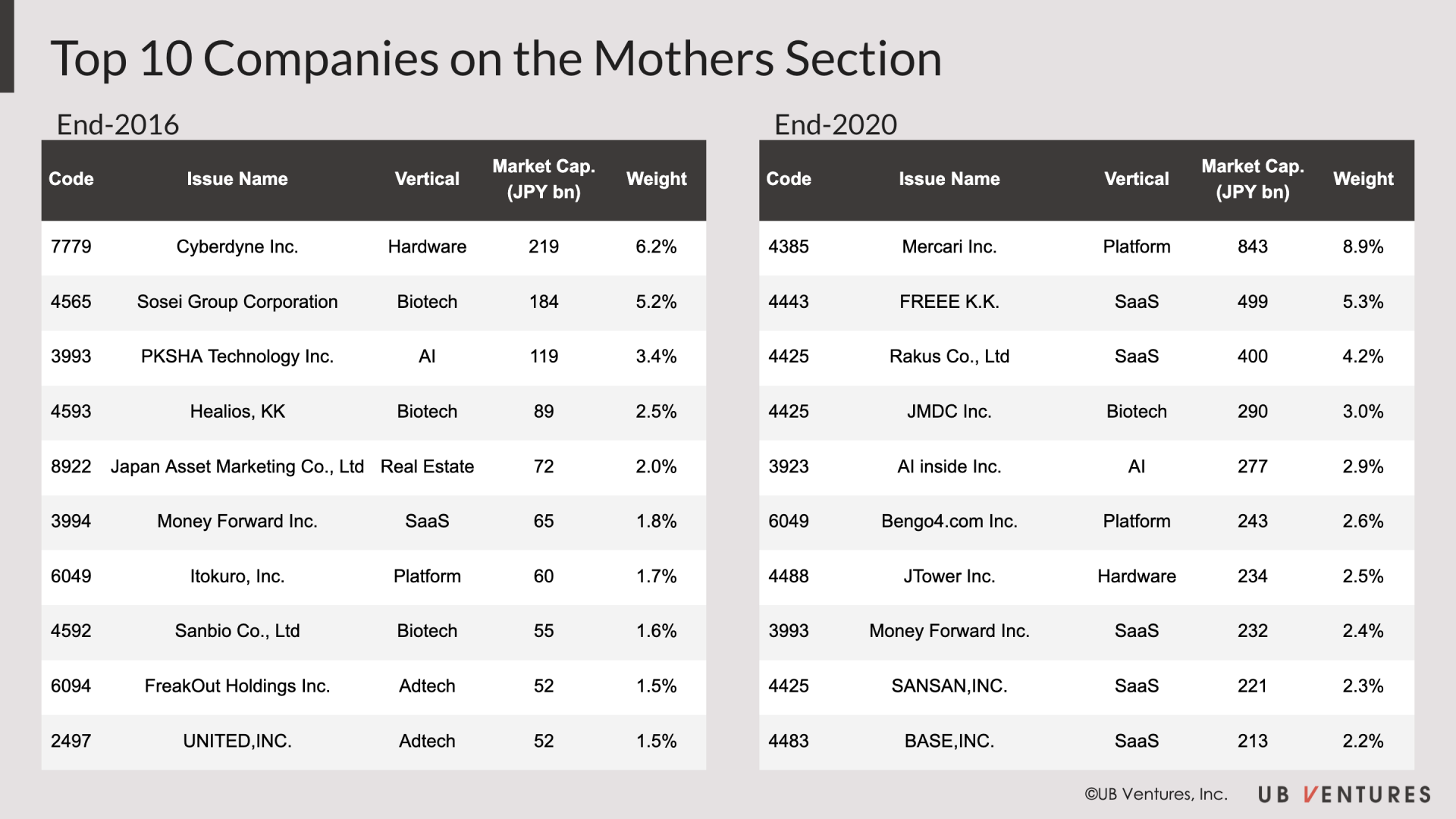

Within the top 10 companies in the Mothers, we are also witnessing a shift in industry verticals towards IT. In 2016, the top 10 companies by market capitalization comprised of mostly manufacturing (i.e. pharmaceuticals/hardware/infrastructure) at 56.6% (or JPY 547bn) while IT only occupied 25.3% (or JPY 244bn); however, that has dramatically shifted towards IT by 2020, with IT occupying 84.8% (or JPY 2,926bn) and manufacturing occupying 15.2% (or JPY 524bn). This dramatic change in the makeup of large startups in Japan is significant, as it signals a fundamental change in the structural demands of the market towards IT and software in particular.

Further, if we were to break down the Top 10 companies by tech verticals (categories being representative and non-exhaustive) in lieu of the aforementioned industry sectors, we can observe added nuances in the change in the specific make-up of IT companies. In 2016, most of the software companies were a mix of small AI, SaaS and Platform companies; however, in 2020, with the exception of Mercari, an e-commerce platform occupying top spot with a JPY 843bn market cap, we see a significant increase in SaaS startups occupying the rest of the Top 10 spots in the Mothers section.

Trend 3: The Rise of B2B SaaS

Within the new SaaS companies occupying top spots in Mothers, specifically, we can observe that most of them are providing cloud-based solutions for corporate processes such as accounting/HR/secretarial work for SMEs (i.e. freee, Money Forward, RAKUS, Sansan). Even Base, fundamentally an e-commerce SaaS platform not unlike Shopify, empowers SMEs to bring their D2C online effectively. This is by no means a coincidence; overall, we are seeing an huge increase in B2B SaaS, with a common aim of setting up simpler, user-friendly interfaces to streamline existing complicated processes and paperwork. With corporate Japan notorious for its bureaucracy and red tape, this structural shift is significant as it shows the private markets already actively providing newer and more seamless solutions to widespread, legacy issues, and in the same vein, demand matching this supply of new technologically-powered, cloud-based solutions. Especially in the light of COVID-19, which has greatly accelerated the pace of acceptance of remote work – which requires a cloud-based infrastructure to operate, it is likely that this will be a sustained trend, within the larger macro trend of more and more SMEs steadily migrating their data to the cloud – UBV believes that B2B SaaS will be a main driving force in setting up a cloud-based infrastructure for the new economy ahead.

Conclusion

Japan’s B2B SaaS startup ecosystem is growing rapidly. In the recent years, we have seen the steady growth of the market capitalization of the Mothers’ Index, catalyzed especially by performance during the COVID-19 pandemic, signaling a thorough maturing and consolidation of capital within the listed startups. Even the mix of the top 10 startups within Mothers have fundamentally changed – while hardware and pharmaceutical companies occupied a large portion of market capitalization in the past, it is thoroughly dominated by mainly IT companies now, specifically SaaS. In particular, the type of SaaS companies occupying top spots have been those that are streamlining the manual back office or corporate processes for SMEs and individuals alike. As it is with the rest of the world, we are witnessing the advent of B2B SaaS, whereby cloud-based services provide solutions to SMEs through improved unit economics and ultimately lowered barriers to entry and usage. Moreover, with the pandemic having shown us the new possibilities of remote work in our daily lives, it is highly likely that this structural change is here to stay in radically changing how corporate Japan operates, with SMEs adopting an ever-increasing suite of B2B SaaS tools, as they continue to migrate fully into the cloud.

(*1)Japan Exchange Group. “IHS Markit and Tokyo Stock Exchange to Combine Data, Creating a Unique Japanese Securities Finance Data Set.” 10 Dec 2020.

(*2) Japan Exchange Group. “Criteria for Listing.” 10 Dec 2020.

(*3)Reuters, ”Japan’s Mothers index outpaces rest of Asia on digitalisation bets”, 18 Sep 2020, taken: https://www.reuters.com/article/japan-stocks-mothers-idUSL4N2GF23Q

By Jorel Chan | UB Ventures Associate

2021.01.14

Here at UB Ventures, we regularly deliver useful content on both Japanese and global startup trends, as well as hands-on experience from our very own venture capitalists and specialists. Please feel free to contact us via the CONTACT page if you would like to be in touch. Click here to follow UB Venture’s SNS account!

-

SCALING

METRICS

TRENDS

SaaS Annual Report 2023-2024

-

SCALING

METRICS

TRENDS

SaaS Annual Report 2022 – The Key to Industry Transformation –

-

TRENDS

Will the next Unicorn Emerge from the Industrial IoT market in Japan?

-

TRENDS

Will hanko seals ever disappear from Japan?

-

TRENDS

System Integrators – the Key to Success for SaaS in Japan

-

SCALING

Has SaaS become a recognized industry in Japan?

-

SCALING

A list of “Don’ts” when building SaaS: Lessons learnt from engaging with 200 startups

-

SCALING

METRICS

TRENDS

SaaS Annual Report 2021

-

SCALING

TRENDS

3 Successful Strategies of Top Logistics Startups in SEA

-

TRENDS

SEA-Specific Vertical SaaS

-

TRENDS

Latest SaaS Trends in SEA

-

TRENDS

The State of Vertical SaaS in Japan